Solana (SOL) is gaining ground on Ethereum (ETH) in terms of on-chain activity and network usage. The token, which traded at a massive 97% discount to Ethereum’s market capitalization in early 2023, has seen that gap shrink to 70%. Yet, as Solana’s metrics improve, questions remain: Is the market still undervaluing Solana relative to Ethereum?

Network Fees: A Rising Rival

In Q2 2024, Solana generated $151 million in network fees, equivalent to 27% of Ethereum and its leading Layer 2 (L2) solutions. Over the past 90 days, that share surged to 49%. This growth underscores Solana’s increasing ability to monetize network activity, though Ethereum’s robust L2 ecosystem still gives it an edge in attracting more diverse demand.

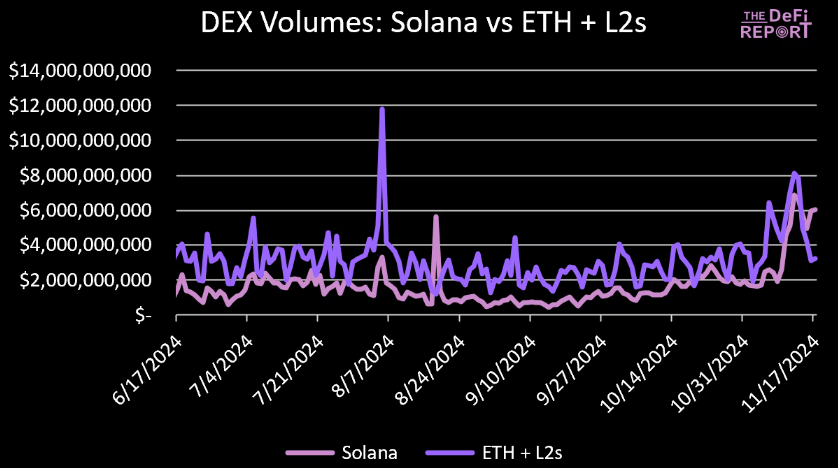

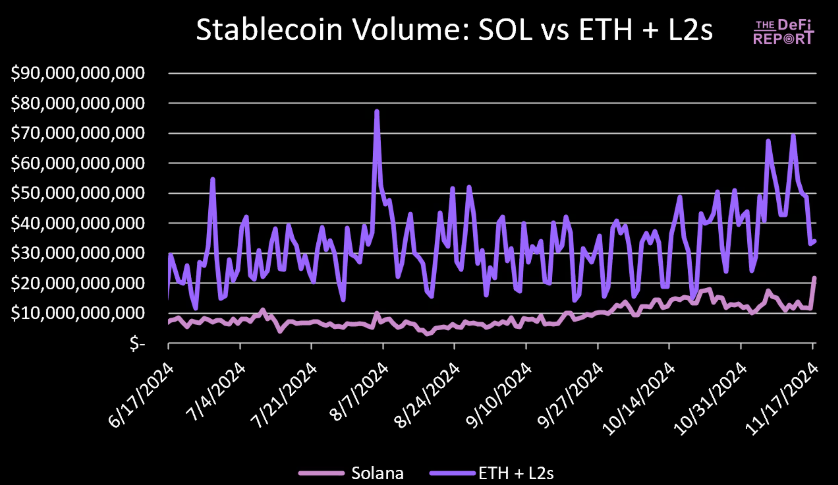

DEX Volumes: A Competitive Edge

Solana’s decentralized exchange (DEX) trading volumes tell a similar story. From $108 billion in Q2—36% of Ethereum’s figure—Solana rose to $153 billion, now 57% of Ethereum’s total. However, this momentum is tempered by fluctuations in stablecoin activity, with Solana’s stablecoin volumes dropping from 190% of Ethereum’s in Q2 to 30% in the last 90 days. The decrease is likely tied to reduced algorithmic trading.

Total Value Locked: Closing the Gap

Solana has also improved its Total Value Locked (TVL), rising from $4.2 billion in Q2 to $8.2 billion, which is now 12% of Ethereum and its L2 counterparts. While still a fraction of Ethereum’s TVL dominance, the rapid growth signals increasing trust and adoption of Solana’s ecosystem for DeFi.

Qualitative Factors Still Matter

Despite Solana’s impressive metrics, Ethereum retains qualitative advantages, including its broader developer community, deeper liquidity, and higher peer-to-peer usage of stablecoins (30% on Ethereum compared to 6% on Solana). These factors highlight Ethereum’s edge as a network for non-speculative use cases.

Conclusion

Solana’s improving metrics suggest a fair re-pricing relative to Ethereum may be warranted. However, investors should weigh both quantitative and qualitative differences before jumping to conclusions. As 2025 approaches, potential catalysts for both networks could further shift the narrative.