Bitcoin continues to hold firm above the psychological $110,000 level, reinforcing its ongoing uptrend. Yet historical patterns suggest the world’s largest cryptocurrency could require an 8% correction before fuelling its next major rally towards a new all-time high (ATH).

A Dip Before the Breakout?

After a turbulent week that tested investor confidence, Bitcoin has rebounded strongly and now trades around $111,340. While this resilience signals robust momentum, analysts caution that the current setup may mirror previous cycles where the price dipped before accelerating higher.

The key marker in this context is the 38.2% Fibonacci Retracement line, positioned near $101,634. Historically, Bitcoin’s pullbacks to this level have acted as launch pads for sharp, sustained surges. Market watchers argue that without a reset at this critical point, the next phase of growth may be delayed or less durable.

In numbers, this implies a potential 8.7% slide from current prices. Though such a correction may alarm short-term traders, seasoned investors often interpret it as a healthy consolidation that refreshes market momentum before a major breakout.

Signals From the Network

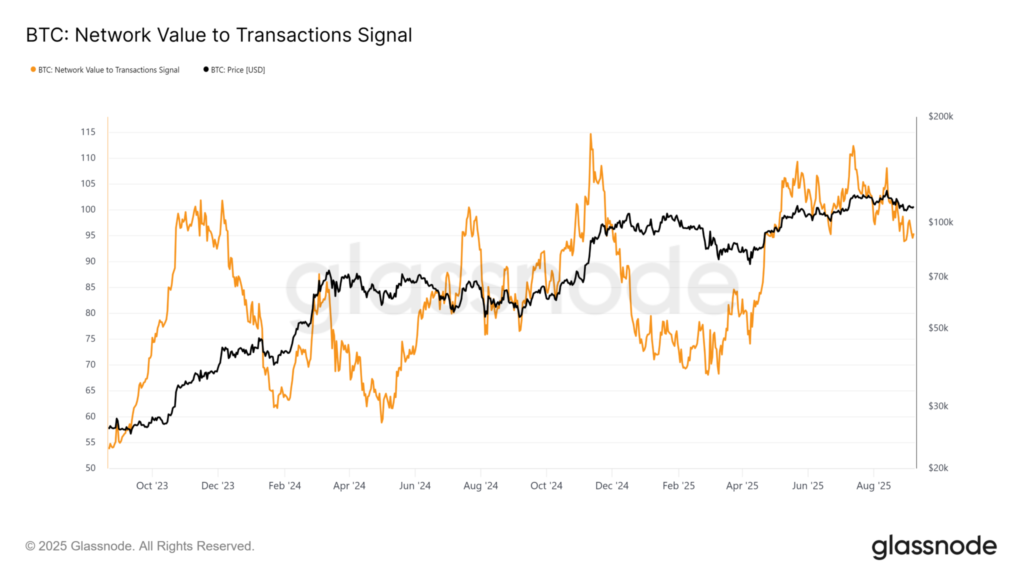

Beyond price levels, on-chain metrics offer further insight into Bitcoin’s immediate prospects. The Network Value to Transactions (NVT) ratio, an indicator comparing market capitalisation to transaction volume, has been trending lower in recent weeks.

Typically, a high NVT suggests overvaluation and precedes price drops, while a cooling NVT indicates subdued activity and reduced speculative excess. The current downtrend in NVT signals a calmer market backdrop, which paradoxically makes a sharp correction less likely in the immediate term.

This means Bitcoin could continue climbing without retesting the $101,634 support. However, it also challenges the historical playbook that points to a retracement before new highs. In short, the next major move hinges on whether buyers are willing to push the rally further without the traditional “reset” dip.

Near-Term Outlook

For now, Bitcoin’s technical structure remains constructive. The cryptocurrency is holding comfortably above $110,000 support, aligned with its four-month uptrend line. If this level remains intact, the next targets lie at $112,500 and $115,000, areas where profit-taking could temporarily slow momentum.

However, traders are cautious. If selling pressure intensifies, particularly from profit-takers locking in recent gains, Bitcoin could swiftly revisit the Fibonacci retracement zone around $101,634. This would not only align with historical precedent but also provide the “clean slate” that past rallies have relied on.

On the downside, a breach below the six-figure mark would significantly alter sentiment. Analysts warn that falling under $100,000 could invalidate the bullish thesis in the short term, extending the correction phase and delaying the march towards a new ATH.

Balancing Risk and Reward

Bitcoin’s position today is a tale of two possibilities. On one hand, its resilience above $110,000 strengthens the bull case, with upside targets clearly in sight. On the other, history cautions that a retracement to just over $101,000 may be necessary to reignite the kind of explosive rally that carries prices into uncharted territory.

For long-term investors, the key lies in perspective. An 8% decline, while uncomfortable, is minor compared with the scale of Bitcoin’s recent gains and could ultimately pave the way for higher highs. For traders, the coming days may hinge on whether the market can sustain momentum above $110,000 or whether profit-taking forces a reset.

Either way, the cryptocurrency market is once again at a pivotal juncture, balancing between immediate upside and the potential for one more dip before the next leap forward.

Leave a Reply