Bitcoin has always been celebrated as decentralised money, free from the influence of governments and central banks. Yet, in 2025, its price movements reveal a more complex reality. Large holders, core developers and global regulators all exert influence, while wider economic conditions and investor sentiment shape the market’s heartbeat.

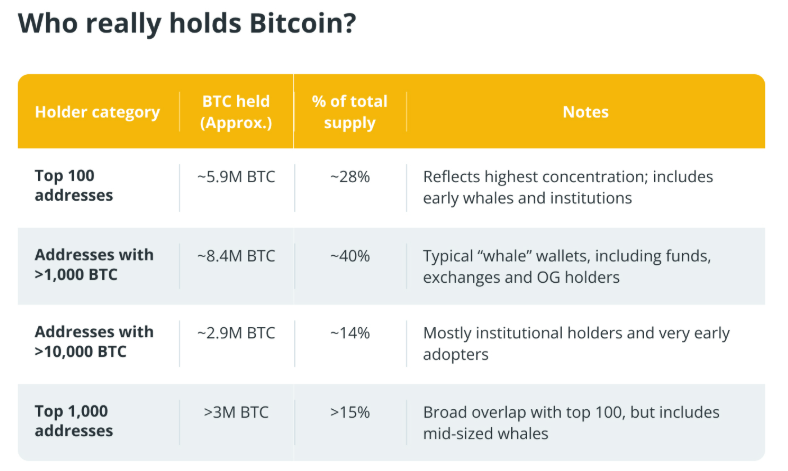

Whales and Their Outsized Impact

If any group comes close to moving the market directly, it is the whales. These are the investors holding thousands of coins, often institutional funds or early adopters who accumulated during Bitcoin’s infancy. Their role in 2025 is more pronounced than ever.

The number of wallets holding more than 1,000 Bitcoin has risen to 1,455 as of May, a sign of renewed accumulation. Much of this growth is linked to large institutions. Strategy alone now controls over 580,000 Bitcoin, equivalent to around 2.76 per cent of the total supply. BlackRock has also expanded its Bitcoin exposure through its iShares Bitcoin Trust ETF and related funds. Together, these two giants hold close to six per cent of all Bitcoin in existence.

Whales do not simply hoard. They buy at scale, take profits during rallies and often sell when retail enthusiasm is strongest. Analysts have observed that several major corrections since January followed large transfers from whale wallets to exchanges. Conversely, when these wallets remain dormant, upward momentum often follows, as seen when Bitcoin broke through 110,000 dollars in April.

Not all whales act the same. Long-standing holders have realised relatively modest profits, around 679 million dollars since April, while newer entrants such as hedge funds have taken more than 3.2 billion off the table in the same period. This suggests a split between older whales consolidating for the future and newcomers more eager to cash in.

Developers Shape the Rails of Bitcoin

While developers cannot directly move markets, their upgrades often influence perception and long-term value. Some of Bitcoin’s most significant rallies have followed major technical milestones.

In 2017, the SegWit upgrade altered how data was stored in blocks, improving efficiency and paving the way for the Lightning Network. That same year, Bitcoin’s price surged from around 4,000 to nearly 20,000 dollars, with SegWit contributing to confidence in the system.

Taproot, activated in 2021, improved privacy and efficiency while expanding Bitcoin’s scripting capabilities. Although it arrived just as Bitcoin touched an all-time high near 64,000 dollars, its significance lay in showing Bitcoin could continue to evolve.

Unexpected innovations have also shaped the landscape. The rise of Ordinals and BRC-20 tokens in 2023 and 2024 allowed NFTs and memecoins to exist on Bitcoin, creating billions in value and driving miner revenues higher.

Now, in 2025, developers are discussing new features such as covenants and opcodes like OP_CAT and OP_CTV, which could enable vaults and programmable spending conditions. While these upgrades are technical, they influence price by altering how investors imagine Bitcoin’s future.

Governments Cannot Control, But They Can Influence

No state can seize control of Bitcoin, but governments can still move markets dramatically. Regulation, taxation and policy decisions create an environment in which investors respond quickly.

The approval of spot Bitcoin ETFs in the United States in 2024 was a landmark event. Several funds received regulatory clearance, sparking a rally past 73,000 dollars and attracting billions of institutional inflows. The message was clear: Bitcoin had entered mainstream finance.

In contrast, Europe’s proposals to tighten rules on self-custodial wallets in 2023 and 2024 unsettled the market. Investors worried about privacy restrictions, and prices briefly slipped as uncertainty took hold.

Macroeconomic policy is another force. Bitcoin still reacts like a high-risk technology asset. When the US Federal Reserve paused rate hikes in late 2023 and hinted at cuts in 2024, liquidity expanded, the dollar weakened and Bitcoin surged.

Attempts at outright prohibition have proved less effective. China’s long-standing bans on trading and mining have not removed demand. In 2025, over-the-counter activity in China remains strong, showing how difficult it is to enforce national barriers on a borderless network.

The Interplay of Sentiment and Macro Forces

Bitcoin’s price in 2025 reflects a decentralised tug of war. Whales dominate supply in thin markets, developers set the rails for innovation, governments alter the regulatory climate and macroeconomic trends influence global appetite for risk.

Yet none of these factors operate alone. Retail enthusiasm, institutional caution and even global narratives all contribute. Spot ETF approvals fuelled record inflows but did not guarantee sustained rallies. Regulatory crackdowns in one region have been countered by growth elsewhere. Whale activity that once triggered panic now sparks calmer reactions. At times, price surges have been driven almost entirely by narrative momentum rather than fundamentals.

In the end, Bitcoin’s price is not dictated by a single player but shaped by a web of influences. It acts less as a verdict and more as a pulse, capturing belief, uncertainty and conviction in real time.

Leave a Reply