SharpLink Gaming has authorised a $1.5 billion share repurchase programme in a move aimed at bolstering its already significant Ethereum treasury. The company, which currently holds the second-largest Ether corporate reserve, sees the initiative as part of a wider strategy to enhance shareholder value and consolidate its position in the cryptocurrency ecosystem.

Aiming to Boost Ether Holdings

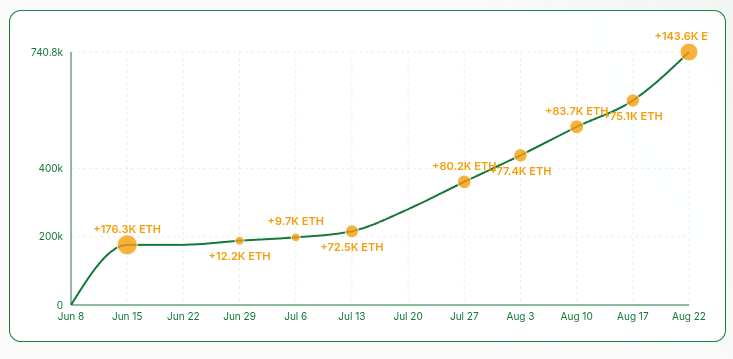

The betting and gaming platform holds 740,800 Ether valued at approximately $3.14 billion, making it the second-largest corporate holder of ETH after BitMine, which has 1.5 million ETH worth around $6.47 billion. SharpLink’s approach focuses on accumulating and staking Ether to increase its ETH-per-share metric. By buying back shares below their net asset value, the firm aims to strengthen this ratio and deliver greater value to investors.

Leadership Backing for Buyback Strategy

In a statement on Friday, Co-CEO Joseph Chalom explained that the repurchase programme would allow the company to act decisively when market conditions align. “This programme provides us with the flexibility to act quickly and decisively if those conditions present themselves,” Chalom said. So far, no shares have been repurchased under the plan, but the company has made clear that it will consider action when its stock trades at or below its net asset value.

Ethereum at the Heart of Corporate Strategy

Earlier this year, SharpLink shifted to an Ethereum-based treasury model and appointed Ethereum co-founder Joseph Lubin as chairman. The move marked a significant commitment to the cryptocurrency, with the firm declaring ETH as its primary treasury reserve asset. Lubin has since described corporate Ether treasuries as both good business and vital for supporting the Ethereum ecosystem. He argued that such strategies will be critical for balancing supply and demand as more blockchain-based applications are developed.

Strong Market Position with Unrealised Gains

SharpLink currently sits on an unrealised gain of nearly $600 million following Ether’s recent price surge to $4,608. Despite trailing BitMine in total holdings, SharpLink’s position underscores its commitment to ETH as the cornerstone of its financial strategy. With a substantial stock buyback approved and a leadership team deeply connected to Ethereum’s founding, the company has placed itself firmly in the camp of businesses betting on the long-term strength of ETH.

Leave a Reply