Perpetual decentralised exchanges (DEXs) are rapidly becoming one of the most competitive sectors in decentralised finance (DeFi), challenging both established players like Hyperliquid and centralised giants such as Binance. With explosive growth in trading volumes, token valuations and community engagement, perpetual futures trading is positioning itself as the next major narrative driving the crypto markets in 2025.

Hyperliquid’s First-Mover Advantage Faces Pressure

Hyperliquid, once seen as the unchallenged leader in the perpetual DEX space, built its reputation by offering fully permissionless trading with deep liquidity and no restrictions on US-based traders. At its peak, Hyperliquid was the second-highest fee generator in DeFi, just behind Tether and it attracted high-profile whales and influencers who boosted visibility across the sector.

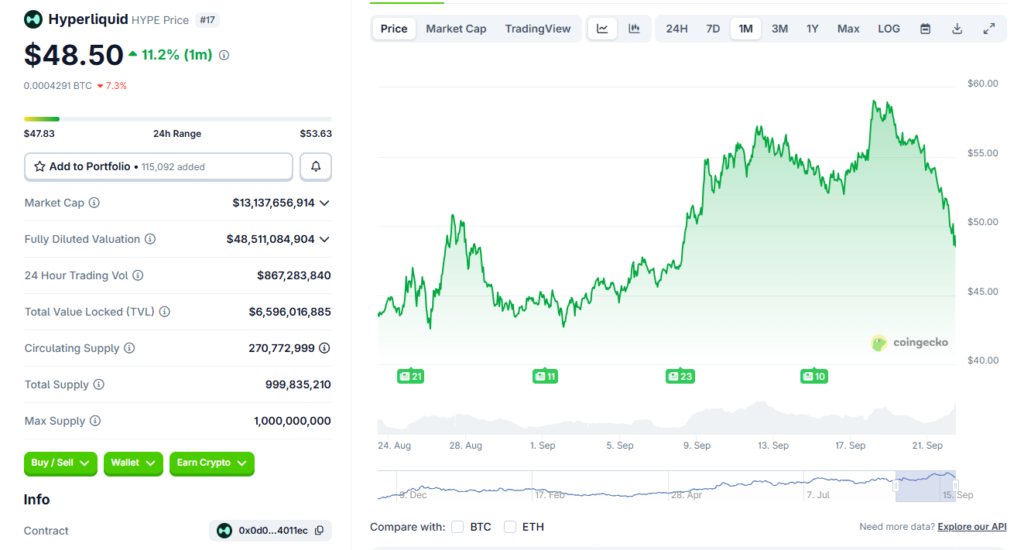

Yet, the landscape is shifting. Hyperliquid’s native token, HYPE, slipped from near $60 to $48 after a market correction, weakening its dominance. New competitors such as Aster, EdgeX and SunPerp are now gaining momentum, offering competitive fee structures, high leverage and liquidity incentives to attract traders.

While Hyperliquid retains leadership in daily fees, the rapid entrance of rivals is forcing it to defend its position against both smaller independent protocols and centralised-backed initiatives, including Binance’s ventures and Justin Sun’s TRON-linked SunPerp.

New Entrants Heat Up the Perpetual Race

The most prominent new arrival, Aster, drew attention after its token surged more than 400% in a matter of weeks. However, scepticism emerged after analysts noted that some of its largest inflows originated directly from Binance’s hot wallet, raising concerns about how “organic” its liquidity really is.

Meanwhile, SunPerp launched on TRON in September, backed by rapid buybacks for SUN tokens, pushing the asset to a three-month high of $0.035. EdgeX has also joined the fray, carving out liquidity with aggressive trading incentives.

These new players are tapping into the growing appetite for no-KYC, permissionless trading platforms, echoing the design of earlier protocols like Deridex, which faced regulatory action in 2023 from the US Commodity Futures Trading Commission (CFTC). Despite past scrutiny, the new wave of perpetual DEXs has doubled down on accessibility, drawing in users who prefer decentralised control and anonymity.

Explosive Growth in Engagement and Market Share

Perpetual DEXs are not only gaining liquidity but also capturing attention across the broader crypto ecosystem. According to Dexu AI, the sector saw a tenfold surge in “mindshare” during September, far outpacing other popular narratives such as artificial intelligence tokens, real-world assets (RWAs), or memecoins.

Projects like Aster, Avantis, Lighter, Extended and Paradex have benefited from high-profile endorsements, including mentions from Binance founder Changpeng Zhao. Innovations in wallet integration and favourable regulatory developments in key regions have further boosted adoption.

Perpetual DEXs now control about 26% of the derivatives market, signalling a major shift as traders migrate from centralised exchanges towards platforms offering similar leverage, liquidity and asset choice, but with added transparency and self-custody benefits.

Token Performance Fuels the Narrative

The growth of perpetual futures trading has fuelled dramatic rallies in related tokens. Hyperliquid’s HYPE token has risen more than 500% year-to-date, despite its recent pullback, while Aster gained over 300% in September alone.

By comparison, other sector benchmarks like AI (+12%), RWAs (+8%) and memecoins (+15%) have significantly underperformed. The outsized returns highlight how perpetual DEXs have become one of the defining stories of 2025.

These platforms allow traders to speculate on hundreds of assets with leverage as high as 100x, replicating the products once dominated by centralised exchanges but now fully on-chain. This alignment of high risk, high return and decentralised infrastructure has made perp tokens some of the hottest assets in the market.

The Road Ahead: DeFi’s Next Growth Engine

The rise of perpetual DEXs represents more than just another crypto trend. It marks a fundamental shift in the structure of digital asset markets. While spot decentralised exchanges processed over $140 billion in volume in August, perpetual futures are quickly becoming DeFi’s main growth driver.

Analysts now project that decentralised derivatives could push total DeFi volumes beyond $3.4 trillion by 2025, cementing perps as a core feature of the sector.

Still, challenges remain. Regulatory uncertainty, liquidity concentration and reliance on hype-driven token launches may expose traders to sudden shocks. For now, whales remain central to determining which platform dominates and traders are warned against blindly chasing the “next hot perp token.”

Even so, with surging adoption, booming token prices and rapidly expanding mindshare, perpetual DEXs are reshaping the competitive landscape of crypto trading. Whether Hyperliquid holds onto its crown or newcomers like Aster and SunPerp steal the spotlight, one thing is clear: the perpetual futures narrative has arrived and it is here to stay.

Leave a Reply