In the world of crypto, eye-popping returns usually come from risky bets on memecoins, lucky timing on tokens, or wild speculation. But in mid-2025, one trader rewrote the playbook, turning just $6,800 into $1.5 million in only two weeks. They didn’t rely on price predictions, staking, or chasing trends. Instead, they mastered a delta-neutral, high-frequency market-making strategy built around automation, exchange rebates, and extreme precision.

A Trader in the Shadows: The Rise of Wallet 0x6f90…336a

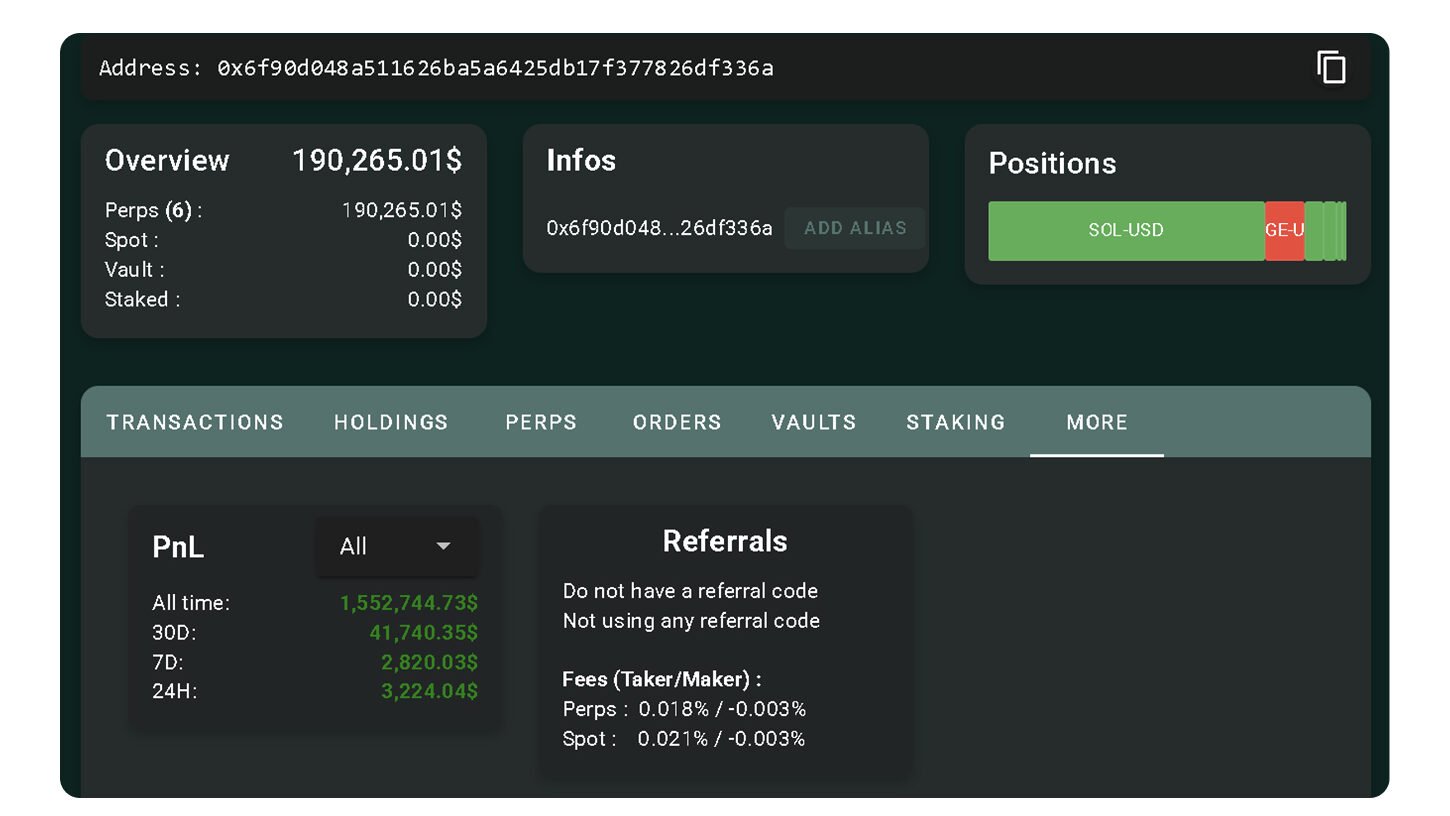

This story centres around a wallet address 0x6f90…336a on a rising decentralized perpetual futures exchange called Hyperliquid. Beginning in early 2024 with under $200,000, this wallet quietly began trading Solana and other perpetual futures. By June 2025, the trader had:

- Pushed $20.6 billion in total volume

- Captured over 3% of all maker-side flow on Hyperliquid

- Maintained strict delta-neutral exposure

- Avoided speculative trades or heavy drawdowns

The trader became a legend in niche crypto circles, dubbed a “liquidity ghost” on platforms like Hypurrscan.io, not because of loud wins, but due to consistency, discipline, and stealth.

This wasn’t about riding the market. It was about engineering it.

How It Worked: High-Frequency, Delta-Neutral Market Making

This strategy was not for the faint-hearted. It revolved around four key elements:

1. One-Sided Quoting: Directional Liquidity

Traditional market makers post both buy and sell orders to capture the spread between them. But this trader flipped that script. Their bots posted only one side, either a bid or an ask at any given time. This reduced the risk of holding a large inventory of volatile tokens, but increased exposure to “adverse selection” (where smarter traders pick off weak quotes). Done correctly, though, this leaner approach made the bot faster and more agile.

2. Maker Rebates: The Hidden Profit Engine

The real money came from maker rebates, small payments given by exchanges to users who provide liquidity. On Hyperliquid, this was roughly 0.0030% per filled order. That’s just $0.03 for every $1,000 traded, but over billions in volume, it added up fast.

- Over 14 days, the trader moved $1.4 billion

- At 0.0030%, that’s around $420,000 in rebates

- Profits were reinvested in real time, compounding returns

This model required no price prediction and no speculation, just high-speed execution, market structure awareness, and tight controls.

3. Automation and Colocation: Speed Was Everything

To rotate billions in volume so quickly, the trader ran bots that were:

- Colocated with the exchange servers (minimising latency)

- Synced in real-time with order books

- Capable of hundreds of trade cycles per day

This level of automation demands professional-grade infrastructure, not retail-level tools. Every millisecond mattered. A single glitch, crash or delay could turn profits into losses.

4. Risk Control: Minimal Exposure, Maximum Discipline

Even with massive volumes, the strategy kept net delta exposure below $100,000 and max drawdowns under 6.5%. Unlike speculative strategies that swing wildly with market moves, this one was:

- Delta-neutral: Not betting on price direction

- Stable: No staking, no leverage punts, no memecoins

- Consistent: Frequent withdrawals locked in gains

This was a masterclass in crypto trader risk management.

Why Most Traders Can’t Copy This

This success wasn’t a fluke, but it’s also not easily repeatable. Here’s why:

- Capital and infrastructure: You need enough funds to absorb volatility and infrastructure to run latency-optimised bots 24/7.

- Advanced coding: Bots must be custom-built and capable of switching strategies in real time based on market shifts.

- Exchange access: Colocation and low-latency connections are often reserved for high-volume players.

- Regulatory risk: As DEXs evolve and KYC rules tighten, this strategy could face new constraints.

The Rise of Infrastructure-Driven Crypto Trading

This trader’s story signals a broader shift in crypto. In 2025, the real edge is no longer in hype or early entry, it’s in engineering and execution. Here’s what that means for the wider market:

- Liquidity provision is now a profession, not just an exchange function

- Perpetual futures dominate because of their flexibility and volume

- Maker rebate arbitrage is a growing opportunity for technical traders

- Spot vs. futures inefficiencies can be mined by delta-neutral bots

A Rare Success That Highlights What’s Possible

The transformation of $6,800 into $1.5 million wasn’t about luck, it was about skill, structure, and discipline. It reflects how far crypto trading has evolved and how technical the game has become.

Retail traders may find this story inspiring but should approach it with realism. Without access to high-frequency infrastructure, rebates at scale, and deep knowledge of market microstructure, replicating this is nearly impossible.

Leave a Reply