The inclusion of cryptocurrency in US 401(k) retirement plans could trigger a new wave of Bitcoin adoption, potentially driving the asset’s price to $200,000 by the end of 2025, according to analysts at Bitwise.

Trump’s Executive Order Opens the Door

On 7 August, President Donald Trump signed an executive order granting Americans the right to access digital assets through their 401(k) retirement plans. The move is being hailed as a landmark moment for cryptocurrency adoption in the United States, creating new opportunities for investors and portfolio managers alike.

André Dragosch, head of European research at crypto asset manager Bitwise, said the development may prove more significant than the approval of spot Bitcoin exchange-traded funds (ETFs) in January 2024. “This could be even bigger than the US Bitcoin ETF approval itself,” Dragosch told listeners during the Chain Reaction daily X Spaces show, adding that it could unlock $122 billion in capital if just 1% of retirement portfolios were allocated to Bitcoin.

Potential Impact on Bitcoin Price

Dragosch projected that Bitcoin could reach $200,000 by the end of 2025, driven by inflows from retirement savings plans. With over $12.2 trillion in assets under management across the 401(k) industry, even a modest allocation could bring significant liquidity to the market.

Bitwise’s own survey suggests that financial advisers are more likely to recommend allocations of 2.5% to 3%, indicating potential inflows that far exceed the conservative 1% baseline. Such exposure would come primarily through Bitcoin ETFs, enabling plan providers to integrate the asset without directly holding it.

Fed Policy as a Parallel Driver

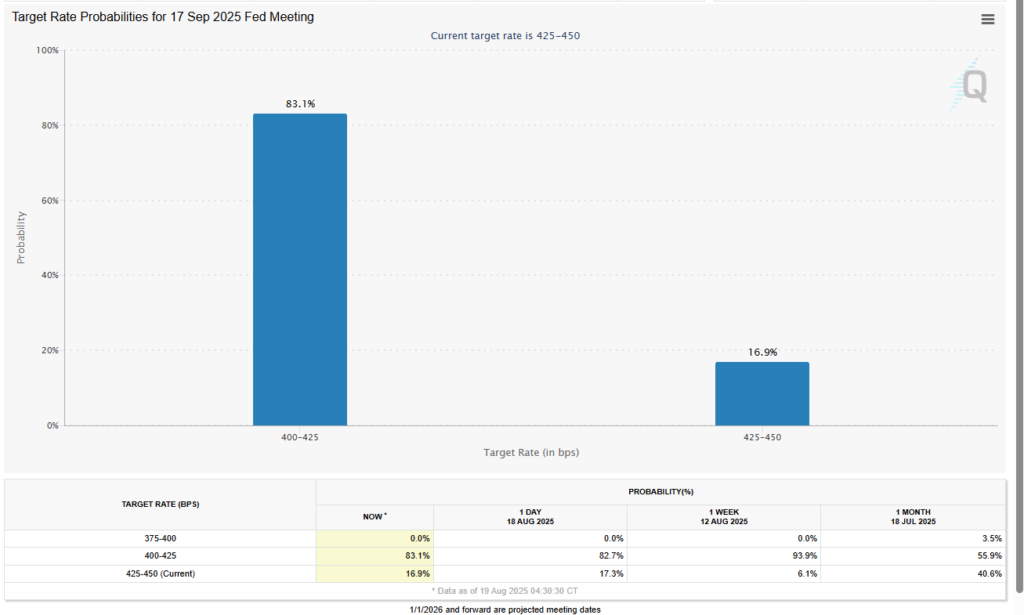

The timing of this shift may also coincide with changes in US monetary policy. Markets currently price in an 83% chance that the Federal Reserve will cut interest rates by 25 basis points at its next meeting on 17 September, according to the CME Group’s FedWatch tool.

“If you see further Fed rate cuts, there’s definitely a case for $200,000 by the end of the year,” Dragosch said. Lower interest rates could make risk assets such as Bitcoin more attractive, boosting capital inflows at a time of widening institutional acceptance.

Role of Major Financial Institutions

Large retirement plan providers including BlackRock, Fidelity and Vanguard are expected to play a central role in integrating crypto exposure into standard 401(k) offerings. While Vanguard has so far declined to support crypto ETFs, BlackRock and Fidelity are seen as highly motivated to expand their digital asset offerings.

BlackRock already manages the world’s largest Bitcoin ETF, the iShares Bitcoin Trust, with more than $84 billion in assets under management and a market share of 57.5%. Fidelity’s ETF ranks second, holding $22.4 billion and 15.3% of the market, according to data from Dune Analytics.

Regulatory Oversight

US Securities and Exchange Commission Chair Paul Atkins confirmed that the agency is working with the Trump administration to expand retirement plan access to alternative investments, including cryptocurrencies. However, he stressed that “proper guardrails” must be implemented to protect retail investors as the sector develops.

If successful, this regulatory framework could further accelerate mainstream adoption of Bitcoin and other digital assets within retirement portfolios.

Leave a Reply