As of September 2025, warning lights are flashing across the US economy, sparking debate over whether the nation is inching closer to recession. From weakening job creation to plunging construction activity and collapsing consumer sentiment, the signs are hard to ignore. While the implications are severe for traditional markets, the impact on crypto could be even more acute as investors reassess risk and liquidity dries up.

Jobs Data Points to Fragility

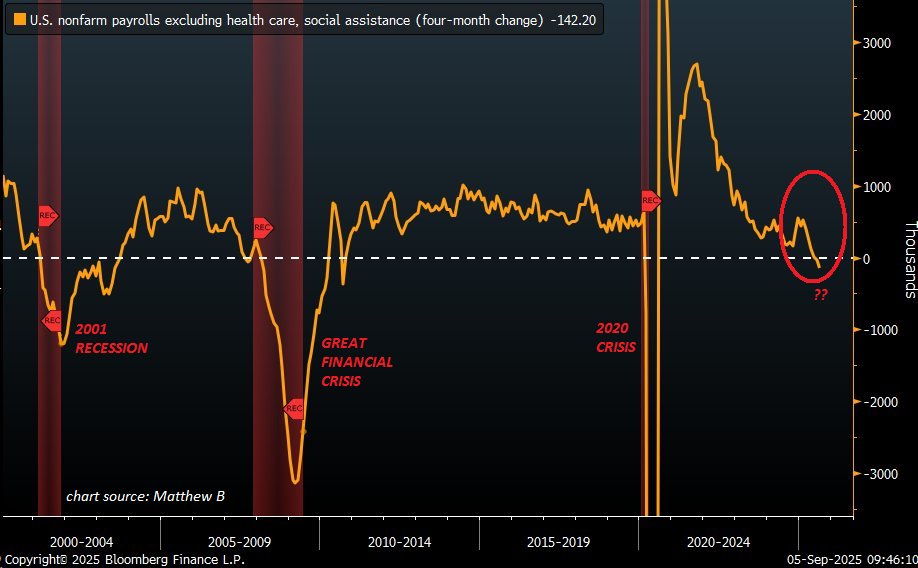

The clearest red flag comes from the labour market. Nonfarm payroll growth slowed to just 22,000 in August, well below the expected 75,000. Analysts highlight that of the approximately 598,000 jobs created during President Donald Trump’s second term, a staggering 86% were concentrated in healthcare and social assistance. Beyond this sector, hiring has essentially ground to a halt.

Even more worrying is the broader trend: data shows the US has shed 142,200 jobs over the past four months, the steepest decline since the 2020 pandemic crash. Historically, such sustained losses have almost always coincided with the onset of recession.

Long-term unemployment has also spiked. The number of Americans jobless for 27 weeks or more has doubled since December 2022, reaching 1.9 million in August. This represents 25.7% of the total unemployed population, a share typically only seen in deep recessions.

In short, the once-resilient labour market now appears increasingly fragile, a development that could ripple across spending, investment, and ultimately risk appetite.

Construction Spending Crumbles

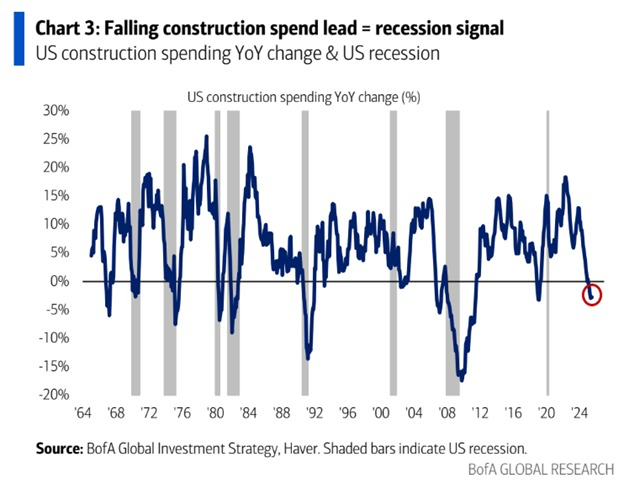

Another early warning signal is found in construction, a sector often described as the backbone of economic momentum. According to The Kobeissi Letter, construction spending fell 2.8% year-on-year in July 2025, one of the sharpest declines since the 2008 financial crisis.

On a monthly basis, investment in construction projects has contracted in 10 of the past 11 months, marking the longest losing streak in 15 years. Construction employment has also dipped for three consecutive months, the longest decline since 2012.

Such weakness points to dwindling confidence among businesses and developers, suggesting hesitation to commit to housing, infrastructure, or commercial projects. Given that construction feeds into a vast ecosystem from raw materials to financial services, its downturn represents a significant blow to the broader economy.

Consumer Sentiment Hits Historic Lows

While technical indicators help define recessions, public sentiment often provides an equally telling perspective. The Wall Street Journal–NORC poll reveals that only 25% of Americans now believe they have a good chance of improving their living standards, the lowest reading since 1987.

The outlook for future generations is even more bleak: over three-quarters of respondents doubt that children will be better off than their parents, while nearly 70% say the so-called American Dream is dead or never existed.

Interestingly, the poll also revealed a partisan split. Republicans expressed less pessimism than Democrats, a familiar trend that often reflects whichever party holds the White House.

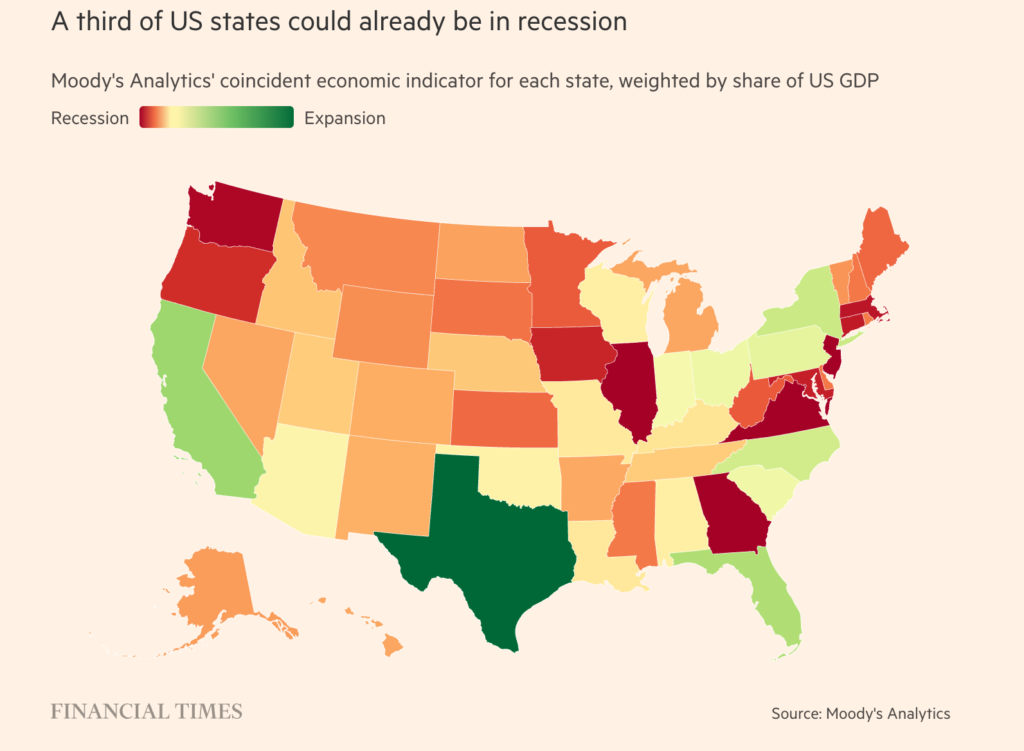

The Financial Times has further highlighted regional divergences in economic resilience. States such as Illinois, Washington, New Jersey, and Virginia may already be in recession, while larger states like New York, Texas, Florida, and California continue to show signs of stability. These disparities could delay the declaration of a nationwide downturn but underline uneven conditions across the country.

What This Means for Crypto

For digital assets, the looming recession is a double-edged sword. In the short term, the picture looks grim. Financial trader Matthew Dixon explained that crypto, like equities, is priced on growth expectations. When forecasts weaken, valuations contract.

As recession fears mount, investors often rotate capital into safer assets such as Treasuries, gold, or stable currencies, draining liquidity from crypto markets. This creates tighter credit conditions, higher borrowing costs, and weaker demand for speculative assets. The effect is typically amplified in the digital asset space, where volatility and sentiment play outsized roles.

In the months ahead, Bitcoin and altcoins could face sustained selling pressure as traders de-risk portfolios. Negative headlines and deteriorating economic data may further spook investors, driving heightened volatility.

However, the longer-term implications may differ. Should the Federal Reserve pivot to monetary easing in response to slowing growth, liquidity could flow back into risk assets, reviving interest in Bitcoin. Moreover, if distrust in fiat currencies deepens amid prolonged economic weakness, Bitcoin’s narrative as a “digital hedge” may gain traction once again. Altcoins, by contrast, could remain vulnerable due to weaker fundamentals and higher risk profiles.

The combination of collapsing job growth, declining construction activity, and record-low consumer sentiment paints a troubling picture for the US economy in late 2025. While not yet formally declared, the pattern of indicators suggests that recession risks are rapidly rising.

For crypto markets, the immediate outlook is challenging. Liquidity flight, risk aversion, and tighter credit conditions will likely weigh on Bitcoin and especially on altcoins. Yet history shows that downturns can also lay the foundation for renewed adoption once monetary policy eases or faith in fiat systems erodes.

Leave a Reply