Rapid Compensation Following 37-Minute Outage

Decentralised derivatives exchange Hyperliquid has reimbursed nearly $2 million to users affected by a brief API outage last week, a move that has been widely praised by the crypto community. The disruption occurred on 29 July and lasted for approximately 37 minutes, during which traders were unable to execute orders.

According to an official statement, the outage was caused by a significant traffic spike rather than a security breach. Hyperliquid’s prompt response and voluntary compensation have been seen as a confidence booster for decentralised trading platforms, which are increasingly competing with their centralised counterparts.

API Crash Attributed to Record-Breaking Traffic

Hyperliquid reported that the issue began at 14:10 UTC and lasted until 14:47 UTC on 29 July. During this window, its API servers became overwhelmed due to an unexpected surge in traffic. The platform had recently reached a record high of $14.7 billion in total open interest, which likely contributed to the spike.

While transactions continued to be sent to the blockchain mempool and were eventually included in blocks, the API returned error messages that prevented users from executing orders in real time. The outage initially sparked concerns of a potential exploit or hack, but these fears were quickly dismissed by Hyperliquid’s internal investigation.

Refunds Issued Without Legal Obligation

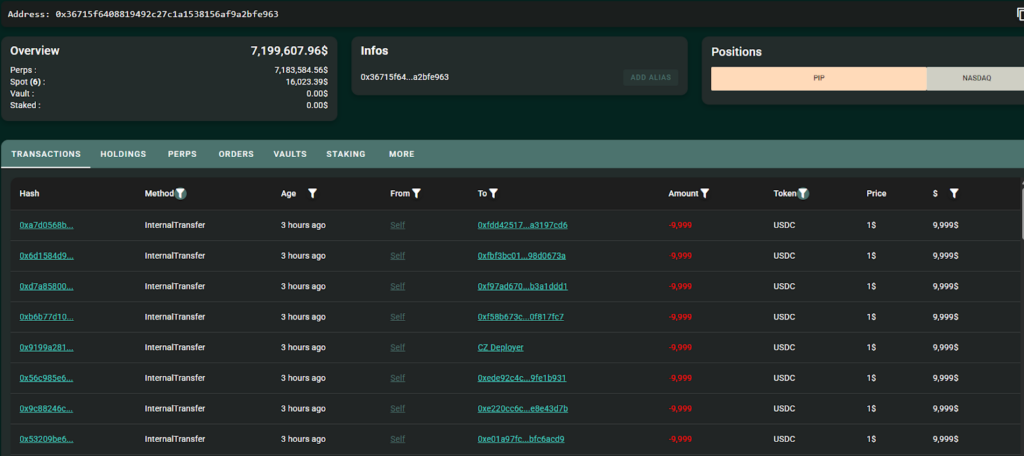

On 5 August, Hyperliquid distributed a total of $1.99 million in USDC to affected users, according to onchain data from Hypurrscan. The company categorised impacted users into three groups and calculated refunds accordingly.

Notably, the platform undertook this reimbursement voluntarily, without any contractual obligation or service level agreement. A trader known as aaalex posted on X that over $1.5 million had already been sent out by Monday, calling the move “incredible”.

For users owed more than $10,000, Hyperliquid has required Know Your Customer (KYC) verification to complete the full refund process. These users have already received up to $9,999, but must finish KYC via a Discord ticket by 18 August to claim the remaining amount.

Previous Security Incident in March

This is not the first time Hyperliquid has faced operational challenges. In March, the platform suffered a $6.26 million exploit related to a vulnerability in its liquidation parameters, which affected the Jelly my Jelly (JELLY) memecoin. Despite such setbacks, Hyperliquid has shown resilience and has continued to grow.

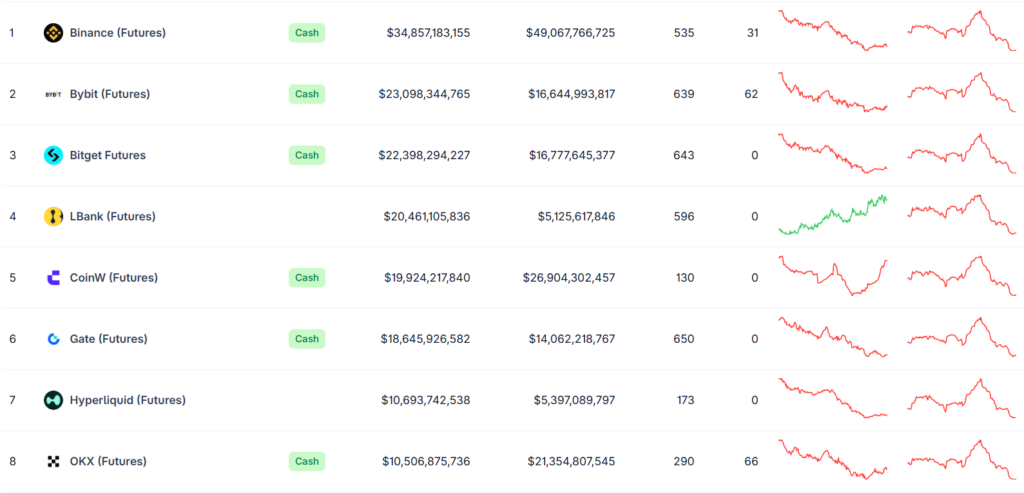

Seventh-Largest Derivatives Exchange Globally

Hyperliquid’s recent efforts have coincided with a sharp rise in its market standing. It is now ranked as the seventh-largest derivatives exchange in the world, with more than $10.6 billion in 24-hour open interest. This marks a significant jump from its 12th-place ranking at the beginning of April, according to data from CoinGecko.

The quick reimbursement following last week’s outage may serve to bolster trust in decentralised exchanges (DEXs), which continue to gain traction in the broader crypto market.

Leave a Reply