XRP has slipped under the $3 mark for the first time since early August, as a mix of heavy whale selling and weak buying pressure drags the token lower. The third-largest cryptocurrency by market capitalisation has dropped around 10% in the past week, leaving investors worried about deeper losses in the days ahead.

Below, we break down the key reasons behind XRP’s latest slump, the role of whales in the decline, and what charts suggest for its short-term outlook.

Breakdown of the $3 Support

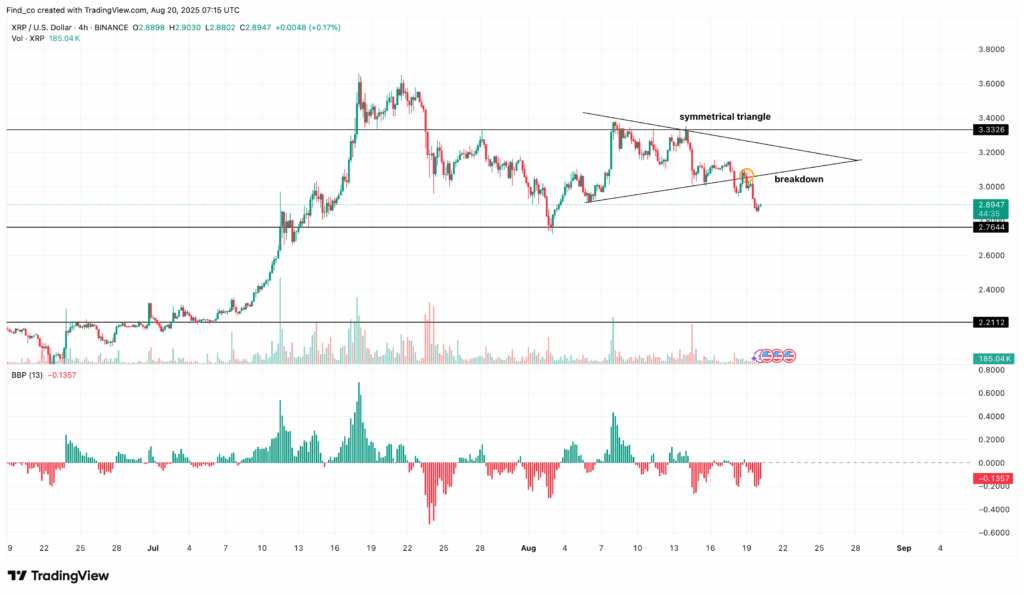

XRP’s price action over the last two weeks has been marked by consolidation within a symmetrical triangle pattern. However, on 19 August, the token finally broke below the triangle’s lower trendline, surrendering its hold on the critical $3 support level.

Analysts had warned that XRP was struggling to build buying momentum. The upper resistance at $3.33 repeatedly acted as a ceiling, and buyers failed to push the token higher despite several attempts. This weakness was further confirmed by the Bull Bear Power (BBP) indicator, which flipped negative on 18 August, signalling that sellers had gained control.

The breakdown below $3 has now opened the door to further downside targets. If selling continues, XRP could retest support at $2.89, followed by $2.76. A steeper decline could even see the token slide to as low as $2.21, according to chart patterns.

Whale Sell-Off Adds Pressure

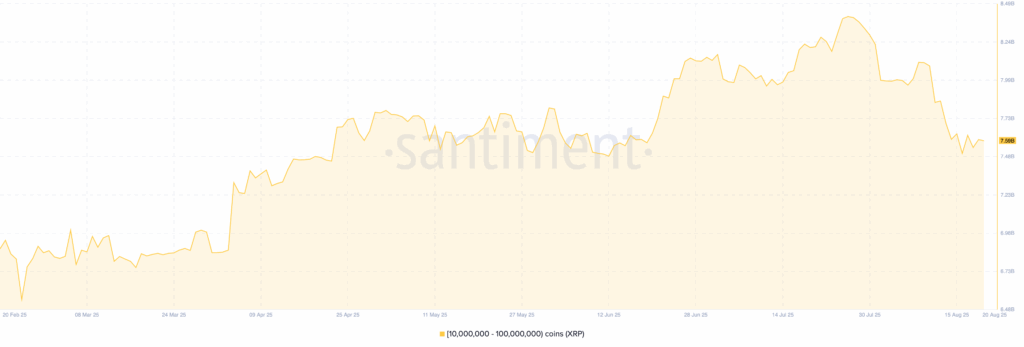

Technical weakness is not the only factor dragging XRP lower. Whale activity has significantly influenced the price in recent days. Data from analytics platform Santiment shows that wallets holding between 10 million and 100 million XRP have slashed their holdings from over 8 billion tokens to 7.59 billion.

In practical terms, this means whales dumped nearly 470 million XRP into the market worth around $1.35 billion at recent prices. Such large-scale selling often overwhelms market demand, creating a sharp imbalance that drives prices lower.

Because whales control such a large share of supply, their trading behaviour often dictates market sentiment. With big holders exiting, retail traders have little incentive to absorb the excess supply, which adds to selling pressure and undermines confidence in a short-term rebound.

Bearish Indicators Point to Further Downside

The daily chart offers little comfort to bullish investors. While XRP has technically formed a bullish pennant, a pattern that can sometimes signal a breakout higher, the lack of meaningful buying volume casts doubt on its strength.

Adding to this negative outlook is the Moving Average Convergence Divergence (MACD) indicator. A bearish crossover has taken shape, with the 12-day exponential moving average crossing below the 26-day EMA. This suggests momentum is shifting firmly towards the bears.

If this trend holds, analysts warn that XRP could slide to around $2.45, which aligns with the 0.618 Fibonacci retracement level. A break below this level would be particularly concerning, as it may accelerate the downtrend and potentially drag the token below $2.

Can XRP Recover?

Despite the current negative signals, there is still a possible path to recovery, but it requires a change in sentiment. For XRP to regain strength, buying pressure needs to return with significant volume. A key trigger could be a reversal in whale activity, with large holders starting to accumulate rather than distribute their tokens.

If that shift occurs, XRP could break above the triangle’s upper trendline and bullish pennant. A move past $3.33 would act as confirmation, potentially propelling the token as high as $3.66 in the short term.

Until then, however, the risks remain tilted to the downside. Investors are watching closely to see whether XRP can defend immediate support levels or whether the selling pressure will drag the token deeper into correction territory.

XRP’s sharp fall below $3 highlights how quickly market sentiment can turn when whale activity and weak technicals align. With large holders offloading more than a billion dollars’ worth of tokens, support zones have been left vulnerable, and indicators are pointing towards further declines.

The next few trading sessions will be crucial. If buyers fail to step in, XRP could sink closer to $2. On the other hand, a reversal in whale positioning could give the token the push it needs to reclaim higher ground.

Leave a Reply