Bitcoin entered September on the back foot, with price weakness compounded by renewed strength in gold. The leading cryptocurrency slipped to multi-week lows, fuelling debate over whether a deeper correction lies ahead.

Traders Eye $100,000 Support

Bitcoin briefly dropped to $107,270 at the weekly open before rebounding towards $110,000 in typically volatile holiday trading. The move came amid low volumes, leaving traders divided on the next decisive direction.

Some market participants expect the $100,000 level to be tested as psychological support. Popular trader CrypNuevo suggested that a wick down to $94,000 was possible, pointing to stop-loss clusters and an unfilled Chicago Mercantile Exchange (CME) gap. Others, however, see potential for a short squeeze, with large liquidation zones sitting between $112,000 and $115,000.

Data from CoinGlass showed significant liquidity overhead, reinforcing the tension between bullish and bearish targets.

Tariffs and Labour Market in Focus

With US markets closed on Monday for the Labour Day holiday, traders turned their attention to macroeconomic risks. A federal appeals court recently ruled that former President Donald Trump had overstepped his authority in imposing tariffs, creating fresh uncertainty around US trade policy. Trump has pledged to fight to keep tariffs in place, warning of economic decline without them.

Attention now shifts to employment figures, a key factor ahead of the Federal Reserve’s policy meeting on 17 September. Unemployment claims will be closely watched, as investors overwhelmingly expect the Fed to cut interest rates by 0.25%.

According to CME Group’s FedWatch Tool, the probability of such a move stood at over 90% on Monday. Analysts at Mosaic Asset warned, however, that persistent inflation could limit how far the central bank is willing to go in loosening policy.

Gold Challenges All-Time Highs

While Bitcoin falters, gold has surged towards record levels. Prices touched $3,489 per ounce on Monday, just shy of the all-time high set in April. Analysts highlighted both seasonal trends and inflationary pressures as key drivers.

September has historically been the second-strongest month for gold over the past fifty years, and the latest rebound followed a firm reading of the US Personal Consumption Expenditures index.

Peter Schiff, a long-time Bitcoin critic, argued that the precious metal’s breakout was “very bearish” for crypto, suggesting Bitcoin could fall much further.

Institutional Interest Shows Strain

The downturn has begun to weigh on institutional activity. Data from Farside Investors showed that US spot Bitcoin exchange-traded funds (ETFs) recorded net outflows of $126.7 million on Friday, reversing earlier inflows during the week.

Overall, August marked the second-worst month on record for ETF withdrawals, totalling $750 million. Charles Edwards of Capriole Investments reported that institutional buying of Bitcoin had plunged to its lowest level since early April.

Despite this, institutional demand still equals roughly 200% of the new Bitcoin supply mined daily, suggesting that long-term interest has not completely dried up.

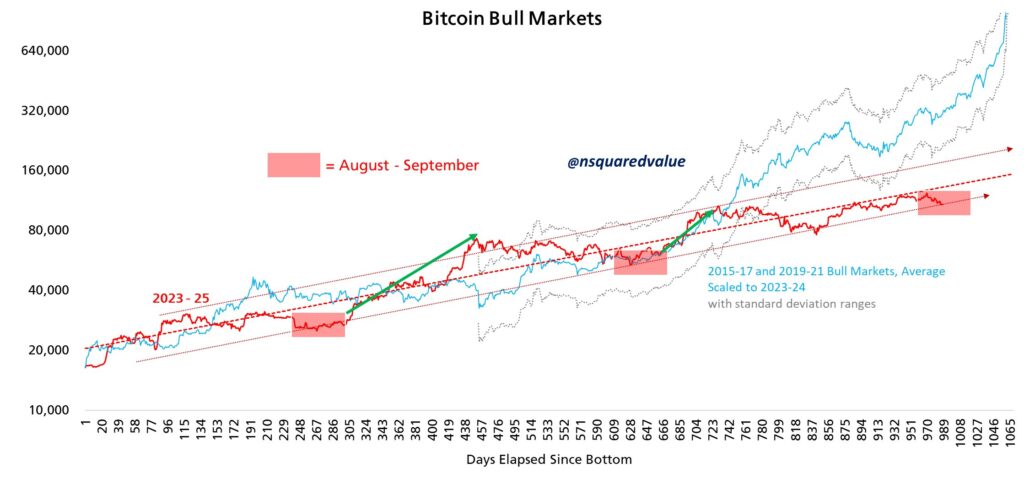

Seasonal Struggles Continue

September has historically been Bitcoin’s weakest month, with average returns of –3.5% across the past twelve years. The latest monthly close confirmed Bitcoin’s fourth consecutive negative August, down 6.5%.

Analyst Timothy Peterson emphasised that seasonality has shaped Bitcoin’s performance for more than a decade, much like traditional equity markets. Investor Mark Harvey added that this August marked the first post-halving “red” month, a possible indication that institutional adoption is diluting Bitcoin’s four-year halving cycle.

As Bitcoin continues to navigate volatile conditions, traders remain split on whether $100,000 will hold as support or whether further downside lies ahead. Meanwhile, gold’s rally serves as a stark reminder of the diverging fortunes between digital and traditional safe havens.

Leave a Reply