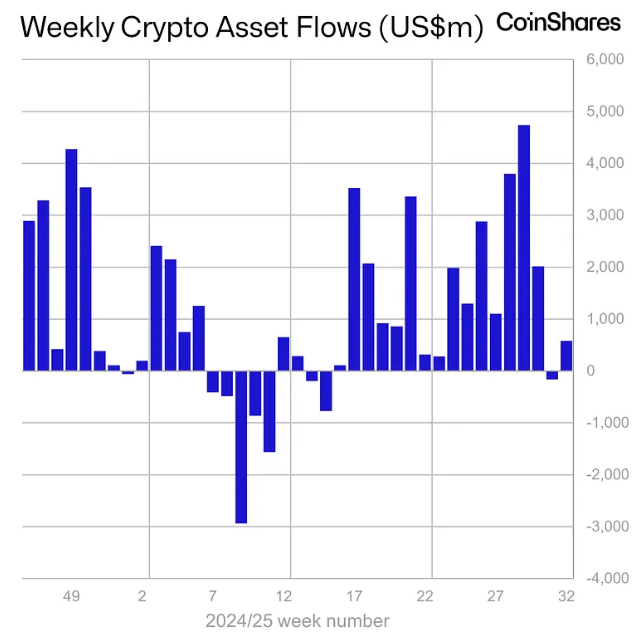

Crypto ETP staged a strong comeback last week, posting $572 million in inflows after a brief pause in a record-breaking streak. The rebound comes as Bitcoin and Ether prices recovered, buoyed by a landmark US government decision to permit digital assets in 401(k) retirement plans.

According to European crypto asset manager CoinShares, the inflows mark a return to positive momentum after the previous week snapped a 15-week run that had brought $27.8 billion into crypto exchange-traded products (ETPs).

US Policy Shift Spurs Mid-Week Surge

CoinShares’ head of research, James Butterfill, said the recovery was partly driven by the policy shift in the US, announced last Thursday, allowing digital assets to be included in 401(k) retirement portfolios.

The start of the week was less promising, with outflows reaching $1 billion on concerns over slowing economic growth after weaker-than-expected US payroll data. However, sentiment reversed dramatically in the latter half of the week.

“In the latter half of the week, we saw $1.57 billion of inflows, likely spurred by the government’s announcement permitting digital assets in 401(k) retirement plans,” Butterfill noted.’

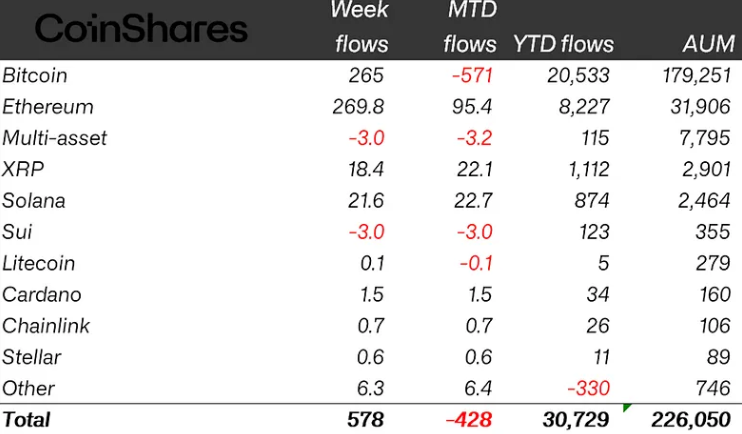

The inflows pushed year-to-date (YTD) figures to a historic $30.7 billion, while total assets under management (AUM) for crypto ETPs touched an all-time high of $226 billion.

Ether Outshines Bitcoin in ETP Gains

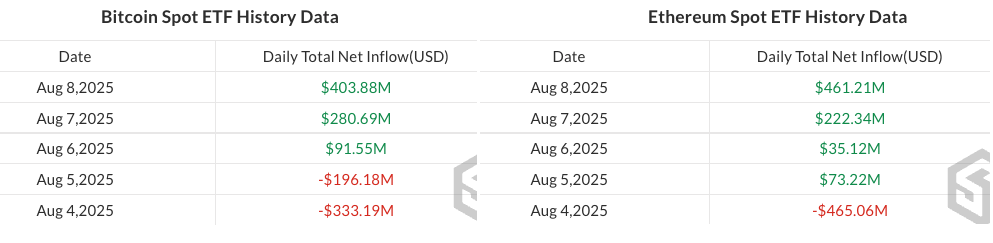

Ether ETPs emerged as the week’s top performers, drawing nearly $270 million in inflows surpassing Bitcoin and other altcoins. This strong performance was supported by ETH’s rally to the $4,000 mark for the first time since December 2024.

The surge brought Ether ETPs’ YTD inflows to $8.2 billion, also a record, with total AUM climbing to $32.6 billion, up an impressive 82% so far this year.

Bitcoin ETPs also enjoyed a solid recovery after two weeks of losses, registering $265 million in inflows. The rebound reflects renewed investor confidence following the 401(k) decision, with BTC prices strengthening in parallel.

Altcoins and Issuer Rankings

Beyond the two largest cryptocurrencies, altcoin-focused ETPs saw healthy investor interest. Products tracking Solana, XRP, and Near Protocol recorded inflows of $21.6 million, $18.4 million, and $10.1 million, respectively.

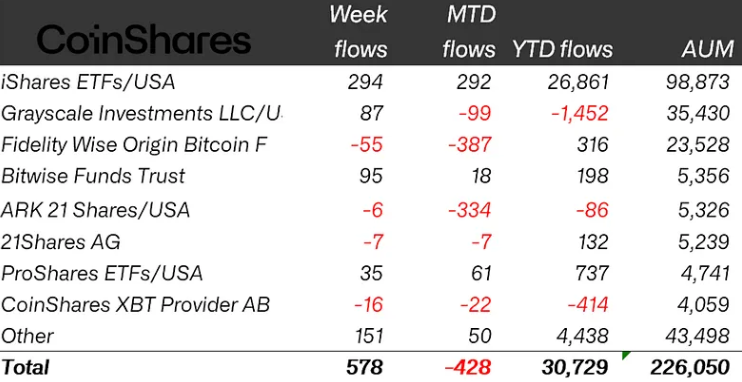

Among issuers, BlackRock’s iShares crypto ETFs led with $294 million in inflows, although this was down 61% from the previous week’s $749 million. Despite the slowdown, BlackRock is now on the verge of a major milestone, with AUM at $98.9 billion, close to the $100 billion threshold.

Grayscale Investments, the second-largest issuer with $35.4 billion in AUM, followed with $87 million in inflows, while Bitwise edged slightly ahead at $95 million.

Not all players benefited from the rally. Fidelity Investments’ crypto funds saw $55 million in outflows, making it the week’s biggest loser among major issuers.

Market Outlook: Momentum Building, Policy Key

The latest inflow figures suggest that institutional appetite for crypto exposure remains robust, particularly when regulatory developments tilt positive. The US 401(k) decision could open the door to a substantial new investor base, potentially sustaining inflows in the coming weeks.

However, short-term sentiment remains vulnerable to macroeconomic data, as seen in early-week outflows triggered by weak US jobs numbers. The balance between policy optimism and economic caution may define the next phase of crypto ETP performance.

With Ether leading inflows, Bitcoin regaining ground, and altcoins attracting fresh capital, the crypto ETP market appears well-positioned to extend its growth provided the broader risk environment remains stable.

Leave a Reply