World Liberty Financial (WLFI), a decentralised finance (DeFi) venture linked to former US President Donald Trump, is preparing to expand its USD1 stablecoin to the Solana blockchain. The move is designed to tap into Solana’s fast-growing $12 billion stablecoin ecosystem and broaden USD1’s footprint across major blockchains.

Early Signs of Solana Integration

Hints of this rollout surfaced at the end of August when Charles, head of WLFI’s Solana ecosystem strategy, confirmed that the launch would happen “sooner than you think.” His statement was echoed by WLFI co-founder Zach Witkoff, who posted “Solana here we come” on X (formerly Twitter).

The company’s official account also released a rebranded logo in Solana’s distinct green and purple colours, signalling a clear commitment to the chain. Independent blockchain researchers had already noticed technical activity suggesting integration was underway.

On 28 August, Dumpster Dao, a research group, reported that a wallet linked to WLFI had deployed a Chainlink Cross-Chain Interoperability Protocol (CCIP) program on Solana. This would enable bridging of the WLFI token and ultimately connect USD1 with Solana’s DeFi applications.

Kamino Finance and Technical Deployment

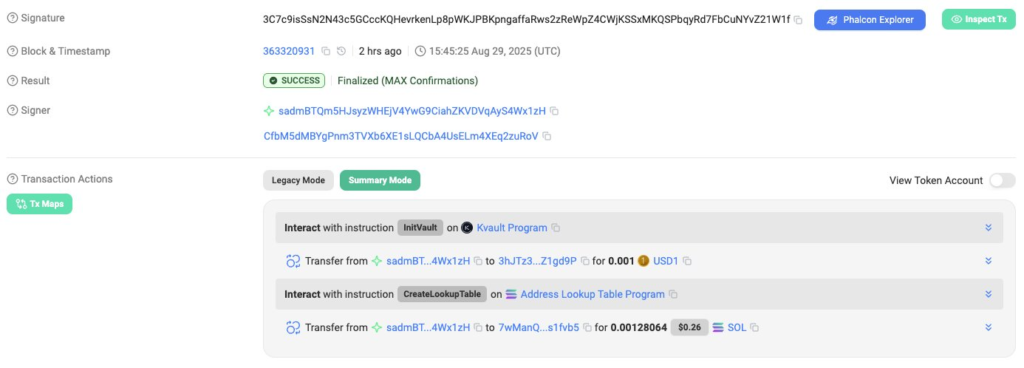

The rollout gained further credibility when Dumpster Dao traced activity involving Kamino Finance, Solana’s largest lending platform. According to their findings, Kamino has created a dedicated USD1 vault. The vault’s deployer address matched details from Kamino’s official documentation, strengthening evidence that the integration was genuine.

On-chain data further revealed stablecoin movements between Kamino’s multisig wallet and the WLFI deployer address on Solana. Such flows indicate that USD1 is already being tested within Solana’s DeFi ecosystem, suggesting that the project has progressed well beyond early announcements.

Expanding in a Competitive Market

The expansion arrives at a time when Solana’s stablecoin market is showing strong growth. According to DeFillama, the chain’s total stablecoin market cap has crossed $12 billion, its highest level in nearly four months. Circle’s USDC leads with $8.7 billion in supply, followed by Tether’s USDT with around $2.17 billion.

Analysts argue that the addition of USD1 could strengthen Solana’s liquidity pools, lending services, and trading activity. By increasing the choice of dollar-pegged assets, the stablecoin may help balance reliance on USDC and USDT, while adding depth to settlement and DeFi transactions.

Building on Rapid Growth

USD1 is a stablecoin pegged to the US dollar and backed by US Treasuries and cash equivalents. Since its launch, it has already been deployed across Ethereum, BNB Chain, and TRON. The asset has gained visibility after being adopted in investment deals by Binance and Bullish, two major crypto exchanges.

These moves have helped USD1 climb into the top six stablecoins globally, with a circulating supply nearing $2.5 billion. The majority of this supply is currently concentrated on BNB Chain. Solana’s entry marks the next stage in World Liberty Financial’s multi-chain strategy to establish USD1 as a widely used stablecoin across the industry.

With technical integrations already visible on Solana and partnerships forming with platforms like Kamino Finance, the rollout of USD1 appears to be close to launch. If successful, it could provide additional momentum to Solana’s DeFi markets and further cement WLFI’s stablecoin as a serious contender in a competitive space dominated by USDC and USDT.

For World Liberty Financial, the Solana move is more than just another deployment. It is a strategic step into one of the fastest-growing ecosystems in crypto, one that could enhance both the utility and market share of USD1 in the months ahead.

Leave a Reply