Bitcoin is trading about 4% higher than a week ago, crossing $116,000 and edging closer to closing the August CME futures gap at $117,300. For crypto traders, this is bullish momentum. For the broader economy, however, the backdrop looks far from healthy.

A mix of stickier-than-expected inflation and weakening labour market data has raised fears of stagflation in the United States. Markets now expect the Federal Reserve to respond with rate cuts as early as this week, a development that has lifted both equities and bitcoin. But does this rally mark the beginning of a sustainable run, or is it merely a short-lived boost fuelled by monetary-policy hopes?

Cracks in the U.S. Economy

The rally in risk assets followed a string of worrying economic releases.

- CPI surprise: Last Thursday’s U.S. Consumer Price Index showed headline inflation slightly above expectations. That suggested inflationary pressures remain persistent despite earlier signs of cooling.

- Job market revisions: On Tuesday, the Bureau of Labor Statistics revised job creation data for the year ending March, showing nearly 1 million fewer jobs than originally reported, the sharpest downward revision in U.S. history.

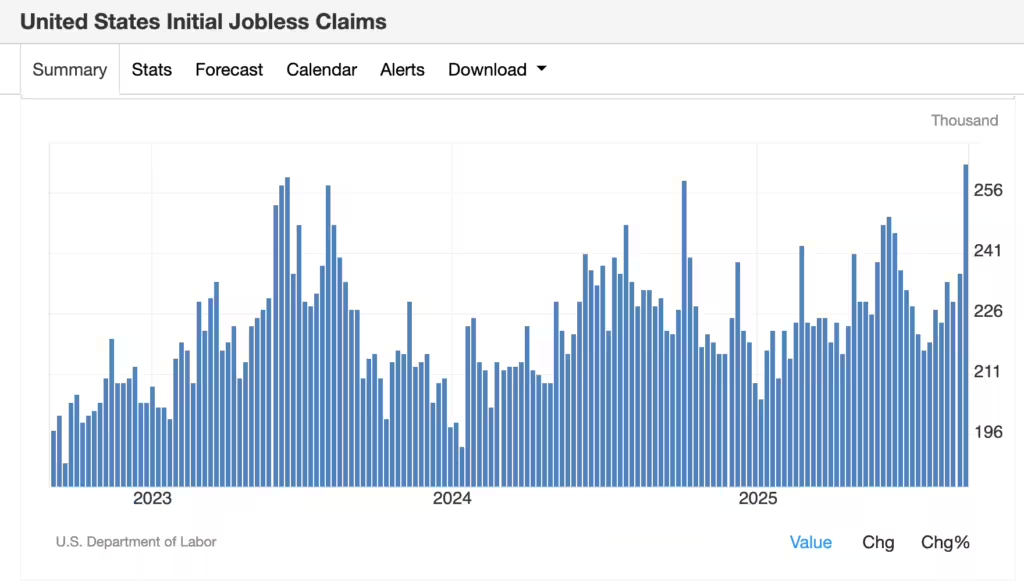

- Labour weakness: The monthly jobs report for August revealed just 22,000 new jobs, with unemployment rising to 4.3%. Initial jobless claims also jumped by 27,000 to 263,000, the highest since October 2021.

Taken together, the numbers point to an economy struggling on both fronts: slower job growth and stubborn inflation. That’s why commentators are once again reviving the dreaded term stagflation.

Risk Assets Rally on Rate-Cut Hopes

Despite the gloomy data, both stocks and bitcoin have climbed. The logic is straightforward: weaker data means the Fed is more likely to cut rates to stimulate the economy.

The S&P 500 closed at record highs two days in a row last week, while bitcoin broke above $116,000. CME’s FedWatch tool shows traders now expect a 25 basis-point cut in September and are pricing in three cuts by year-end.

Falling bond yields reinforce this narrative. The 10-year U.S. Treasury briefly dipped below 4% this week, a sign investors see slower growth ahead and are moving into government debt. Meanwhile, the U.S. dollar index (DXY) is holding multi-year support, an inflection point that could either extend bitcoin’s rally if broken or cap its upside if the dollar strengthens again.

Bitcoin’s Chart Still Constructive

From a technical standpoint, bitcoin’s price structure remains encouraging for bulls. Since bottoming at $107,500 in early September, BTC has been forming higher lows, a sign of accumulation.

The 200-day moving average has risen to $102,083, a long-term bullish marker. The Short-Term Holder Realized Price (STH RP), often regarded as a reliable support level in bull markets, has reached a record high of $109,668. These rising baselines suggest underlying demand, even if macro headwinds remain.

Still, traders should watch for volatility around the Fed’s upcoming decision. A smaller-than-expected rate cut or hawkish commentary could unwind the rally quickly.

Bitcoin Stocks: A Mixed Picture

While bitcoin itself gained ground, crypto-linked equities told a more complicated story.

- MicroStrategy (MSTR): Shares were flat for the week, underperforming both BTC and rivals. The stock remains below its 200-day moving average of $355, closing Thursday at $326, a critical long-term support zone. Its mNAV premium has compressed to under 1.5x once debt and preferred stock are factored in, showing reduced investor enthusiasm.

- MARA Holdings (MARA): Up 7% for the week, outperforming bitcoin itself.

- XXI (CEP): Gained 4%, another relative winner.

MicroStrategy continues to lean heavily on share issuance to support its bitcoin treasury strategy. Preferred stock issuance has been muted, with only $17 million raised this week. However, new options listings on its perpetual preferred stock could provide alternative yield opportunities for investors.

This divergence between bitcoin and its proxy stocks highlights an important theme: while the digital asset benefits directly from macro shifts, companies tethered to bitcoin face added operational and structural challenges.

Bullish or Bearish?

On balance, bitcoin’s latest climb reflects more about expectations for monetary easing than organic strength in the global economy. The data paints a concerning picture: higher inflation, weaker jobs and rising stagflation risks. If the Fed delivers aggressive rate cuts, risk assets could see a strong tailwind.

Yet the reliance on policy stimulus also means the rally is fragile. If inflation proves too sticky and the Fed hesitates, bitcoin and equities alike could see sharp pullbacks.

For now, price action suggests traders are willing to bet on the bullish side, at least in the short term. But beneath the surface, the cracks in the U.S. economy remind investors that bitcoin’s rally is still tethered to macro fragility.