MicroStrategy, a business analytics firm turned “bitcoin treasury” juggernaut, is on the verge of being included in the prestigious Nasdaq-100 Index. With a $75 billion market cap and a near-500% stock price surge in 2024, it currently ranks as the 66th-largest company in the market. Analysts believe its inclusion is “basically guaranteed,” though some warn Nasdaq might classify the firm as a finance company, potentially making it ineligible.

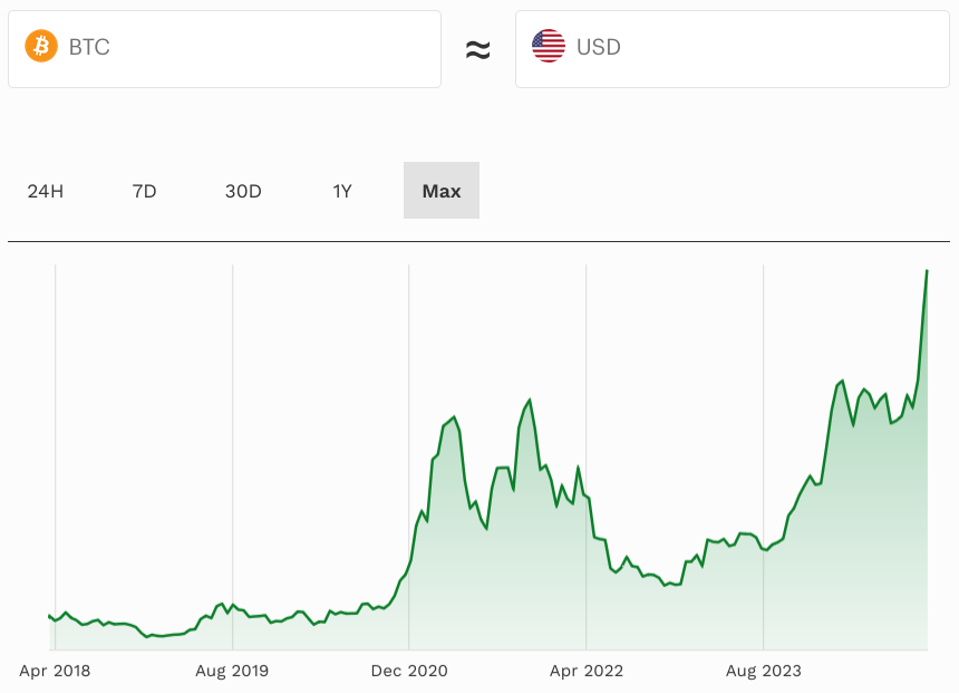

Ripple Effect on Bitcoin Prices

The bitcoin price, which saw a strong rally earlier this year, has recently stalled just below $100,000. However, predictions of a $200,000 surge in 2025 have reignited market optimism. Meanwhile, Ripple’s XRP has overshadowed bitcoin in the past week, with traders anticipating a Wall Street shake-up that could shift the crypto landscape.

MicroStrategy’s Bitcoin Arsenal Grows

The firm, led by bitcoin advocate Michael Saylor, has transformed into a “bitcoin proxy” for investors. This week alone, MicroStrategy purchased $1.5 billion worth of bitcoin, bringing its total holdings to over 400,000 BTC, valued at $38 billion. These acquisitions are funded through share sales, including 3.7 million shares sold this week.

New Flows of Capital Await

If added to the Nasdaq-100, MicroStrategy would become eligible for the $312 billion Invesco QQQ ETF, guaranteeing passive capital inflows from institutional investors. Jeff Park of Bitwise noted this inclusion would attract a new class of investors who wouldn’t typically buy MicroStrategy stock independently.

The Nasdaq will announce its index reshuffle on December 13, with the decision potentially marking a turning point for bitcoin’s mainstream adoption and market impact.

Leave a Reply