Pantera Capital has invested $300 million into a fast-growing niche of companies known as digital asset treasuries (DATs) firms that hold large amounts of cryptocurrencies like Bitcoin, Ether, Solana, and other altcoins.

The investment firm believes these companies can deliver better returns than exchange-traded funds (ETFs) or holding tokens directly. In a note to investors, Pantera general partner Cosmo Jiang and content head Erik Lowe said DATs can grow their net asset value per share through yield-generating strategies, resulting in more token ownership over time.

According to Pantera, owning shares in a DAT means investors benefit not just from rising crypto prices, but also from the treasury’s ability to increase its holdings through innovative financial tactics.

How Digital Asset Treasuries Boost Returns

DATs operate differently from traditional crypto investment products. Instead of simply holding coins, they actively use their reserves to generate extra returns. Pantera has invested in DATs in the US and UK that employ a range of strategies:

- Issuing shares at a premium to net asset value to raise capital.

- Using convertible bonds to benefit from market volatility.

- Earning staking and DeFi yields from their token holdings.

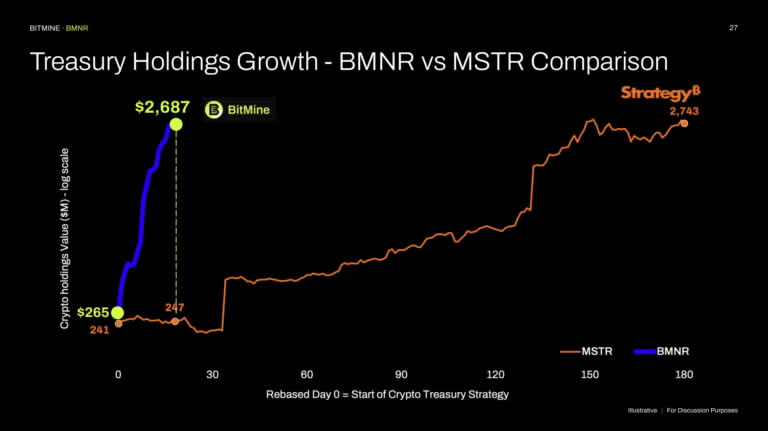

A notable example is BitMine Immersion Technologies, chaired by Tom Lee. In just two and a half months, it has become the largest Ether treasury and the third-largest crypto holder among public companies. BitMine now owns nearly 1.2 million ETH worth about $5.3 billion, and aims to acquire 5% of Ethereum’s total supply.

Since launching its ETH accumulation plan in June, BitMine’s share price (BMNR) has surged over 1,300%, far outpacing Ether’s 90% gain in the same period.

Big-Name Backers and Wall Street Interest

The explosive growth of DATs has attracted high-profile investors, including Stan Druckenmiller, Bill Miller, and ARK Invest. Pantera believes institutional investors will increasingly recognise the long-term potential of top-tier DATs.

Crypto treasury firms are quickly becoming one of Wall Street’s hottest trends, with billions flowing in and share prices climbing rapidly. These companies can effectively accumulate more tokens without needing new market purchases, giving them a compounding advantage over time.

However, Pantera also acknowledged that success depends on each firm’s ability to sustain its yield strategies over the long term.

Overleveraging and Market Downturns

Despite the optimism, industry leaders have warned of significant risks. Ethereum co-founder Vitalik Buterin has cautioned that excessive leverage could destroy some treasury firms if the crypto market turns bearish.

Framework Ventures’ Vance Spencer noted that much of the ETH bought by treasuries is likely to end up in on-chain lending markets to boost yields, potentially increasing systemic risk if prices fall sharply.

Traditional finance analysts share these concerns. Standard Chartered warned in June that Bitcoin-focused treasury firms could be hit hard during steep BTC price drops. Similarly, VanEck’s Matthew Sigel argued that relentless BTC accumulation by some public companies might ultimately harm shareholders more than help them.

Outlook: High Potential, High Risk

Pantera’s $300 million commitment shows its strong confidence in DATs’ ability to outperform ETFs and direct token holdings. The model offers the potential for compounded growth through active treasury management, but also comes with serious downside risks if overleveraging or market shocks occur.

For investors, DATs represent an innovative way to gain crypto exposure with the potential for higher returns, but like all high-reward opportunities, they require a careful understanding of the risks involved.

Leave a Reply