STBL, the governance token of the Real World Assets (RWA)-backed stablecoin project, has experienced a dramatic price swing. After soaring 1,400% since its Token Generation Event (TGE) and hitting a new all-time high of $0.60, the token has since slipped nearly 19%. At the time of writing, it trades around $0.50.

Despite this retracement, market signals suggest the downturn could be short-lived, with technical indicators hinting at a fresh rally.

From Explosive Growth to Correction

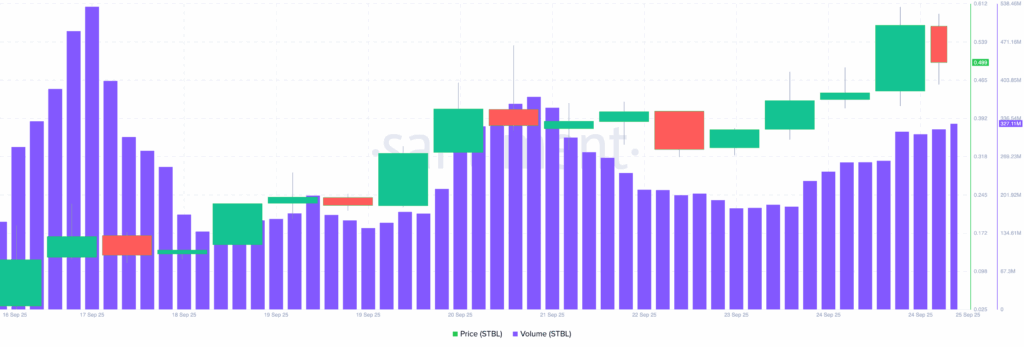

STBL’s sharp rise began shortly after its launch, culminating in the $0.60 milestone reached only hours ago. The explosive 1,400% rally attracted widespread attention, but like many fast-rising tokens, profit-taking has set in. The price now stands 18.9% below its peak.

Even with the retracement, trading activity remains robust. Daily trading volume has surged to $327 million, up from less than $190 million just two days prior. This recovery in liquidity highlights growing investor interest and suggests the market may be preparing for renewed upside momentum.

Regulatory Support Fuels Sentiment

A key catalyst behind STBL’s surge was news from the Commodity Futures Trading Commission (CFTC). The regulator announced a new initiative to explore the use of tokenised collateral, including stablecoins, in derivatives markets.

STBL’s structure is closely aligned with this vision. The project splits RWAs into a stable principal token, USST, which appeals to traders seeking yield-bearing, regulatory-aligned stability. This design made STBL an attractive option following the CFTC’s announcement, positioning it as a strong contender for future collateral frameworks.

Avtar Sehra, STBL’s founder, described the token as:

“The perfect endgame for tokenised collateral, marrying regulatory-aligned stability with RWA yield capture, delivering the highest possible capital efficiency for derivatives markets.”

This narrative has helped STBL stand out in the crowded RWA sector, giving traders confidence in its longer-term value proposition.

Technical Signals Point to Upside

From a technical standpoint, STBL’s outlook appears constructive despite the pullback. On the 4-hour chart, the token is moving within an ascending channel, a structure that often signals sustained upward momentum.

The Moving Average Convergence Divergence (MACD) indicator has formed a bullish divergence, suggesting momentum is shifting in favour of buyers. Such divergences are typically seen as precursors to trend continuation, especially when paired with an already bullish structure.

Further confirmation comes from the Supertrend indicator, which remains in green and sits below STBL’s current price. This positioning indicates that downside risks are limited in the short term. Analysts suggest the token is unlikely to fall below $0.41 and instead could break higher if demand continues.

Price Targets: Resistance and Beyond

If STBL’s bullish setup holds, the first key test lies at the $0.52 resistance level. A successful breakout could open the door to $0.61, just above the token’s recent peak.

In an extended rally scenario, STBL could even reach as high as $0.94, nearly doubling from current levels. However, if the bulls fail to overcome resistance, the outlook may shift. In that case, the token could slide to $0.29, erasing much of the recent rally.

For now, traders are watching closely as trading volumes climb and sentiment improves. Rising liquidity paired with regulatory alignment may provide the fuel for STBL’s next move upward.

Outlook: Temporary Pause or Start of a Larger Rally?

STBL’s remarkable run and subsequent pullback highlight the volatile nature of early-stage tokens, particularly those tied to new sectors like RWAs. The project’s alignment with the CFTC’s tokenised collateral vision has provided a powerful narrative, one that could sustain market interest well beyond the current cycle.

With indicators pointing to a potential rebound and trading activity on the rise, the coming days may prove decisive for STBL. Whether it breaks past resistance or consolidates further, the token has already made a strong case for being one of the most closely watched projects in the RWA space.

Leave a Reply