XRP is showing strong signs of repeating its previous rally pattern, raising hopes among investors of a sharp price surge in the coming weeks. The cryptocurrency’s latest price movements mirror a bullish fractal seen earlier this year, potentially setting the stage for another breakout towards the $3.75 to $4.00 range in August.

Falling wedge pattern signals potential 20 percent surge

XRP is currently trading near $2.98 and forming a falling wedge pattern similar to one observed between December 2024 and January 2025. At that time, XRP had consolidated within the wedge while maintaining support above its 50-day exponential moving average (EMA), later breaking out with a 70 percent rally that pushed its price from approximately $2 to over $3.39 in a matter of weeks.

Now, in August, the pattern appears to be repeating. XRP is again consolidating within a falling wedge following a steep rally, while holding support at the 50-day EMA and reclaiming the 20-day EMA as support. Technical indicators, particularly the relative strength index (RSI), also reflect similar behaviour. The RSI has pulled back from overbought territory and stabilised around 50, mirroring the setup that preceded the January breakout.

Resistance test underway with upside potential to $3.75

At present, XRP is testing the upper boundary of the falling wedge. A breakout from this level could result in a price rally of more than 20 percent, taking the coin towards the $3.75 mark in the short term. However, failure to break above the resistance may lead to a brief pullback. In such a scenario, XRP could retest the 50-day EMA for support. A close below that level might trigger a further decline toward the wedge apex, near the 200-day EMA around $2.34.

Some market analysts are optimistic that XRP could even surpass the $4 level during this cycle. They point to factors such as whale accumulation and expectations of a Federal Reserve interest rate cut in September, which may drive increased risk appetite across financial markets.

XRPL fundamentals support bullish outlook

Beyond technical signals, XRP’s fundamentals remain solid. Ripple’s XRP Ledger (XRPL) processed over 70 million transactions in July 2025 alone. Additionally, more than 1 million new accounts have been created on the network since the beginning of the year, according to data from Dune Analytics.

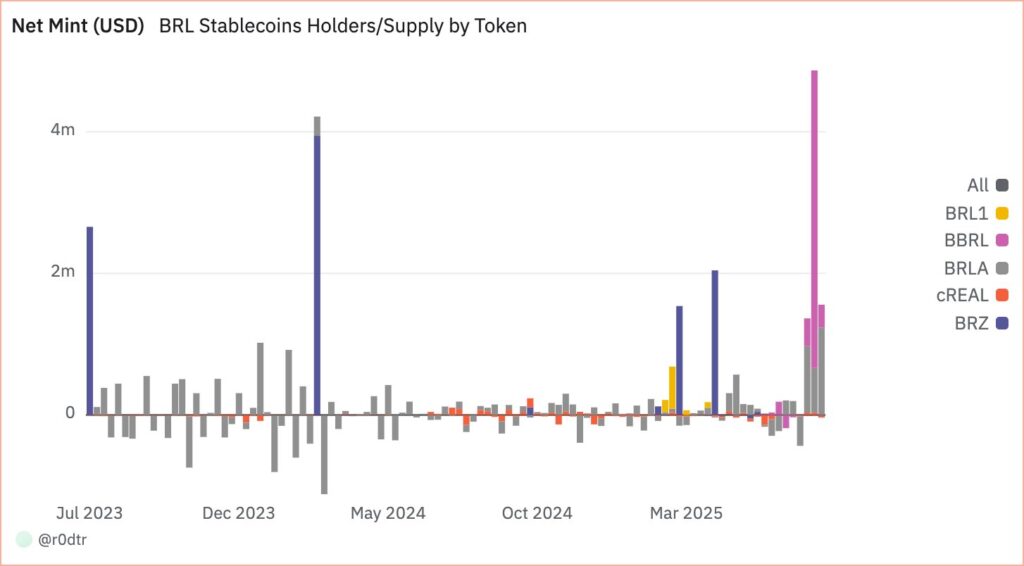

Stablecoins have emerged as a key driver of this growth. In Brazil, Braza Bank issued over $4.2 million worth of its BBRL stablecoin on XRPL in July, making it the second-largest Brazilian real (BRL) stablecoin after Transfero Group’s BRZ. In the United States, Ripple’s RLUSD stablecoin has seen significant growth as well, with daily transfer volumes rising from approximately 5,000 to over 12,000 in just one month.

Increased user activity boosts utility narrative

The rise in stablecoin issuance and transfers on XRPL is contributing to its broader utility narrative. As adoption grows across different regions, it is strengthening investor confidence in XRP’s long-term value. Analysts believe that this increasing network activity and adoption could provide the momentum needed to push XRP past the $3.75 resistance and even challenge the $4.00 level in the coming weeks.

While short-term volatility remains a possibility, both technical patterns and on-chain fundamentals are aligning in favour of an upward breakout. As August progresses, market watchers will be closely monitoring XRP’s price action for confirmation of a bullish continuation.

Leave a Reply