A mysterious Bitcoin whale worth more than $11 billion has shifted a significant portion of his portfolio into Ethereum, overtaking the holdings of one of the largest corporate Ether treasuries. The move is being seen as part of a wider trend of institutional investors diversifying beyond Bitcoin into assets with greater potential upside.

Multi-Billion Dollar Shift into Ether

According to on-chain tracker Lookonchain, the whale sold another $215 million in Bitcoin to acquire $216 million worth of Ether on decentralised exchange Hyperliquid. This latest purchase has brought his total Ether holdings to 886,371 ETH, valued at over $4 billion.

The rotation began on 21 August, when the investor sold $2.59 billion worth of Bitcoin in exchange for $2.2 billion in spot Ether alongside a $577 million perpetual Ether long position. Last week, he also closed $450 million of this position at an average price of $4,735, securing a $33 million profit before acquiring an additional $108 million in spot Ether.

Inspiring Other Major Buyers

The whale’s aggressive strategy has encouraged other deep-pocketed investors to follow suit. Reports suggest that nine other large addresses collectively purchased $456 million worth of Ether on Wednesday alone. Analysts argue that such movements highlight a “natural rotation” from Bitcoin into Ether and other altcoins that offer higher growth prospects.

Nicolai Sondergaard, research analyst at crypto intelligence firm Nansen, explained: “The growing whale demand for Ether reflects a market shift, where investors are increasingly looking for assets with more upside potential. At the same time, Ether’s price is benefitting from corporate accumulation.”

Overtaking SharpLink’s Ether Treasury

With his current Ether position, the whale now holds more than SharpLink Gaming, the second-largest corporate Ether treasury. SharpLink controls 797,000 ETH, valued at around $3.5 billion. However, the whale’s holdings remain about half the size of Bitmine Immersion, the top corporate holder, which owns 1.8 million ETH worth over $8 billion, according to data from StrategicEtherReserve.

The comparison highlights how individual whales are starting to eclipse corporate treasury firms in terms of crypto reserves, further blurring the lines between institutional and private holdings.

ETF Inflows Strengthen Institutional Demand

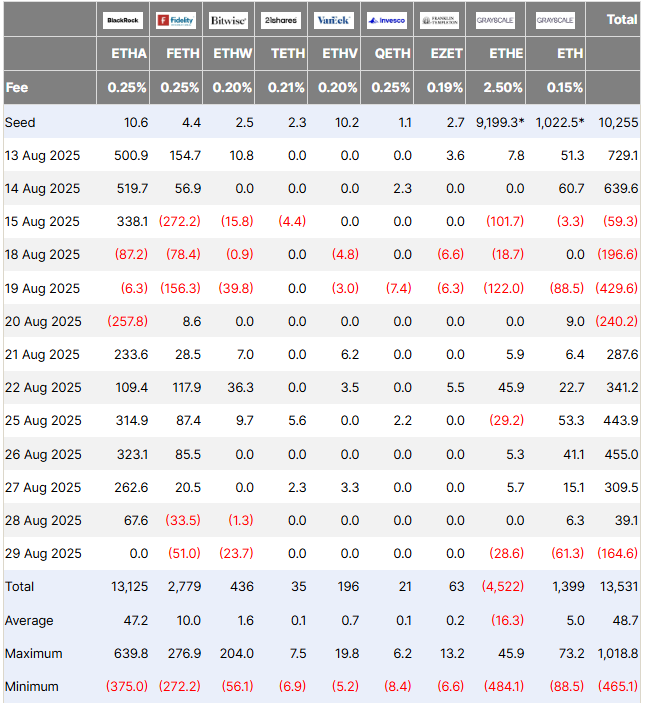

Alongside whale activity, institutional demand for Ether continues to grow. Spot Ether exchange-traded funds (ETFs) have accumulated more than $1.8 billion worth of ETH over the past five trading days, according to Farside Investors.

Iliya Kalchev, dispatch analyst at digital asset platform Nexo, believes this represents a clear expansion of institutional horizons: “Institutions are clearly broadening their scope beyond Bitcoin. For crypto, the pattern is clear: short-term moves will continue to hinge on macro releases, but the structural drivers of adoption, institutional inflows, and tokenised finance remain intact.”

A Sign of Market Maturity

The whale’s bold repositioning is being interpreted as a sign of confidence in Ether’s long-term role within digital finance. As investors search for higher-yielding assets in the crypto space, Ethereum’s ecosystem—fuelled by decentralised finance, tokenisation, and growing ETF participation—appears increasingly attractive.

Whether this whale continues to influence broader market trends remains to be seen, but his trades have already sparked fresh momentum in Ether and encouraged other large players to reassess their allocations.

Leave a Reply