The $21.4 billion Pokémon trading card market may soon enter the blockchain era, with analysts suggesting it could trigger a cultural and financial shift akin to prediction markets’ adoption on Polymarket.

Pokémon Meets Blockchain

Pokémon, the franchise synonymous with gaming, anime and trading cards, could become the next major real-world asset (RWA) to migrate on-chain. Danny Nelson, research analyst at Bitwise, highlighted the potential in a post on X, describing it as the trading card industry’s “Polymarket moment.”

The term refers to the prediction market platform Polymarket, which gained mainstream traction by transforming how people interact with speculative trading. Nelson believes a similar “sticky” trend could emerge with Pokémon cards, one that creates enduring demand rather than short-term hype.

With the trading card game valued at $21.4 billion globally, the prospect of tokenisation opens the door for millions of fans to access and trade cards more efficiently.

Why Cards Could Outshine Other RWAs

Real-world asset tokenisation has surged into a $28.34 billion market in 2025, focusing largely on stocks, treasuries and real estate. While impactful, Nelson argued that these sectors already enjoy strong digital infrastructure, making blockchain less transformative.

In contrast, Pokémon cards still rely heavily on physical logistics, with prized editions of Charizard, Pikachu and Gardevoir cards shipped between collectors worldwide. Blockchain tokenisation could eliminate frictions such as shipping delays, authenticity disputes and liquidity challenges.

Platforms like Whatnot, which handled $3 billion in card sales last year, underline the size of the opportunity. Nelson also suggested Pokémon exchange-traded funds (ETFs) or pooled investment products may arrive sooner than many expect, bridging traditional finance with blockchain-powered collectibles.

Collector Crypt and the Solana Edge

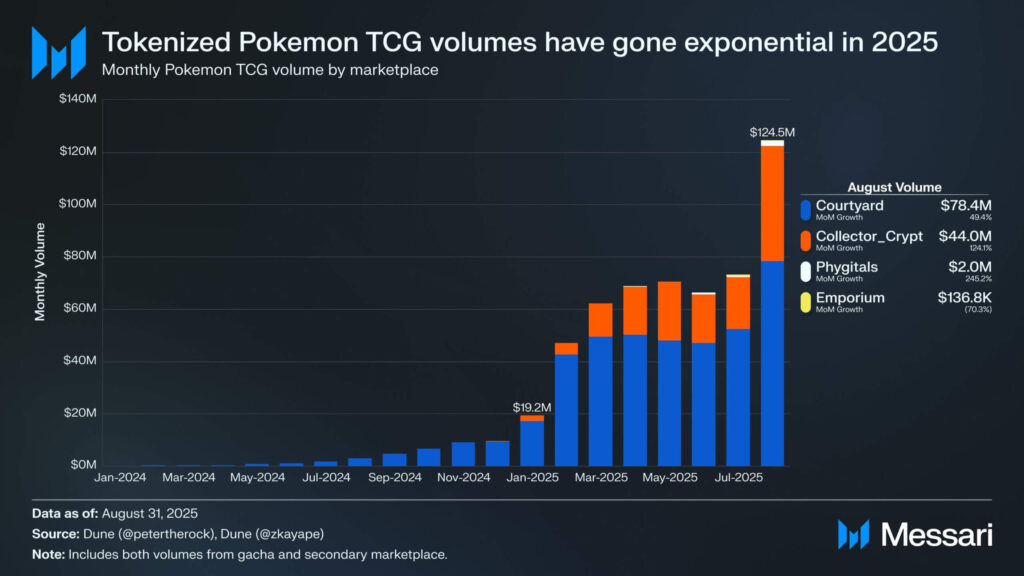

A new player has already emerged to seize the momentum. Collector Crypt recently launched a tokenisation platform on Solana through Metaplex, enabling Pokémon cards to be traded quickly and profitably.

Its native token, CARDS, surged tenfold in just one week, reaching a fully diluted valuation of $450 million. The platform is projected to generate $38 million in annual revenue at current activity levels.

Collector Crypt’s other venture, the Gacha Machine project, added further fuel to the trend, generating $16.6 million in revenue over the same week. The rapid growth signals strong market appetite for tokenised trading card ecosystems.

NFTs Back on the Rise

The timing also aligns with a rebound in NFT activity. According to DappRadar, trading volumes climbed 9% in August to $578 million, the highest since January. Interestingly, the data showed fewer overall trades but higher spending per transaction, pointing to collectors allocating more capital into premium assets.

If Pokémon cards shift on-chain at scale, they could accelerate this trend by pulling in collectors from outside the crypto space. With one of the most recognisable brands in the world as an entry point, blockchain adoption could broaden significantly.

A Collectibles Revolution in Motion

For years, blockchain’s promise of transforming traditional markets has centred on institutional-grade assets. Now, Pokémon cards could show that consumer-facing collectibles are just as ripe for disruption.

By bringing authenticity, liquidity and accessibility to a beloved global hobby, tokenisation could redefine how fans interact with the Pokémon universe. More importantly, it could mark a new wave of mainstream crypto adoption rooted not in speculation alone, but in nostalgia and culture.

Leave a Reply