The crypto market witnessed one of its heaviest shakeouts of the year on Monday, with over $1.8 billion in leveraged positions liquidated within 24 hours. The sell-off, which swept across Bitcoin, Ether and altcoins, dragged total market capitalisation down by more than $150 billion to a two-week low of $3.95 trillion.

While the flush left many traders reeling, analysts remain divided on whether the event marked a final reset before the next leg higher or if deeper corrections lie ahead.

Record Liquidations Trigger Market Jolt

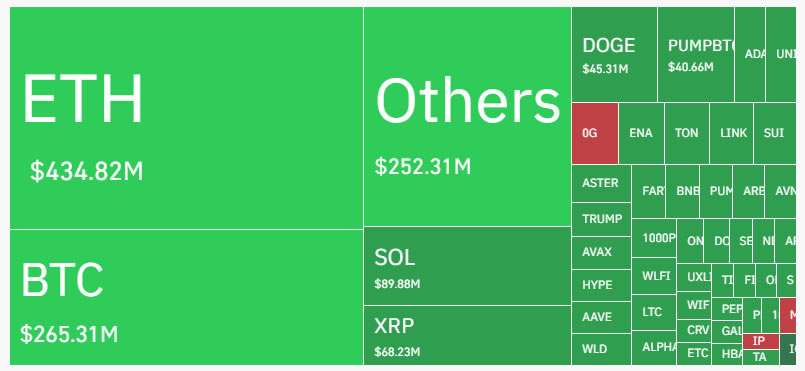

According to data from CoinGlass, nearly 370,000 traders saw positions wiped out, making this the largest long liquidation event of the year. Ether bore the brunt of the wipeout with over $500 million in longs liquidated, more than double the figure for Bitcoin. Altcoins were hit even harder in percentage terms, with BNB, Solana and other majors sliding between 4% and 6%.

Bitcoin dropped below $112,000 on Coinbase, while Ether fell under $4,150, marking its steepest pullback since mid-August. Despite the rout, Bitcoin’s overall correction from its all-time high remains relatively shallow at just 9.5%, a smaller drawdown than typically seen in past bull markets.

Excessive Leverage Blamed, Not Weak Fundamentals

Market veterans described the crash as another case of overleveraged traders facing the consequences. Real Vision founder Raoul Pal noted that crypto markets often see the same pattern repeat: traders pile in with leverage ahead of an anticipated breakout, the rally stalls and cascading liquidations follow. Only then, he said, does the true breakout tend to occur.

Researcher “Bull Theory” pointed to an “excessive imbalance” in altcoin leverage versus Bitcoin, arguing that markets cannot ignore such conditions. “When altcoin leverage gets this extreme, one sharp move down triggers cascading liquidations. That’s how you flush out weak hands and reset the board,” they said.

Maja Vujinovic, CEO of FG Nexus, echoed that view, calling the $1.7B liquidation spike a “leverage wash” rather than a structural break. She emphasised that spot demand, ETF inflows and stablecoin liquidity remain intact, suggesting consolidation rather than capitulation.

Technical Factors Could Drive Further Dips

Despite the argument that the flush was largely technical, some analysts caution that more downside may be needed before the market can stabilise. IG market analyst Tony Sycamore highlighted that Bitcoin has decoupled from traditional assets like gold and tech stocks in recent weeks.

He expects the correction to extend closer to the $105,000–$100,000 support zone, which includes the 200-day moving average at $103,700. Such a move, he said, would shake out weaker participants and set the stage for a stronger rally into year-end.

Historically, September has been one of Bitcoin’s weaker months, with losses in 8 of the past 13 years. Yet, the asset is still up around 4% for September so far and October has typically brought stronger performance, fuelling optimism that a rebound may not be far off.

Market Sentiment Shifts but Fundamentals Hold

Beyond technicals, sentiment has turned more cautious. Analytics firm Santiment reported that more traders are now betting on Bitcoin’s decline, with negative narratives gaining ground on social media. The announcement that defunct exchange FTX will return $1.6 billion to creditors this month added further uncertainty, as claim redemptions can create selling pressure.

Even so, ETF flows remain a bright spot. Spot Bitcoin ETFs attracted $886.6 million in net inflows last week, lifting total assets to $152.31 billion. Spot Ethereum ETFs saw $556 million in net inflows, a sign of continued institutional demand. Meanwhile, macro tailwinds persist, with the Federal Reserve’s recent 25-basis-point rate cut and guidance for more easing supporting risk-on assets like crypto.

Industry executives argue that the sell-off reflects leverage dynamics rather than cracks in fundamentals. Doug Colkitt of Fogo likened the rout to a “margin call avalanche,” stressing that liquidations are “a feature, not a bug” of crypto markets. Similarly, Mike Maloney, CEO of Incyt, underlined Bitcoin’s relative resilience, noting its smaller drawdown compared to altcoins.

Looking Ahead: Reset Before Uptober?

With leverage reset and funding rates turning negative, some strategists believe the odds of a rebound are rising. 10X Research suggested liquidation spikes often mark local lows and could signal a buying opportunity if other conditions align.

As September draws to a close, traders are watching for fresh inflows into ETFs, how bankruptcy estate redemptions impact liquidity and whether dip buyers step in ahead of October. For many in the industry, the recent wipeout is less a warning sign of structural weakness and more a painful but necessary reset.

If history is any guide, “Uptober” could once again deliver the next leg higher.

Leave a Reply