Bitcoin ETFs ended the third quarter of 2025 on a high note, pulling in $7.8 billion in net inflows despite a spell of outflows that rattled market sentiment in late September. While some corners of the crypto community expressed growing concern over the downturn, analysts insist that the sector remains historically strong and well-positioned for a bullish October.

A Strong Quarter in Perspective

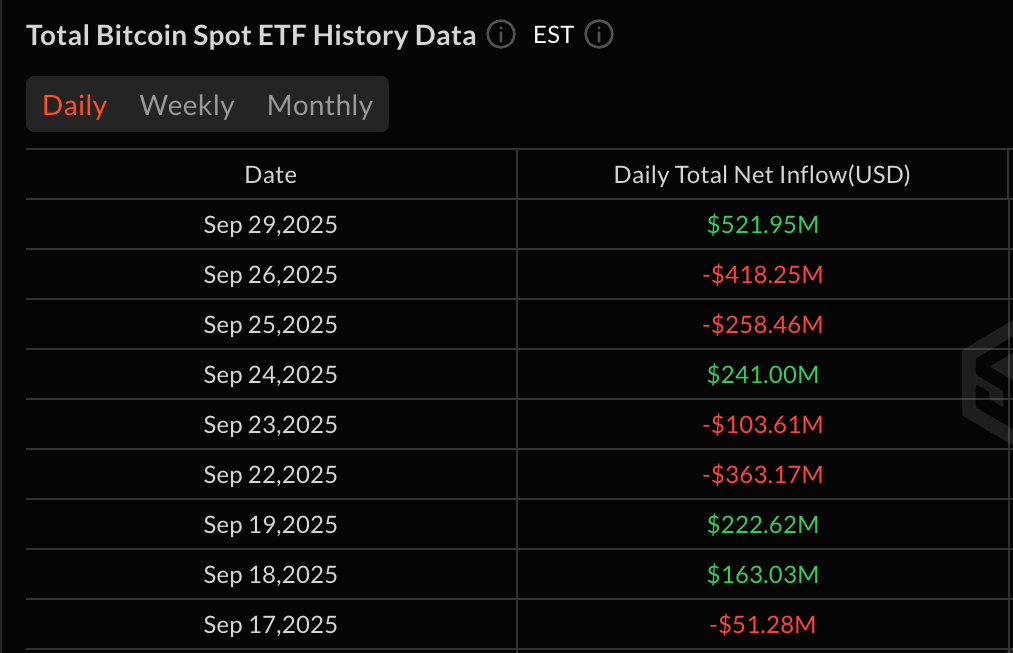

The recent slump saw Bitcoin ETFs experience more than $1 billion in outflows over the course of a week, sparking a wave of pessimism on social media and among traders. Institutional participation dipped, leading to price pressure on Bitcoin itself and feeding fears that the market may be losing steam just as the fourth quarter begins.

However, broader data tells a different story. Even with September’s wobble, Bitcoin ETFs amassed $21.5 billion in inflows across 2025 so far, firmly establishing the investment vehicles as one of the most successful financial innovations in both crypto and traditional finance this year. The $7.8 billion added in Q3 alone underscores the continuing appetite for regulated exposure to Bitcoin, even amid volatility.

September Slump Mirrors TradFi Trends

ETF analysts emphasise that the recent dip is far from unusual. Traditional finance ETFs often stagnate in September, and the Bitcoin products’ ability to attract inflows at all during this period stands out as remarkable.

Eric Balchunas, a senior ETF analyst, criticised the bearish reactions, dismissing them as “childish” and highlighting the gulf between crypto’s expectations and the norms of legacy markets. In his view, while a few quiet weeks may be interpreted as weakness by digital asset traders, traditional investors see such pauses as business as usual.

Indeed, Bitcoin ETFs managed to bring in over $500 million in inflows in a single day last week, even while overall market sentiment appeared sour. This resilience suggests that long-term institutional demand for Bitcoin remains intact.

Altcoin ETFs Loom, But BTC Retains the Edge

Speculation has mounted over the potential launch of ETFs tied to XRP and other leading altcoins in the US. Some analysts argue these new products could expand the crypto ETF market considerably, while others worry they may siphon capital away from Bitcoin.

Yet Bitcoin’s first-mover advantage, brand recognition, and dominant position in the digital asset sector make it unlikely to be displaced. The asset continues to enjoy a “host of intangible advantages,” according to analysts, including greater trust from institutions, superior liquidity, and its status as the sector’s benchmark store of value.

While altcoin ETFs may carve out their own share of the market, most observers agree that Bitcoin’s position as the flagship crypto ETF product remains secure.

Looking Ahead to October

With September behind, market watchers are now turning their attention to October, a month traditionally more favourable for both equities and crypto markets. Analysts widely predict a bullish October for Bitcoin, with renewed institutional inflows expected to bolster ETF demand.

Despite last month’s turbulence, the sector’s fundamentals appear sound. Bitcoin ETFs continue to defy century-old market patterns, generating inflows even in historically slow months and offering investors a bridge between crypto innovation and traditional finance stability.

For now, the message from seasoned analysts is clear: short-term outflows should not overshadow the remarkable success story of Bitcoin ETFs, which remain a cornerstone of crypto’s integration into mainstream investing.

Leave a Reply