Bitcoin (BTC) could be gearing up for a rally within the next week as institutional buyers dominate trading activity on US exchange Coinbase.

According to Charles Edwards, founder of digital asset investment firm Capriole Investments, institutional players accounted for 75% of Coinbase’s trading volume on Tuesday. Historical data from Capriole indicates that every time institutional share has exceeded this level, Bitcoin prices have been higher a week later.

Capriole’s latest analysis shows institutional “excess demand” this week is running at 600% of Bitcoin’s daily mining supply, which currently sits at around 450 BTC. This means large investors are scooping up far more Bitcoin than is being produced, a classic bullish signal for price momentum.

Corporate Treasuries Join the Buying Spree

It’s not just funds and trading desks making moves. Corporate treasuries are also piling in.

Data shows that on Tuesday alone, corporate treasuries added 810 BTC to their reserves, while Monday’s tally was significantly higher at nearly 3,000 BTC. Such aggressive accumulation from both institutions and corporates points to a rapidly tightening supply on exchanges.

Fed Policy Optimism Fuels Risk Appetite

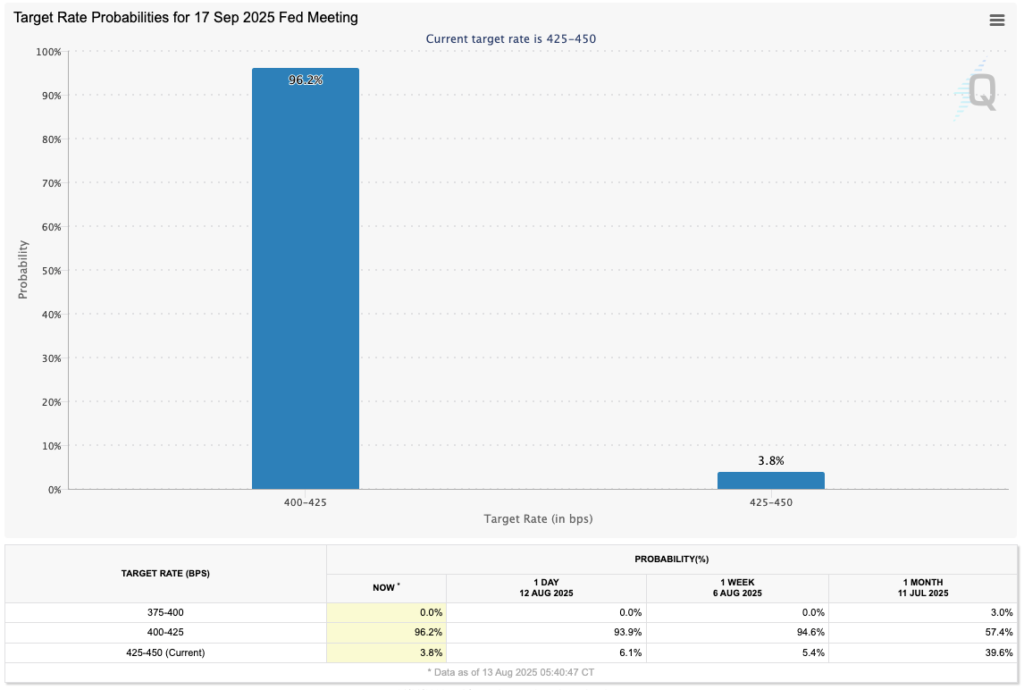

The surge in demand comes on the back of lower-than-expected US Consumer Price Index (CPI) figures for July, which boosted confidence that the Federal Reserve will begin cutting interest rates next month. Edwards noted that the CPI print matched expectations, effectively cementing a September rate cut in market eyes and possibly three cuts before the year’s end.

“Rates down = risk assets up, and Bitcoin is the fastest horse historically,” Edwards commented. He added that with the labour market showing signs of weakness, there is even a chance the Fed could opt for a larger-than-usual 0.5% cut.

Lower interest rates tend to make risk assets like Bitcoin more attractive, as borrowing becomes cheaper and yield on cash declines. This, coupled with a weakening dollar environment, often results in capital flowing towards alternative assets, including cryptocurrencies.

Markets Eye Jackson Hole for Next Clues

The latest CME FedWatch Tool data shows markets heavily favouring a 0.25% rate cut in September, while pricing in around 60 basis points of cuts for 2025. Trading firm QCP Capital observed that the terminal rate projection for 2026 remains around 3%, despite weaker labour market readings and the possibility of a more dovish Fed chair taking over that year.

Investors will now be watching next week’s Jackson Hole Economic Symposium closely for further guidance on the Fed’s policy path. Any signals of a more aggressive rate-cutting cycle could further fuel institutional demand for Bitcoin, adding momentum to an already tightening supply-demand dynamic.

A Potential Perfect Storm for BTC

With institutional and corporate buying already far outpacing supply, and macro conditions turning increasingly supportive, Bitcoin appears well-positioned for upward price pressure in the short term.

Historically, similar conditions have preceded notable gains within days. If the current trend holds, BTC could soon test and potentially break previous all-time highs.

For now, the combination of record institutional participation, cooling inflation, and looming rate cuts paints a bullish backdrop for the world’s largest cryptocurrency.

Leave a Reply