Institutional investors are ramping up their exposure to digital assets, with both Bitcoin and Ether spot exchange-traded funds (ETFs) recording significant inflows on Friday. The surge underscores renewed confidence in crypto markets as macroeconomic conditions stabilise and demand for regulated investment products grows.

Bitcoin ETFs See Fifth Straight Day of Gains

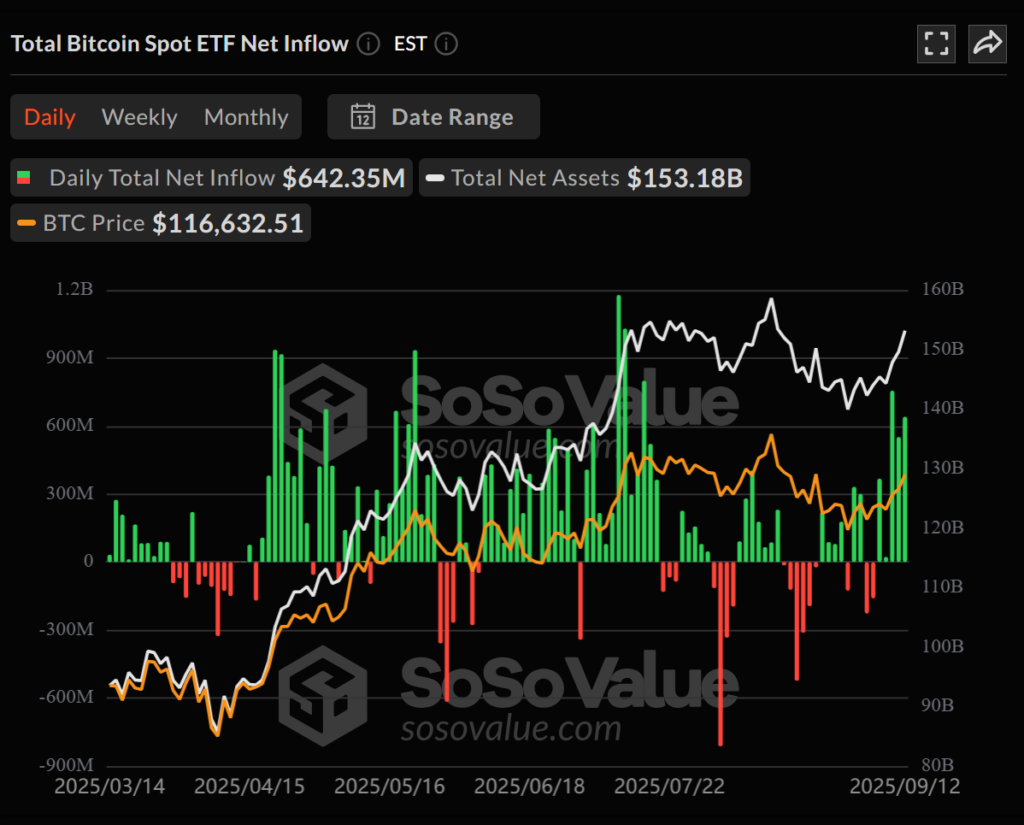

Spot Bitcoin ETFs posted $642.35 million in net inflows on Friday, marking the fifth consecutive day of positive momentum, according to data from SoSoValue.

Cumulative inflows now stand at $56.83 billion, with total net assets under management (AUM) reaching $153.18 billion, roughly 6.6% of Bitcoin’s total market capitalisation. Trading volumes across Bitcoin ETFs topped $3.89 billion, highlighting robust investor activity.

Fidelity’s FBTC was the standout performer, attracting $315.18 million in fresh capital, followed closely by BlackRock’s IBIT, which added $264.71 million. Both funds also posted daily gains of over 2%, reflecting stronger sentiment in the underlying asset.

The inflows follow a quieter start to the month and suggest that investors are regaining confidence as global economic conditions show signs of stabilisation.

Ether ETFs Mirror the Momentum

Spot Ether ETFs also saw a strong performance, pulling in $405.55 million in net inflows on Friday, their fourth consecutive day of gains.

Total inflows into Ether ETFs have now reached $13.36 billion, with net assets standing at $30.35 billion. BlackRock’s ETHA led the way with $165.56 million in new capital, while Fidelity’s FETH followed closely with $168.23 million. ETHA alone saw $1.86 billion worth of trades on the day, underscoring growing institutional interest in Ethereum-based products.

Vincent Liu, chief investment officer at Kronos Research, noted the significance of the trend:

“Bitcoin and Ethereum spot ETFs keep seeing strong inflows, showing rising institutional confidence. If macro conditions hold, this surge could strengthen liquidity and drive momentum for both assets.”

Institutional Confidence on the Rise

The back-to-back inflows into both Bitcoin and Ether ETFs highlight a broader shift in institutional positioning. After a subdued period earlier in the month, the recent surge suggests growing conviction that crypto markets are regaining strength.

Spot ETFs, launched in the US earlier this year, have provided institutions with a regulated, liquid pathway to gain exposure to cryptocurrencies without directly holding the underlying assets. With trading volumes increasing and AUM steadily climbing, these products are cementing their role in bridging traditional finance and digital assets.

BlackRock Explores ETF Tokenisation

In a further sign of the evolving landscape, BlackRock is reportedly exploring ways to tokenise its ETFs on blockchain networks. The move comes after the success of its Bitcoin ETF products and reflects growing interest in integrating traditional investment vehicles with decentralised finance (DeFi).

Tokenised ETFs could enable features such as 24/7 trading, fractional ownership and interoperability with DeFi protocols. However, regulatory uncertainty remains a significant hurdle before such products can be rolled out at scale.

If realised, tokenisation could represent the next stage of innovation, extending the accessibility and functionality of ETFs beyond traditional market hours and infrastructure.

Outlook

The strong inflows into both Bitcoin and Ether ETFs signal that institutional demand for crypto exposure is back on the rise. With macro conditions improving and major asset managers like BlackRock exploring tokenisation, the link between digital assets and traditional finance is strengthening.

If the momentum continues, both Bitcoin and Ethereum could see heightened liquidity and price support in the weeks ahead, reinforcing their position as the leading assets in the evolving digital economy.

Leave a Reply