The cryptocurrency XRP is facing growing concerns after recent data revealed that large holders, often referred to as whales, have offloaded a substantial volume of tokens. Analysts are now warning of a possible 30 per cent price correction if key support levels fail to hold in the coming days.

Whale Wallets Shed 640 Million XRP Tokens

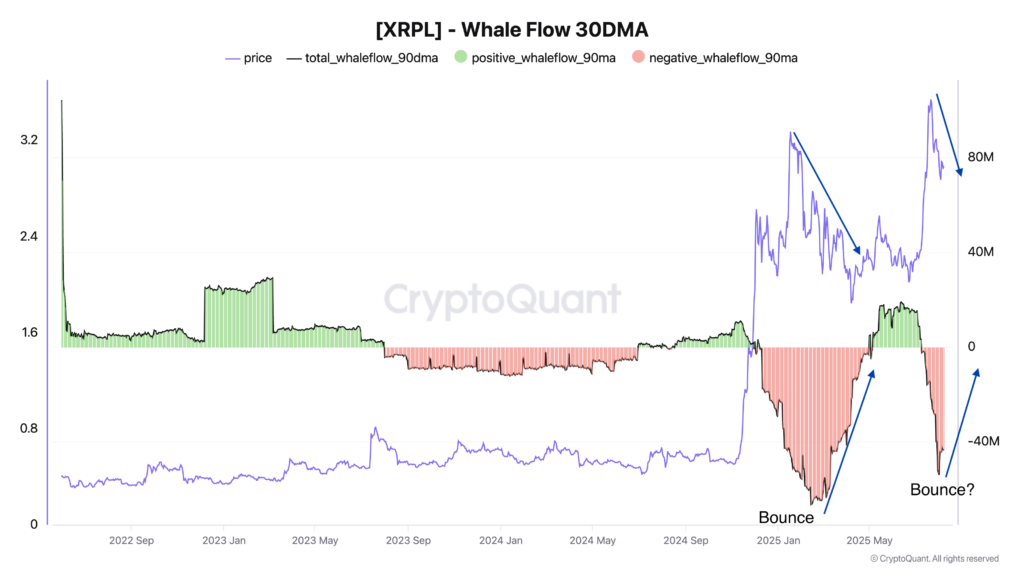

According to onchain analytics platform CryptoQuant, XRP whales have offloaded approximately 640 million tokens since 9 July. At current market prices, the value of these outflows is estimated to exceed $1.91 billion. The majority of this distribution occurred while XRP was trading between $2.28 and $3.54.

This marks the second major wave of whale distribution in less than a year. A similar trend was observed between November and January, when whales reduced their holdings while XRP prices rallied from $1.65 to $3.27. Analysts believe this indicates that retail investors have absorbed most of the selling pressure during these periods of heightened activity.

Internal Movements or Real Selling?

Not all whale outflows necessarily indicate direct selling on the open market. Some movements could involve internal wallet reshuffling or transfers between platforms. However, there appears to be an inverse correlation between whale behaviour and market performance.

For instance, between January and April, whale activity shifted towards accumulation just as XRP prices corrected from $3.27 to $1.87. This suggests that large investors may prefer to accumulate during market dips rather than rallies.

Market Remains Structurally Weak

An analyst from CryptoQuant, known as The Enigma Trader, highlighted the lack of consistent accumulation from large holders. He warned that unless whale wallets begin absorbing at least 5 million XRP daily, the market could remain structurally weak.

At present, there is no clear indication of strong accumulation, which is typically necessary for a sustained trend reversal. While there are some early signs of modest recovery in whale flows, they remain far below the levels required to restore long-term bullish sentiment.

Technical Signals Point to Downside Risk

Technical indicators are also flashing caution. XRP’s weekly chart shows a growing bearish divergence, with prices making higher highs while the relative strength index (RSI) continues to register lower highs since January.

This divergence is often interpreted as a weakening in upward momentum. A similar pattern was observed during the market peak of April 2021. Adding to the bearish outlook, trading volume has declined during the recent price increases, further suggesting momentum exhaustion.

XRP must hold above the $2.65 support level to avoid a deeper correction. A break below this threshold could trigger a slide towards the 20-week exponential moving average (EMA) near $2.55. If that level also fails to hold, the price could decline further to the 50-week EMA around $2.06, which is seen as a key mean-reversion level after extended rallies.

Price Outlook Hinges on Whale Activity

The coming days will be crucial for XRP. Analysts are closely monitoring whale behaviour and whether accumulation resumes at significant levels. Without renewed interest from major holders, XRP’s recovery may stall, leaving it vulnerable to a sharp correction.

For now, traders and investors are advised to watch the $2.65 support zone closely. A sustained breach of this level could validate the bearish divergence and set the stage for a 30 per cent price drop.

Leave a Reply