Two publicly listed companies, Japan’s Metaplanet and the United Kingdom’s The Smarter Web Company, have significantly expanded their Bitcoin treasuries with combined purchases worth almost $100 million, further cementing their positions among the world’s largest corporate holders of the cryptocurrency.

Metaplanet’s Strategic Expansion

On Tuesday, Tokyo-listed Metaplanet revealed it had acquired 518 Bitcoin for approximately $61.4 million, paying an average of $118,519 per coin. This latest purchase brings the company’s total holdings to 18,113 BTC, currently valued at around $2.15 billion, with an average acquisition cost of $101,911 per coin.

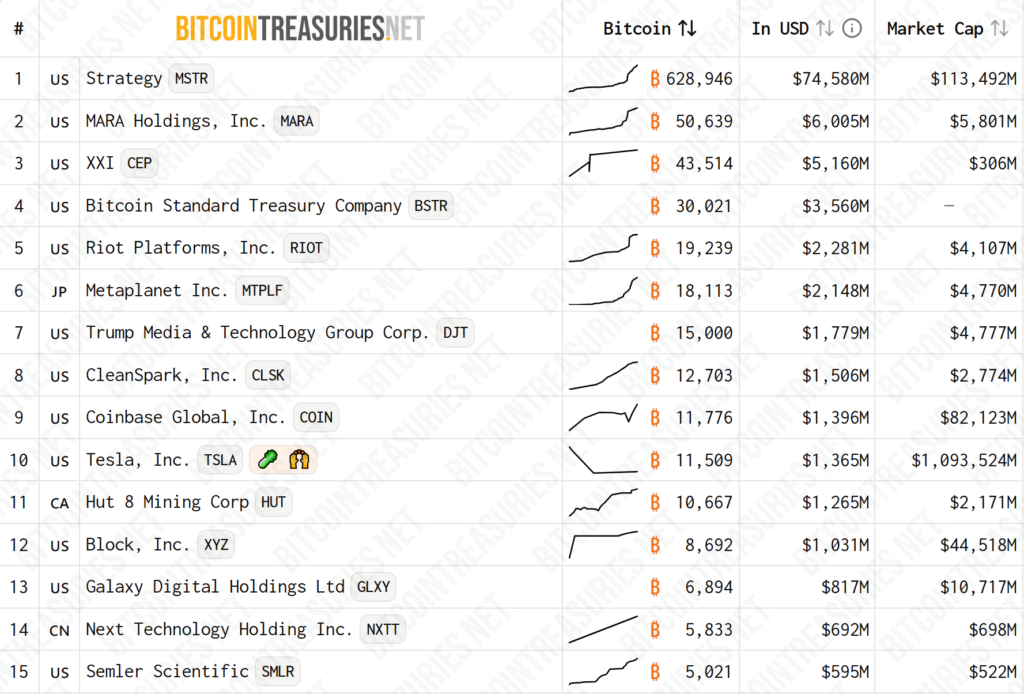

Led by CEO Simon Gerovich, Metaplanet now ranks sixth globally among public companies holding Bitcoin, trailing only Michael Saylor’s MicroStrategy, MARA, XXI, Bitcoin Standard Treasury Company, and Riot. Earlier this month, the firm announced plans to raise up to 555 billion yen ($3.7 billion) through the issuance of perpetual preferred shares to finance its aggressive acquisition strategy.

Smarter Web Strengthens Bitcoin Reserves

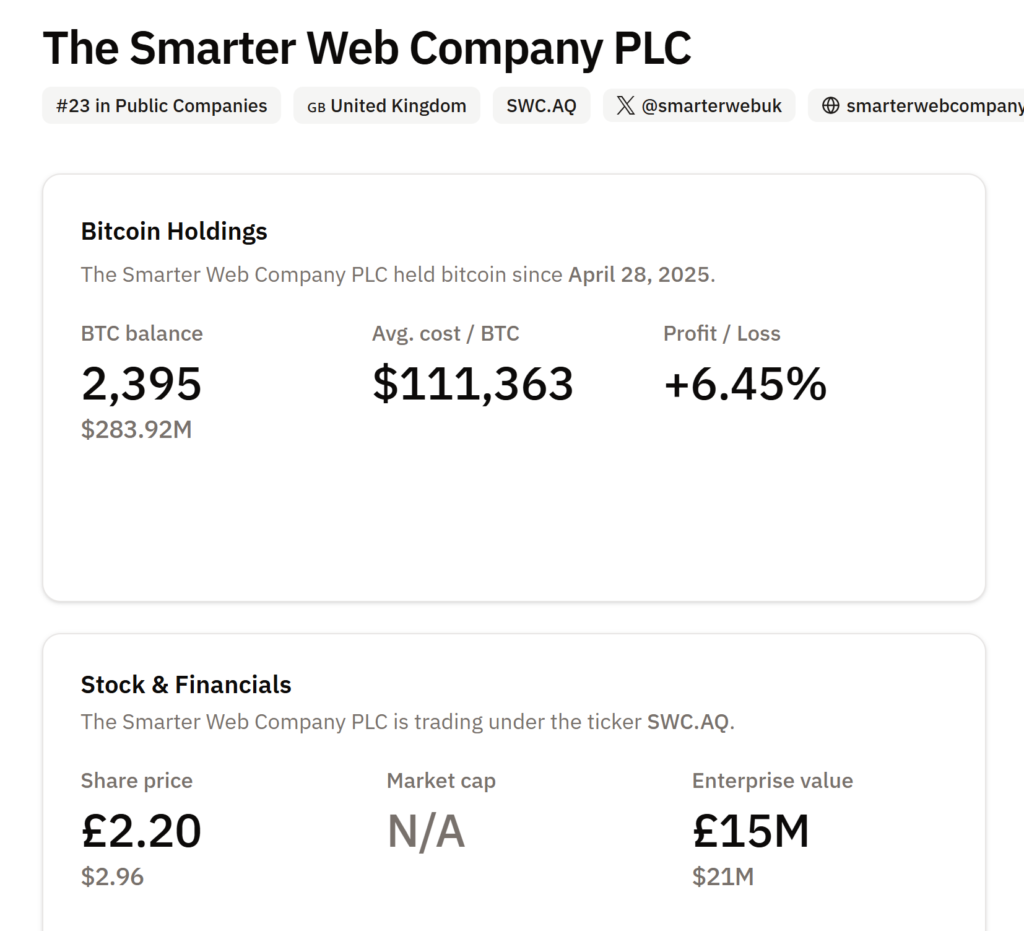

The London-listed Smarter Web Company also disclosed on Tuesday that it had purchased 295 BTC for £26.3 million ($35.2 million) at an average price of $119,412 per coin. The acquisition was partly funded by a $10.2 million equity raise completed a day earlier, alongside a $21 million Bitcoin-denominated bond offering last week.

Smarter Web now holds a total of 2,395 BTC, bought at an average of $110,555 each, amounting to a total investment of $264.8 million. At current prices, the company’s holdings are worth about $284.8 million, giving it an unrealised gain of roughly $20 million.

With over 1,500 BTC added in July alone, Smarter Web has climbed from 36th to 23rd place in the global rankings of public company Bitcoin holders and aims to break into the top 20 in the coming weeks.

Corporate Bitcoin Treasuries Top $100 Billion

The surge in corporate Bitcoin purchases reflects a growing trend among publicly listed firms to treat the cryptocurrency as a long-term strategic asset. As of July, companies specialising in Bitcoin treasuries collectively hold 791,662 BTC, worth more than $100 billion and representing nearly 4% of the total circulating supply.

Analysts suggest this concentration of assets in corporate hands could introduce systemic vulnerabilities. Large holdings by a relatively small number of entities may expose Bitcoin to potential political or regulatory actions.

Analysts Warn of Possible Nationalisation

Prominent crypto analyst Willy Woo has speculated that the US government could, in the future, move to nationalise corporate Bitcoin reserves. Drawing comparisons to President Richard Nixon’s 1971 suspension of gold convertibility, Woo suggested a scenario in which the state might centralise or seize such holdings, potentially “rugging” corporate owners in a similar manner to the end of the gold standard.

While such an outcome remains speculative, the discussion underscores the shifting dynamics of Bitcoin ownership as it moves increasingly into the hands of large, publicly traded corporations. For now, companies like Metaplanet and Smarter Web continue to see strategic value in expanding their exposure to the digital asset despite potential future risks.

Leave a Reply