Ethereum (ETH) has been under pressure after slipping from its recent highs, but analysts argue the setup remains bullish. With institutions buying aggressively and short bets piling up, the stage may be set for a massive short squeeze that could propel ETH beyond $5,000.

Institutions Accumulate as ETH Slips

Ethereum’s breakout above its all-time high of $4,934 was short-lived, with the token sliding more than 5% last week from above $4,400 to under $4,200. Despite the pullback, institutional interest in ETH remains strong.

Blockchain data reveals that BitMine, a major corporate investor, acquired over $1 billion worth of ETH in a single week. This purchase boosted its total holdings to 2.416 million ETH, valued at approximately $10.1 billion, representing more than 2% of the total supply. That makes BitMine the largest corporate Ethereum holder worldwide.

Even with such large-scale accumulation, selling pressure persists. Data from Glassnode shows the number of ETH addresses in profit has reached an all-time high and many whales are cashing out at record levels. This has encouraged short-term traders to increase their bearish bets.

Short Bets Stack Up Against Ethereum

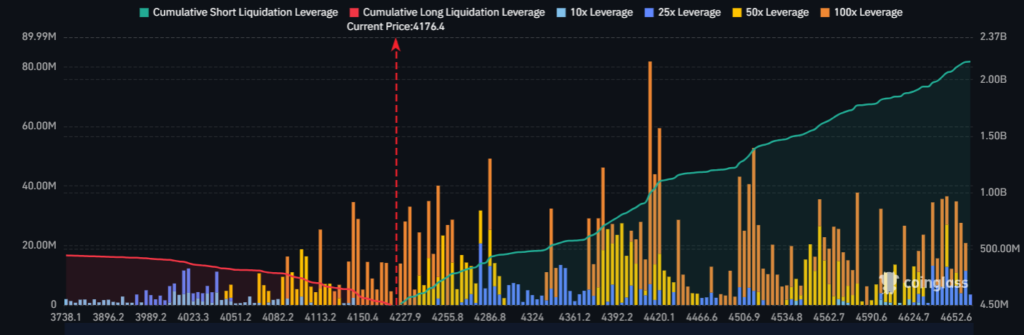

Ethereum currently faces one of the largest potential liquidation volumes among all altcoins. According to liquidation maps, traders have been heavily increasing their short exposure, creating billions of dollars in potential liquidations if ETH rebounds.

If Ethereum climbs back toward $4,500, short positions worth around $4.4 billion could be wiped out. A more forceful recovery above $4,900 could push that figure closer to $10 billion. In contrast, if ETH dips toward $3,560, long liquidations are estimated at just $900 million.

This imbalance highlights how much more capital is betting against ETH than for it. If prices push even slightly higher, bears could be forced to exit, triggering a chain reaction of buy orders, the classic recipe for a short squeeze.

Technical Setup: Key Levels to Watch

At present, ETH is trading near $4,200 after losing support at $4,500. If the $4,200 level breaks, holding above $4,000 will be crucial for bulls to keep momentum. A deeper drop could embolden short-sellers further, although the current conditions suggest a potential reversal.

The Relative Strength Index (RSI) has dropped to around 28, which signals oversold conditions and supports the case for a short-term bounce. Should ETH recover, the first major resistance lies at $4,500. A breakout above this level would significantly strengthen the bullish case and could ignite the anticipated short squeeze.

If that squeeze unfolds, ETH could quickly retest its previous all-time high of $4,934, and potentially surpass it.

Market Context and Outlook

The latest volatility comes in the aftermath of the Federal Open Market Committee (FOMC) meeting and the subsequent rate cuts, which triggered broader market uncertainty. Analysts suggest that once macroeconomic conditions stabilise, ETH could regain clearer direction.

Meanwhile, Ethereum exchange-traded funds (ETFs) continue to attract inflows, reflecting ongoing institutional demand. Coupled with large-scale accumulation by players like BitMine, the long-term outlook for ETH remains constructive.

In the near term, Ethereum appears to be in a make-or-break zone. A move higher could unleash billions in liquidations, forcing shorts to cover and propelling ETH above $5,000. On the other hand, a failure to hold key support around $4,000 could lead to further downside before any meaningful recovery.

Ethereum’s price action is currently dominated by a tug-of-war between institutional accumulation and aggressive short positioning. With billions of dollars in short bets at risk of liquidation, ETH is uniquely positioned for a powerful rally if buying pressure re-emerges.

For now, all eyes remain on the $4,200 and $4,500 levels. Whether Ethereum consolidates, drops further, or triggers a short squeeze, the coming weeks could define the next phase of ETH’s journey towards reclaiming and surpassing its all-time high.

Leave a Reply