Hyperliquid, the decentralised perpetual futures exchange built on its own layer-1 protocol, posted an extraordinary July performance with $320 billion in trading volume. This represents a 47% increase from June’s $216 billion and a 28% rise over May’s previous record of $248 billion. The platform also achieved a significant milestone by accounting for 11.9% of Binance’s perpetual futures volume, cementing its status as the top decentralised exchange (DEX) for perpetuals.

The exchange’s growth is being driven by demand for on-chain derivatives, particularly Ethereum (ETH) perpetual contracts and altcoin derivatives like Solana and Avalanche. Hyperliquid’s architecture, including zero gas fees, an on-chain matching engine, and instant execution, continues to appeal to traders seeking efficiency, transparency, and low slippage.

Whales, Altcoins, and Trading Momentum

Hyperliquid’s trading activity remained consistent throughout July, with no idle days reported. Whale activity was a major factor in the exchange’s surge, as high-net-worth traders closed out significant positions during the latter half of the month. The platform also crossed a major threshold in open interest, surpassing $15 billion, led by a doubling in Ethereum-based perpetual exposure.

Altcoins contributed heavily to the surge in volume, with Solana (SOL) and Avalanche (AVAX) among the most actively traded tokens. This reflects a growing appetite among traders for diverse leveraged products beyond Bitcoin and Ethereum, indicating the maturity of the on-chain derivatives market.

Buyback Mechanics Set Hyperliquid Apart

One of the most striking developments, largely overlooked, is Hyperliquid’s aggressive token buyback programme. A tweet from respected crypto trader Moon recently sparked discussion:

“At the current buyback rate, Hyperliquid will buy the entire circulating token supply in under 4 years… We have not had a token like this EVER in crypto history, not even close.”

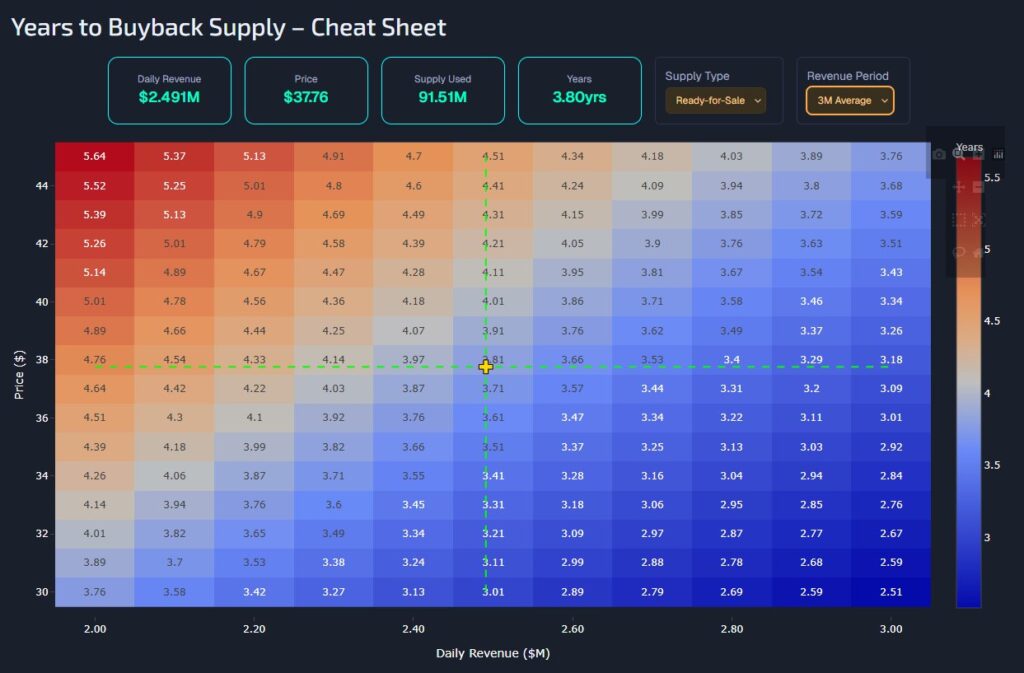

This statement, while bold, is not unfounded. Let’s consider some realistic figures:

- At peak, daily fee revenue exceeded $4 million, and even the July low was still around $2 million.

- Let’s assume an average of $3 million in daily fees.

- If 50% of that is used for buybacks, that’s $1.5 million per day, or about $547 million per year.

- The current circulating supply of the HYPE token is roughly 60 million tokens. With the price currently around $38.50, the total market value of circulating tokens is $2.31 billion.

At this rate, Hyperliquid could repurchase all circulating tokens in under 4.2 years, an astonishing pace by crypto standards. This model puts immense long-term buy pressure on the token, particularly if fees continue to grow.

Market Share, Challenges & The Road Ahead

While Hyperliquid retained over 75% of market share among decentralised perpetual DEXs (outpacing dYdX and GMX), it did face some headwinds. Despite strong volume, the HYPE token dropped by 17% in July, largely due to broader market caution and declining liquidity across exchanges. Analysts also noted fee revenue declines across the board, with Hyperliquid, Ethereum, and Solana seeing double-digit drops compared to earlier months.

However, these short-term fluctuations do not necessarily undercut the broader trend. The platform ended the month with $597 million in TVL (total value locked) and over $1.1 billion in HYPE tokens locked in open interest, reflecting user confidence and deep liquidity.

Looking forward, Hyperliquid’s continued success will hinge on scaling solutions, infrastructure upgrades, and its ability to retain top trader activity. More importantly, its tokenomics model backed by real fee generation and strategic buybackscould serve as a blueprint for sustainable decentralised finance (DeFi) projects.

A Protocol to Watch Closely

Hyperliquid’s performance in July 2025 signals more than just a strong trading month. It highlights the growing importance of on-chain infrastructure for advanced trading products, the potential for non-inflationary token models, and the demand for alternative financial platforms outside of traditional exchanges.

The idea that a protocol could realistically buy back its entire token supply within four years is not only unprecedented, it suggests that Hyperliquid could reshape expectations across DeFi. If it maintains its current trajectory, it may become a defining case study in how decentralisation, execution efficiency, and economic design come together in one protocol.

Leave a Reply