PayPal has announced that US merchants can now accept payments in over 100 cryptocurrencies through its new “Pay with Crypto” feature. The company is selling this as a game-changer for digital commerce and a bridge between the $3-trillion crypto economy and everyday businesses. On paper, it looks like PayPal has just opened its doors to 650 million crypto users worldwide. But the reality is far more complex.

In our view, this is not the full-scale revolution that some headlines suggest. It is a cautious first step. PayPal has done something clever by giving merchants stable payouts while letting consumers spend crypto directly. Yet big questions remain about adoption, fees, regulation and trust.

What Pay with Crypto Really Offers

At its core, Pay with Crypto is PayPal’s settlement layer built on blockchain. Customers can pay in Bitcoin, Ether, Solana, stablecoins like USDC and Tether, or even tokens like XRP and BNB. Merchants on the other side do not need to touch volatile coins. They get paid in either US dollars or PayPal’s own stablecoin, PYUSD.

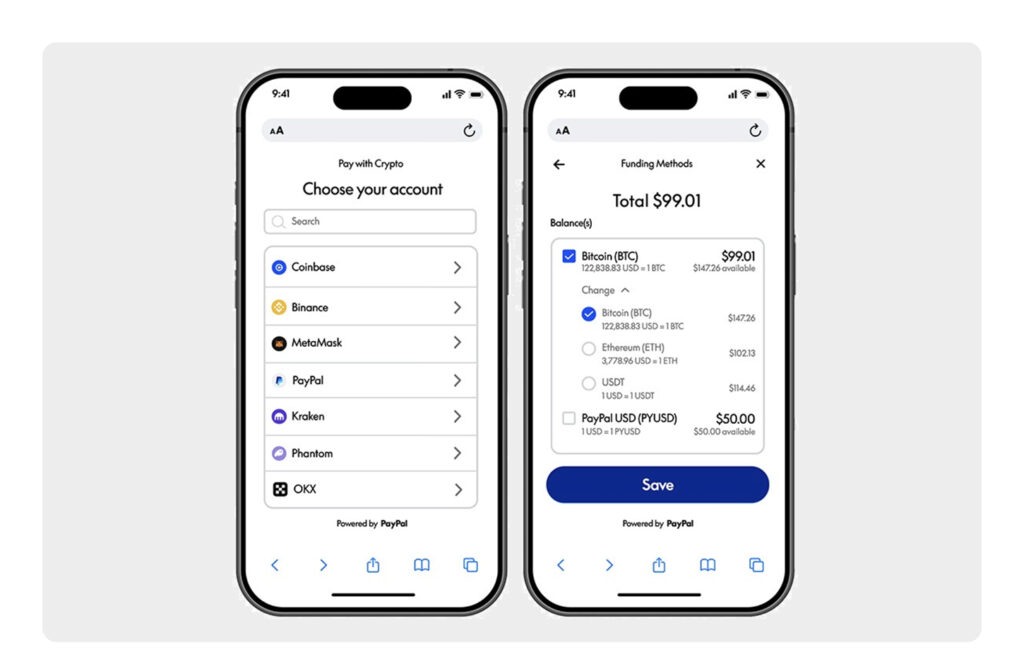

From a design point of view, this solves one of crypto’s oldest problems: price volatility. Sellers can avoid the risk of accepting Bitcoin that might fall 5% before they convert it. For buyers, it simplifies the process of paying with crypto. No more manual swaps on exchanges. You connect a wallet such as MetaMask or Coinbase Wallet at checkout and pay directly.

It is also wallet-agnostic. That is an important shift because PayPal is no longer forcing people to pre-load crypto into its own app. Instead, it opens the door to Web3-native users who prefer to hold funds in non-custodial wallets. This is smart. It means PayPal is not fighting the crypto-native crowd but inviting them in.

Why Merchants Might Care (and Why They Might Not)

PayPal is offering merchants some strong reasons to care. The most obvious is lower fees. Right now, the promotional fee is just 0.99% until mid-2026. That is a lot cheaper than credit card processing fees which usually range between 1.5% and 3.5%. Even after the rate rises to 1.5%, it still looks attractive, especially for small businesses dealing with international customers.

Settlement speed is another perk. Instead of waiting days for a payout, merchants get near-instant funds either in fiat or in PYUSD. For cash-strapped small businesses, faster settlement could mean better liquidity and smoother operations. On top of that, those who hold PYUSD balances on PayPal can earn roughly 4% APY. That turns idle cash into yield-bearing assets, something most merchants are not offered by traditional processors.

But will businesses actually embrace this? That is the big question. For many small shops, changing payment methods feels like a risk. They want certainty, not experiments. PayPal is removing some barriers, but it has not solved the trust issue entirely. Merchants still need to trust PayPal’s stablecoin, trust that fees will not creep up too high after the promotional period, and trust that regulators will not crack down on crypto settlement features. That is a lot of trust to ask for.

The Consumer Side: Real Utility or Gimmick?

For buyers, Pay with Crypto promises simplicity. At checkout, you can select crypto just as easily as a card. The conversion to fiat happens instantly, and the merchant receives a stable payout. This is the closest crypto has come to being usable as money in everyday commerce.

But let’s be honest. Most people are not clamouring to spend their Bitcoin or Ethereum on shopping. Crypto is still largely seen as an investment or a speculative asset. Stablecoins might be more logical for payments, but then you have to ask: why would someone bother using a stablecoin via PayPal if they can already pay with a card or PayPal balance?

The answer might lie in cross-border transactions. Crypto payments can avoid high international card fees and slow settlement times. For people in emerging markets or those who get paid in stablecoins, this could finally make sense. But for the average US consumer, Pay with Crypto might feel like a novelty rather than a must-have.

The Bigger Vision (and the Catch)

PayPal’s vision does not stop here. The company is already working on PayPal World, a digital wallet alliance that aims to link payment systems like India’s UPI, China’s Tenpay, Mercado Pago in Latin America and Venmo in the US. If it works, this could connect nearly two billion users across borders with stablecoin-enabled transactions.

Add to that its partnership with Fiserv to ensure stablecoin interoperability, and you start to see a bigger ambition: PayPal wants to position itself as the backbone of crypto payments worldwide. It wants to be the company that makes stablecoins usable in real commerce.

That is the dream. But the reality has hurdles. PYUSD still needs regulatory approval in some regions like New York. None of the crypto balances are insured by the FDIC or SIPC, which means users are exposed if something goes wrong. And while the current fee structure looks attractive, it will not stay at 0.99% forever. Once it goes up, will merchants still find it appealing compared to traditional rails?

A Quiet Revolution in Plain Sight

PayPal deserves credit for taking a real step into crypto payments. Unlike many companies that talk about blockchain but never deliver, PayPal has built a working product that solves volatility for merchants and simplifies spending for consumers. It is one of the few serious attempts to bridge traditional finance with the Web3 world.

But we remain cautious. The narrative of “650 million crypto users now on PayPal” is more marketing than reality. Just because wallets can connect does not mean people will suddenly start spending their coins. Adoption will likely be slow, and trust will be tested on the regulatory and pricing fronts.

Still, if PayPal can build out PayPal World, secure wider regulatory approval and maintain competitive fees, it may well become the first global company to make crypto truly usable for day-to-day payments. Until then, this is an experiment worth watching, but not yet the revolution some claim it to be.