The Philippines has taken a major step towards adopting Bitcoin as a strategic reserve asset. A new proposal from Congressman Miguel Luis Villafuerte seeks to make Bitcoin part of the country’s long-term financial security plan. If passed, the law would put the Philippines among the world’s largest state-level Bitcoin holders.

The Strategic Bitcoin Reserve Act

On 22 August 2025, Congressman Villafuerte filed House Bill No. 421, known as the Strategic Bitcoin Reserve Act. The bill instructs the Bangko Sentral ng Pilipinas (BSP) to acquire 10,000 Bitcoin over a five-year period, starting with 2,000 BTC annually. At current prices, this amounts to more than $1.1 billion.

The proposed law treats Bitcoin as a “modern strategic asset” and positions it alongside gold and foreign-exchange reserves. According to Villafuerte, the Philippines cannot afford to be left behind while other nations are building their Bitcoin holdings.

The plan also features strict safeguards. The Bitcoin would be placed under a 20-year lock-in period, ensuring that the reserve functions as a true long-term store of value rather than a short-term speculative asset. During this time, only limited liquidations would be allowed, up to 10% of the total reserve, and only for the purpose of paying down sovereign debt.

Oversight and Transparency Measures

To address concerns about security and accountability, the proposal includes a strict oversight framework. The BSP governor would manage the reserve in coordination with the Department of Finance, Department of Defense, and the Securities and Exchange Commission.

The Bitcoin would be held in cold storage facilities spread across the country, with access limited to designated officials. This reduces the risk of cyberattacks or centralised single points of failure.

Quarterly proof-of-reserve audits would be conducted by independent third parties, with findings published online. This ensures that citizens and international observers can verify the nation’s holdings in real time. The legislation also reaffirms that private citizens and businesses remain free to hold and trade Bitcoin without government restrictions, preserving the open nature of the cryptocurrency market.

Economic Context and Motivation

The Philippines carries a national debt of ₱16.09 trillion ($285 billion), of which around 68% is owed domestically. Lawmakers supporting the bill argue that diversifying reserves is essential to safeguard the country against financial instability.

Traditionally, governments rely heavily on the US dollar and gold to back their reserves. However, global uncertainty has raised concerns about overdependence on these assets. Bitcoin, often described as “digital gold,” offers a decentralised alternative that is resistant to political and monetary manipulation.

Villafuerte stressed that Bitcoin is a strategic hedge against inflation, currency depreciation, and potential shocks in the international financial system. By adopting this approach, the Philippines would be signalling to investors and global markets that it recognises the value of digital assets in modern economic strategy.

A Growing Global Trend

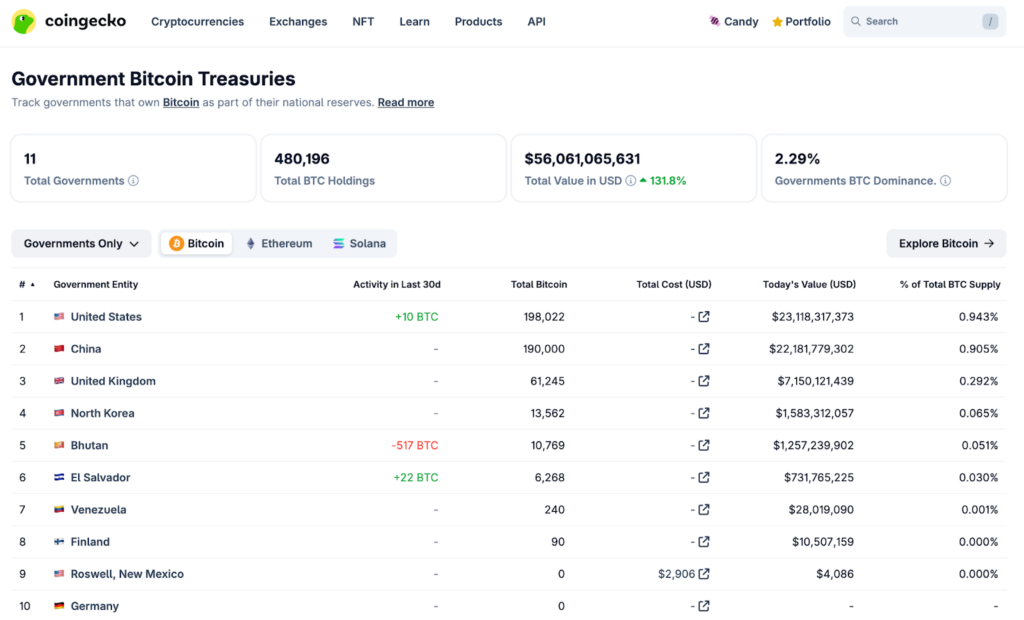

The Philippines is not alone in turning to Bitcoin as a sovereign asset. Governments worldwide now collectively hold over 480,000 BTC worth $56 billion, according to CoinGecko data.

Some notable examples include:

- North Korea with 13,562 BTC

- Bhutan with 10,769 BTC

- El Salvador, the first country to make Bitcoin legal tender in 2021, currently holding 6,268 BTC.

El Salvador remains the most visible pioneer. While retail adoption has slowed, the government continues to quietly accumulate Bitcoin, with total sovereign holdings now exceeding $725 million.

If the Philippines follows through with its 10,000 BTC reserve plan, it will leap ahead of El Salvador and join Bhutan as one of the largest state-level holders. Such a move could place the country at the centre of the global race for strategic digital assets.

A Bold but Risky Bet

The Philippines’ proposed Bitcoin reserve represents a bold shift in financial strategy. By locking in 10,000 BTC for two decades, the country would cement its belief that Bitcoin is more than a speculative asset, it is a cornerstone of future national wealth.

Supporters say the plan will protect the Philippines from global economic shocks and give it an advantage in the digital age. Critics may point to Bitcoin’s volatility and regulatory uncertainties as risks.

What is clear, however, is that the Philippines has entered the conversation among governments stockpiling Bitcoin. If passed, the Strategic Bitcoin Reserve Act could mark the start of a new era where digital assets stand beside gold and the US dollar in shaping the financial security of nations.

Leave a Reply