Bitcoin began the week with strong price action, edging towards record highs after a weekend surge above $122,000. Traders are now eyeing a possible retracement to $117,200 to fill a new CME futures gap, as markets brace for crucial US inflation data and shifts in Federal Reserve policy expectations.

Weekend Surge to $122K Sparks Excitement

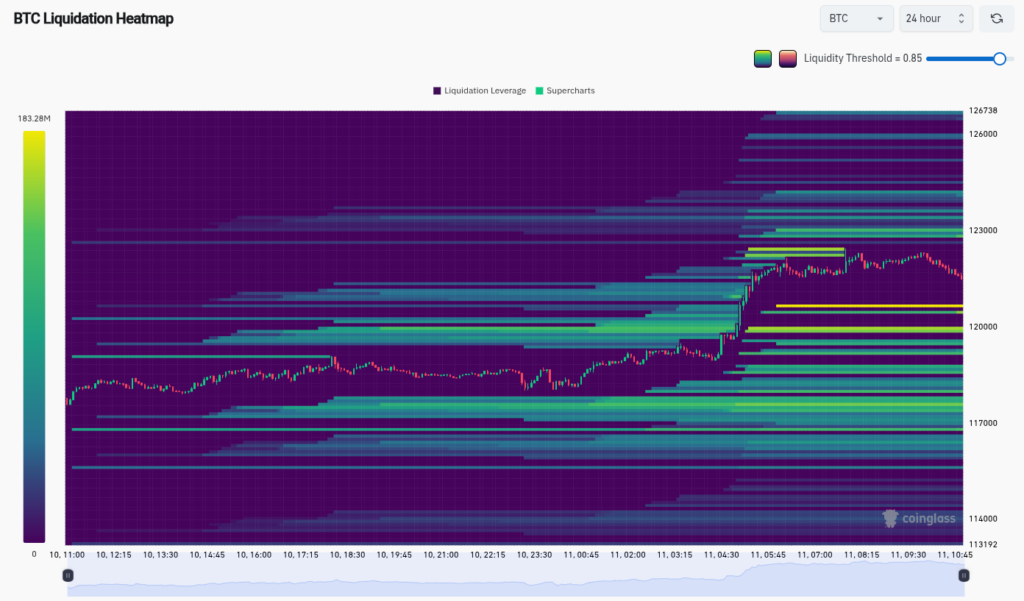

BTC/USD rose sharply after the weekly close, reaching local highs of $122,312 on Bitstamp before easing back. This move liquidated more than $100 million in short positions and pushed resistance levels to $123,000 and beyond, according to CoinGlass. While analysts welcomed the rally, some urged caution, noting it was driven by weekend trading and might be followed by a dip.

Trader Michaël van de Poppe suggested Bitcoin could test lower levels before attempting new highs, potentially creating opportunities in altcoins. Others highlighted a rare bullish sign: the ratio of leveraged futures to spot buying is near lows last seen in late 2022, signalling strong spot demand likely to withstand volatility.

Focus on Filling the CME Gap

The weekend’s price surge created a gap in CME Group’s Bitcoin futures market, now drawing traders’ attention. CME gaps often close quickly, and filling this one would bring BTC/USD back to around $117,200 – a level that recently flipped from resistance to support. Analyst Rekt Capital described this mark as pivotal for Bitcoin’s recovery trend, with the upcoming weekly close set to be decisive.

US Inflation Data Could Shape the Week

The release of July’s US Consumer Price Index (CPI) and Producer Price Index (PPI) this week is expected to be a major influence on risk assets, including Bitcoin. Markets are currently pricing in nearly a 90% chance of a Federal Reserve rate cut in September, up from 57% a month ago, according to CME Group’s FedWatch Tool.

Analysts say a lower-than-expected CPI reading would likely confirm a September cut, potentially boosting crypto markets. Conversely, higher inflation could reduce those odds and weigh on Bitcoin prices. Several senior Fed officials are also scheduled to speak this week, potentially offering further insight into policy direction.

Whales Hold Fire on Selling

Onchain data from CryptoQuant indicates that large-scale Bitcoin holders, or whales, have yet to show signs of profit-taking. Historically, spikes in $10 million-plus Tether (USDT) transactions on the Tron network have preceded BTC price corrections. However, recent activity remains subdued, suggesting whales are holding rather than converting assets into stablecoins.

Coinbase Premium Turns Red

Some analysts remain wary despite the bullish momentum. The Coinbase Premium Index, measuring the price difference between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs, has slipped into negative territory. This suggests weaker demand from US-based traders and raises questions about the sustainability of the rally.

Trader Roman also expressed concern over low trading volumes accompanying Ether’s recent breakout to its highest level since 2021, warning that such moves are more convincing when backed by strong volume.

Leave a Reply