Bitcoin has bounced back above $115,000, posting modest gains as derivatives markets once again take centre stage in driving momentum. With spot demand still subdued and ETF inflows weakening, futures and options activity are setting the tone for the world’s largest cryptocurrency. Analysts suggest the market is regaining “firmer footing,” but critical resistance and support levels lie just ahead.

Derivatives Markets Take the Lead

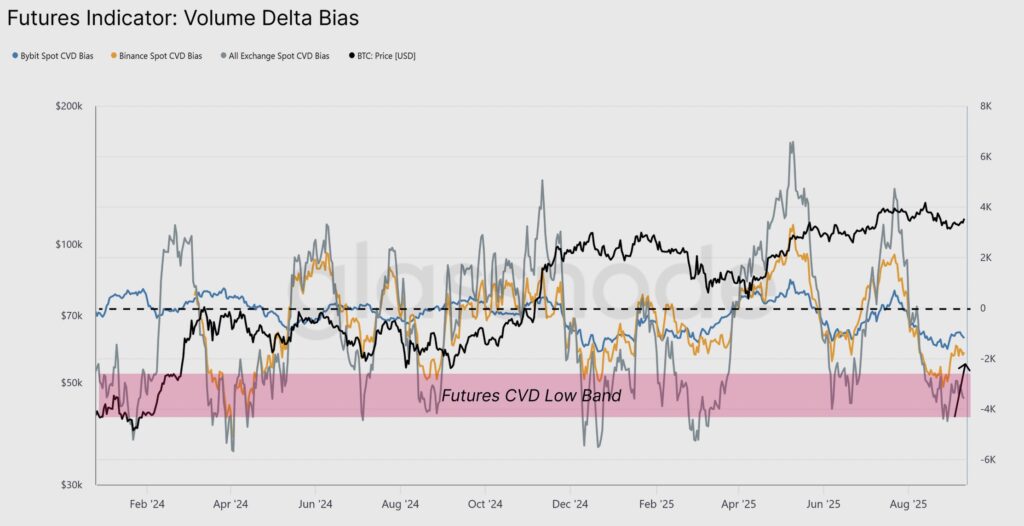

Bitcoin’s ability to mount a recovery has been shaped less by direct spot buying and more by the positioning within derivatives markets. According to Glassnode’s latest Week Onchain report, derivatives have become the primary driver of short-term price action.

The data shows that Bitcoin’s volume delta bias, a measure of buying versus selling pressure, has turned positive following the rebound from $108,000. This points to seller exhaustion across major exchanges such as Binance and Bybit, where futures traders stepped in to absorb recent sell pressure.

Glassnode notes:

“Going forward, the evolution of derivatives positioning will be critical to navigating the market in this low spot-liquidity environment.”

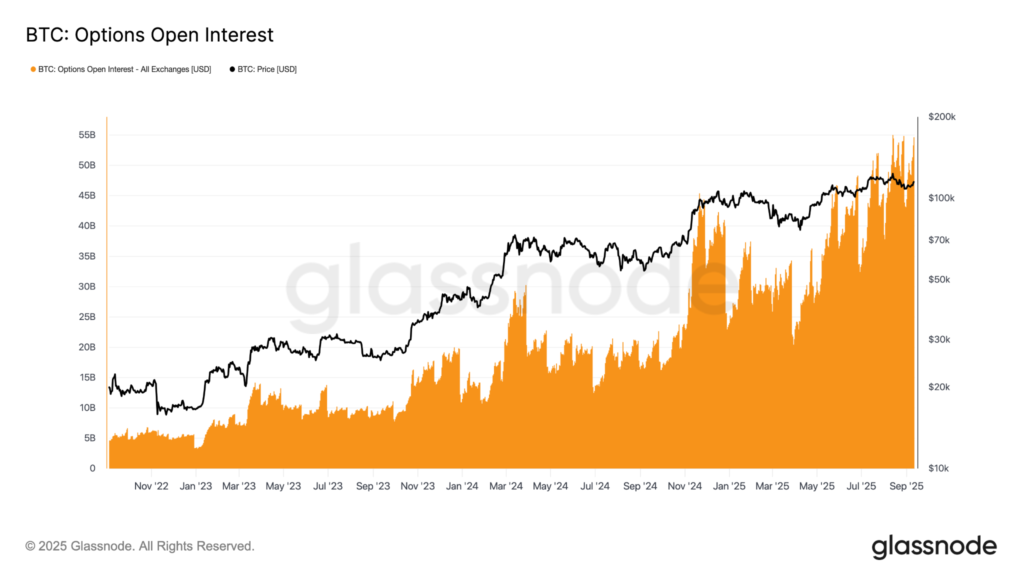

Meanwhile, options open interest (OI) surged to an all-time high of $54.6 billion, up from $43 billion at the start of September. This 26% rise underscores the growing role of derivatives in shaping sentiment and price direction.

Options Data Signals Bullish Bias

Options activity offers further insight into current market psychology. The latest OI data shows a clear tilt toward calls rather than puts, reflecting a market leaning bullish while still guarding against downside risks.

In fact, the last time options OI set a record high was in mid-August, when Bitcoin climbed to fresh all-time highs above $124,500. Analysts suggest that history could repeat itself if momentum builds further.

“Both futures basis and options positioning reflect a more balanced structure than in past overheated phases,” Glassnode observed, pointing to signs of a healthier market foundation.

This Friday’s $4.3 billion options expiry could also be pivotal. Data indicates that the majority of bets favour bullish outcomes, provided Bitcoin holds above $113,000. If successful, the expiry could fuel a breakout toward $120,000.

Resistance and Support Zones in Focus

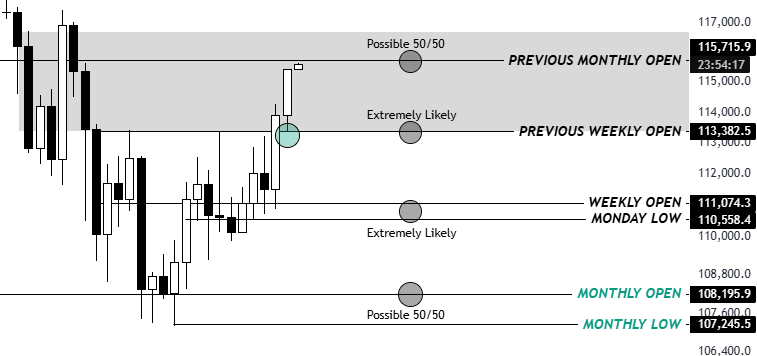

Data from TradingView shows Bitcoin hovering at $115,400 after stalling near resistance at $116,000. The immediate challenge is for BTC to hold above $115,000 to sustain the current rebound.

The upside is capped by a major supply zone stretching from $116,000 to $121,000. A break through this area would open the path toward retesting the $124,500 record highs. However, bears are expected to defend this range aggressively, with liquidation clusters already visible between $116,400 and $117,000. CoinGlass data suggests that if these clusters are breached, a short squeeze could drive prices rapidly higher toward $120,000.

On the downside, support levels are building around $114,500, in line with the 50-day simple moving average (SMA). The next cushion lies near $112,200, supported by the 100-day SMA. Below that, psychological support exists at $110,000, with the recent September low at $107,200 acting as a key floor.

A Crucial Pivot Point Ahead

Market analysts remain cautious despite the recent bounce. Pseudonymous trader KillaXBT pointed to Bitcoin pushing towards the previous monthly open around $115,700, describing it as a “crucial pivot point” for trend direction.

“This is a crucial pivot point in terms of trend direction. We could see some deviation above, as always,” they said on X (formerly Twitter).

With bids clustered around $114,700 and strong sell orders near $116,000, the immediate future for Bitcoin may hinge on how traders react to these pressure zones. A decisive move in either direction could set the tone for the remainder of September.

Consolidation or Breakout?

For now, Bitcoin remains in a tug-of-war between bullish derivatives-driven momentum and strong resistance at higher levels. If bulls can defend the $115,000 level and absorb pressure around $116,000, the path toward $120,000 could open quickly, particularly with the upcoming options expiry.

However, a failure to hold current support zones could see bears push BTC back toward $113,000 or even the $110,000 region. With options OI at record highs, volatility appears all but guaranteed in the coming sessions.

Bitcoin’s short-term future may therefore depend less on spot demand and more on how derivatives traders position themselves around key price levels. As the market stands, all eyes are on the $116,000 barrier, a level that could decide whether Bitcoin breaks higher or returns to a broader consolidation.

Leave a Reply