Bitcoin futures traders are showing renewed bullishness this October as whales return to the market. Fresh data highlights a sharp rise in buy volume, even as the unfilled $110,000 gap on the Chicago Mercantile Exchange (CME) continues to attract traders’ attention.

Futures Buyers Drive Market Momentum

October has brought a surge in futures buy volume, signalling strong confidence in Bitcoin’s price trajectory. Data from onchain analytics platform CryptoQuant shows that net buy volume has outpaced sell volume by $1.8 billion on Binance, the largest crypto exchange.

“Futures buyers are stepping up,” noted CryptoQuant contributor J. A. Maartunn in his latest analysis. He pointed out that Bitcoin’s recent price highs have been fuelled by sustained whale activity, which he described as “a clear sign of aggressive long positioning.”

This marks a significant turnaround from just days earlier when traders were anticipating a correction.

The $110,000 CME Gap

Attention has also turned to the CME Group’s Bitcoin futures chart, where a “gap” just above $110,000 remains unfilled. Historically, CME gaps often become short-term price targets, yet sellers failed to drive Bitcoin low enough to close this one.

In recent months such gaps have typically been filled within weeks, sometimes even days. Plans are already underway at CME to extend trading hours to a 24-hour cycle, a move expected to eliminate these gaps entirely.

ETFs Surge with Strong Inflows

Alongside futures, spot Bitcoin exchange-traded funds (ETFs) in the United States are posting striking inflows. On Thursday alone, ETFs brought in more than $600 million, while the total for the week reached $2.25 billion.

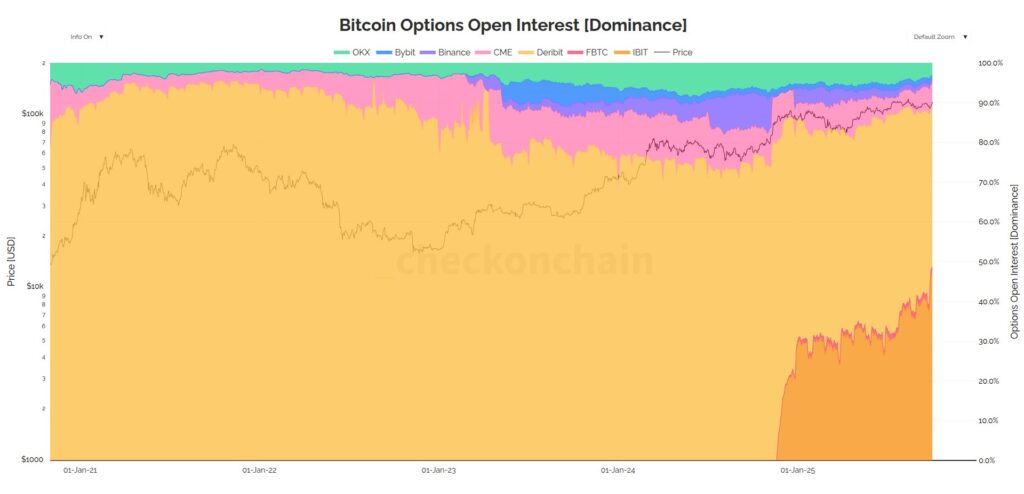

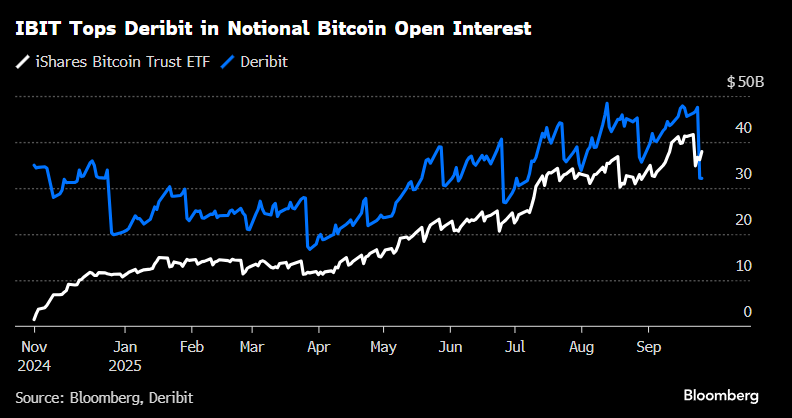

This surge has surprised many observers. James Check, creator of onchain data platform Checkonchain, emphasised the significance of the options market linked to BlackRock’s iShares Bitcoin Trust (IBIT).

“The growth of IBIT options is the least discussed yet most significant market structure shift for Bitcoin since the ETFs themselves,” he argued.

Options Market Overtakes Futures

The rise of IBIT has been dramatic. Bloomberg ETF analyst Eric Balchunas confirmed that IBIT’s open interest has reached $38 billion, surpassing even Deribit, the leading crypto derivatives platform.

“Options are now larger than futures by open interest,” Check observed. Balchunas echoed this view, adding, “ETFs are no joke. Fat crypto margins are in trouble.”

A New Phase for Bitcoin Trading

The combination of aggressive long positioning in futures, strong ETF inflows and the rapid growth of options trading signals a new phase for Bitcoin’s market structure. With Bitcoin trading near its all-time highs at $121,304, traders appear increasingly willing to back further upside momentum.

Yet the unfilled $110,000 gap lingers as a potential magnet for price action. Whether Bitcoin retraces to close it or continues its upward trajectory, October is shaping up to be another defining month for the world’s largest cryptocurrency.

Leave a Reply