The launch of the WLFI token has attracted huge attention across the crypto industry, not only because of its financial scale but also due to its political connections. World Liberty Financial (WLF), the platform behind WLFI, raised $550 million during its presale in 2024, but access to the token was limited to accredited investors under U.S. Securities and Exchange Commission (SEC) rules. Now, the project is preparing for its most significant step yet: opening WLFI to the wider market.

This article breaks down the WLFI launch in simple terms, explaining how the unlock works, where the token will trade, and the key risks that investors should keep in mind.

What Is World Liberty Financial?

World Liberty Financial (WLF) was launched in October 2024 as a decentralised finance (DeFi) platform built on Ethereum’s layer-2 network using Aave V3 technology. The project has ambitious goals: to provide lending, payments, and liquidity solutions through a combination of its native token WLFI and its stablecoin USD1.

However, what sets WLF apart from most DeFi projects is its political profile. The Trump family has played a leading role in the project:

- Donald Trump was named “Chief Crypto Advocate.”

- Eric Trump and Donald Trump Jr. were introduced as “Web3 Ambassadors.”

- Around 75% of the proceeds from the presale reportedly flowed to Trump family–affiliated companies, such as WLF Holdco LLC.

This heavy political involvement makes WLF unusual within crypto, an industry that usually promotes decentralisation and independence from traditional power structures. Supporters argue that WLF is challenging the banking establishment, while critics claim it is simply replacing one form of centralisation with another.

The presale, held on 15 October 2024, raised $550 million but was open only to accredited investors. This created a highly concentrated ownership structure, with some wallets holding millions of WLFI tokens. Alongside the token, WLF also manages a crypto treasury valued at more than $1.5 billion and the USD1 stablecoin, pegged to the U.S. dollar and backed by Treasuries.

The WLFI Unlock and How the Lockbox Works

The token generation event (TGE) is scheduled for 1 September 2025, when WLFI will finally become tradable and transferable on the open market. The unlock process has been designed around a smart contract system called the WLFI Lockbox.

What is the Lockbox?

The Lockbox is an audited smart contract built on Ethereum. It manages the controlled release of tokens to early backers. To access their WLFI, users must activate the Lockbox by moving tokens into the contract. Once activated, their wallet will temporarily show a zero balance, an intentional design feature that has already confused some participants.

The Lockbox was audited by Cyfrin to ensure security, and WLF insists it is the only legitimate channel for token unlocks.

Unlock schedule

- Initial unlock: On 1 September at 08:00 ET (12:00 UTC), 20% of the tokens purchased in the $0.015 and $0.05 presale rounds will become available for claiming.

- Remaining 80%: The release schedule for the rest will be decided through a governance vote by token holders.

- Team and insiders: Founders, advisors, and partners will not unlock their allocations during this first phase, keeping the spotlight on early backers.

The Coinbase Wallet issue

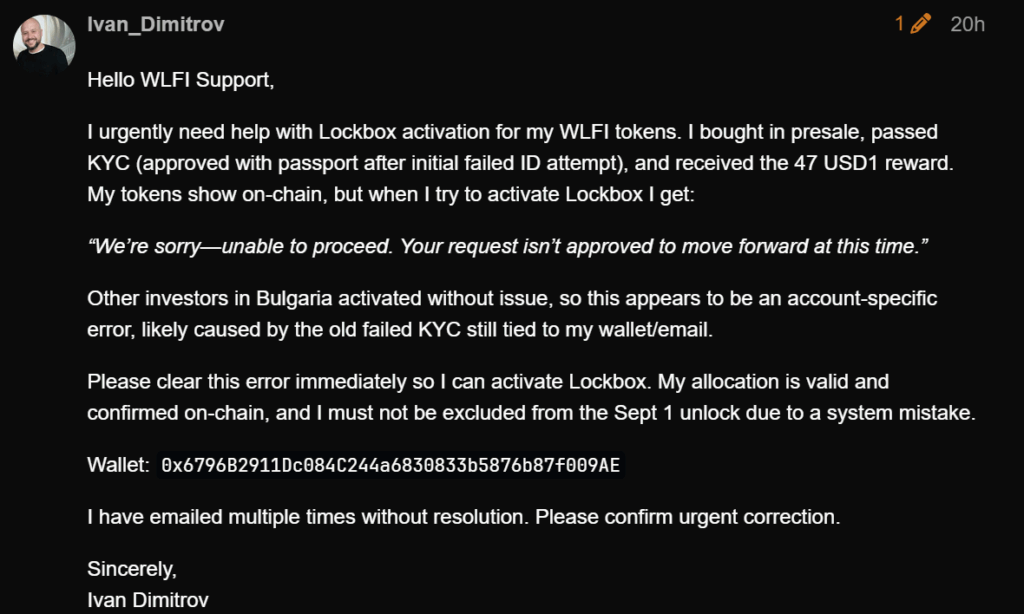

On 25 August 2025, when the Lockbox opened for activation, some Coinbase Wallet users reported connection problems. They were unable to sign the unlock agreement or activate the contract. WLFI explained that this was caused by a temporary compatibility issue between Coinbase’s Web3 interface and the Lockbox contract.

Although WLFI announced a fix within hours, many users continued to complain of being blocked despite completing KYC checks and holding tokens on-chain. The compliance team admitted that some wallets were still under review, and frustration grew as investors accused the project of offering copy-paste replies instead of real support.

With an estimated $40 billion tied up in the initial unlock, this technical problem quickly became a major talking point across the community.

Where and How Will WLFI Trade?

The opening of WLFI trading marks a turning point for WLF. Until now, the token was locked to presale participants. From 1 September, it will enter the open market for the first time, with both decentralised and centralised trading options.

Decentralised exchanges (DEXs)

WLFI is expected to debut first on Uniswap, the most widely used decentralised exchange on Ethereum. As with many new tokens, Uniswap provides immediate liquidity without the need for centralised approval.

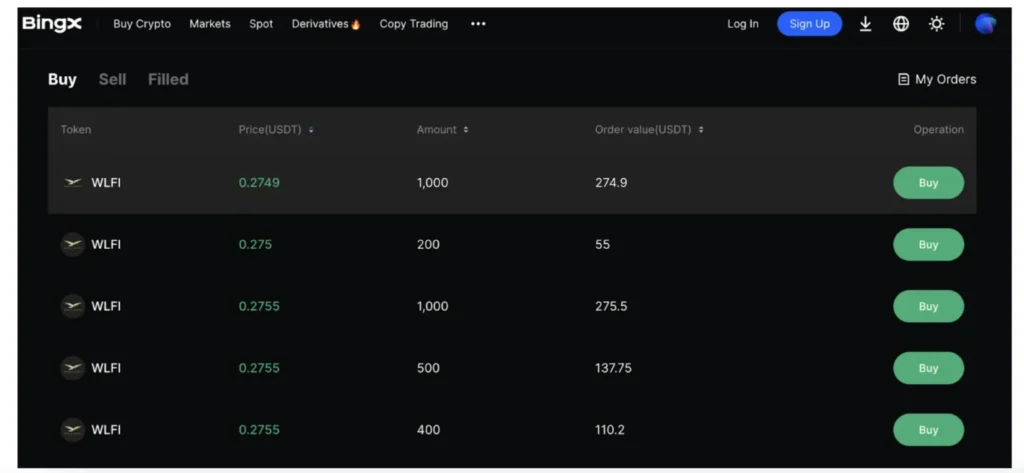

Centralised exchanges (CEXs)

Several major exchanges including Binance, OKX, and BingX have already launched pre-market perpetual futures for WLFI. Once spot trading goes live, these platforms are likely to be among the first centralised exchanges to list WLFI, giving it instant global exposure.

Pre-launch trading on Hyperliquid

For traders unwilling to wait, Hyperliquid, a decentralised derivatives exchange, introduced a WLFI-USD perpetual contract on 23 August 2025. This allows speculation on WLFI’s price before its official release.

- Leverage: Up to 3× exposure to WLFI price movements

- Collateral: USDT or USDC

- Margin structure: 1/3 initial margin and 1/6 maintenance margin

This means a trader can control a $3,000 position with a $1,000 deposit, magnifying both gains and losses.

Pre-launch trading has already generated billions in volume, making WLFI one of the most actively traded assets on Hyperliquid. It also provides a form of price discovery, as the perpetual market offers clues about what the spot price may look like once trading begins.

Risks and Concerns Around WLFI

While excitement is high, the WLFI project comes with significant risks. Investors should weigh these carefully before buying or trading the token.

Concentrated ownership

Because the presale was restricted to accredited investors and insiders, WLFI’s ownership is highly concentrated. This could allow large holders, including Trump-affiliated entities, to influence governance and markets disproportionately.

Regulatory pressure

Given WLFI’s political ties and the large sums involved, the SEC and other regulators may scrutinise the project closely. There is a real possibility that WLFI could be classified as a security, limiting its availability on major exchanges.

Political and reputational risk

The strong connection to the Trump family may appeal to some investors but alienate others. Institutional investors in particular may hesitate to engage with a project tied so closely to a polarising political figure.

Technical and smart contract risk

Although the Lockbox has been audited, smart contracts can still contain bugs or be exploited. User error is also a concern, particularly as the system makes wallets appear empty after activation.

Market volatility

With 20% of tokens unlocking immediately and the rest subject to community governance, WLFI could face sharp swings in price. The limited float combined with heavy speculation on futures markets increases the risk of volatility.

Centralisation in governance

Critics argue that WLF mirrors the same centralised structures that DeFi aimed to disrupt. With the Trump family reportedly receiving 75% of presale proceeds, questions remain about whether token holders truly have meaningful control.

What WLFI Means for Crypto Markets

WLFI is more than just another token launch. It represents a new experiment at the intersection of politics, finance, and decentralised technology.

If successful, it could demonstrate how political figures and traditional power structures can leverage blockchain to create alternative financial ecosystems. On the other hand, if it stumbles under regulatory pressure or governance disputes, it may serve as a cautionary tale about the risks of mixing politics with crypto.

The launch also highlights the growing trend of pre-TGE trading, as seen with Hyperliquid’s WLFI perpetual. This mechanism allows traders to speculate before a token even exists on the spot market, reshaping how price discovery works in crypto.

The WLFI token launch is one of the most politically charged and financially significant events in the crypto space in recent years. Built on Ethereum’s layer-2 with a $550 million presale, WLFI is now set to become a fully tradable asset, beginning with its 20% unlock on 1 September 2025.

The project has ambitious plans, including its USD1 stablecoin and large crypto treasury, but it also faces major challenges. Ownership is highly centralised, regulatory risk is real, and technical issues with the Lockbox rollout have already caused frustration.

For traders, WLFI offers early opportunities through decentralised and centralised exchanges, as well as leveraged pre-launch trading on Hyperliquid. However, with opportunity comes significant risk: volatility, political exposure, and governance concerns all loom large.

Leave a Reply