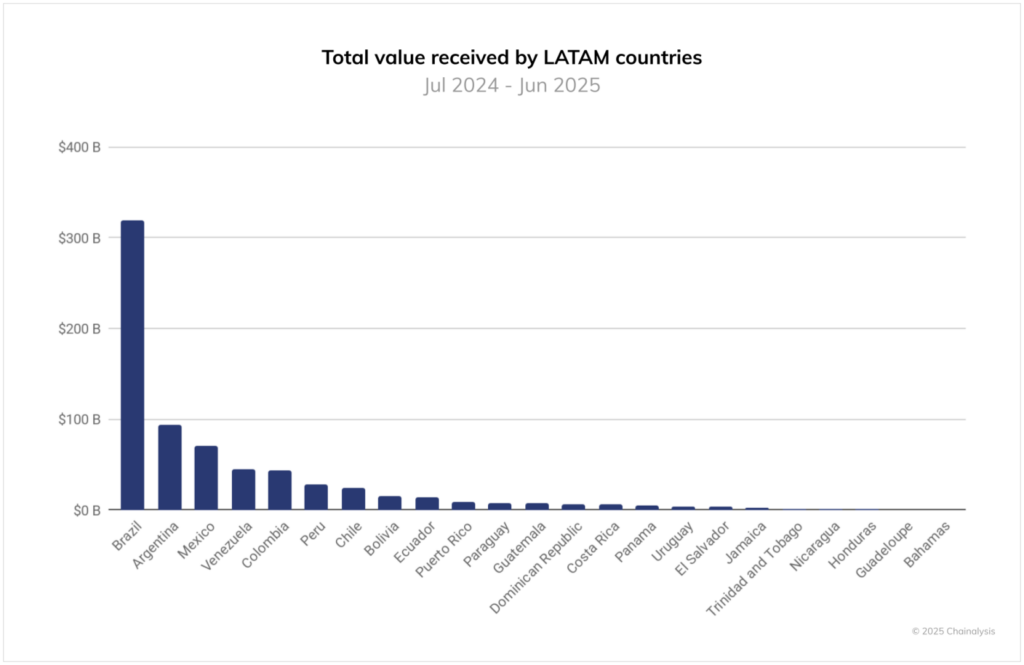

Brazil has emerged as Latin America’s undeniable crypto powerhouse, commanding nearly one-third of the region’s total digital asset volume. Between July 2024 and June 2025, Brazilian users received an estimated $318.8 billion in digital assets, according to a Chainalysis report more than triple the activity seen in Argentina, the region’s second-largest market.

Across Latin America, crypto transactions reached a staggering $1.5 trillion during the same period, with monthly activity skyrocketing from $20.8 billion in mid-2022 to a record $87.7 billion in December 2024. Brazil’s leadership in this surge reflects a mix of economic necessity, technological adoption, and regulatory foresight.

In a country long accustomed to inflation and currency volatility, crypto assets, particularly stablecoins have become a lifeline for households and institutions seeking financial stability and liquidity that the Brazilian real often fails to provide.

The Engine of Brazil’s $318B Crypto Economy

Over 90% of Brazil’s crypto transaction volume involves stablecoins such as Tether (USDT) and USD Coin (USDC), used for everything from cross-border remittances and merchant payments to salaries and corporate settlements. This massive adoption underscores a shift away from speculative crypto trading toward practical, everyday financial applications.

For millions of Brazilians, stablecoins now serve as an informal hedge against inflation and as an efficient tool for international transactions. Their simplicity, dollar-pegged stability, and liquidity have made them more attractive than traditional banking instruments, particularly for freelancers and small businesses engaging in global trade.

Institutional participation has also grown sharply. Chainalysis notes that institutional transactions have more than doubled year-on-year, while retail engagement remains robust. Leading banks and fintech giants such as Itaú Unibanco, Mercado Pago, and Nubank have integrated crypto services directly into their platforms, signalling a seamless convergence between traditional finance and digital assets.

Meanwhile, homegrown exchanges like Mercado Bitcoin, Foxbit, and BitPreço have cemented Brazil’s dominance by offering secure, compliant, and locally integrated crypto infrastructure.

Regional Comparison: Brazil Leads, Others Catch Up

Brazil’s crypto activity far outpaces that of its regional peers. Argentina, burdened by triple-digit inflation, recorded $93.9 billion in crypto volume, driven largely by citizens using digital assets as an inflation shield. Mexico followed with $71.2 billion, while Venezuela and Colombia registered $44.6 billion and $44.2 billion, respectively.

Smaller but dynamic markets like Peru ($28 billion) and Chile ($23.8 billion) are growing rapidly, buoyed by remittance inflows and DeFi experimentation. Despite its high-profile embrace of Bitcoin as legal tender, El Salvador generated a modest $3.5 billion in crypto activity, underscoring that government-led adoption does not always translate into widespread usage.

Notably, 64% of crypto activity across Latin America occurs through centralised exchanges (CEXs), a significantly higher proportion than in Europe or North America. For many Latin Americans, CEXs provide the most accessible bridge between fiat and digital money, offering straightforward onboarding, fiat conversion, and remittance functionality.

Regional players like Bitso in Mexico and Colombia and Ripio in Argentina have built trust by integrating with national payment networks, ensuring regulatory compliance and easier access for first-time crypto users.

Brazil’s Regulatory Edge: BVAL, RESBit, and Central Bank Oversight

Behind Brazil’s crypto leadership lies a maturing regulatory framework. The Virtual Assets Law (BVAL), enacted in 2022–2023, set the foundation for the country’s digital asset regulation. It places oversight under the Banco Central do Brasil (BCB), embedding stringent AML/KYC standards that balance innovation with consumer protection.

Building on that, the government has launched several public consultations, Nos. 109, 110, and 111/2024 to address regulation of DeFi, custodians, and stablecoin issuers. The resulting guidelines, expected by late 2025, aim to provide greater clarity and reinforce Brazil’s leadership in digital finance.

In parallel, a bold new proposal known as RESBit (Bill 4501/24) is under consideration. If passed, it would establish a $19 billion Bitcoin reserve, integrating the asset into Brazil’s sovereign wealth management strategy. Debated during an August 2025 parliamentary hearing, the measure could make Brazil one of the few nations, alongside the United States, China, and the European Union, to formally incorporate Bitcoin into its national financial framework.

The BCB is also tightening oversight of the foreign exchange (Forex) sector through new consultations aimed at regulating electronic Forex (eFX) platforms. Although crypto exchanges are not explicitly mentioned, these measures could indirectly impact those facilitating cross-border transfers and crypto-to-fiat conversions involving non-real currencies.

A Digital Future Anchored in Stability

Brazil’s crypto ascent is not a speculative fad, it’s a structural financial evolution driven by necessity, technology, and foresight. Stablecoins have become the country’s unofficial alternative currency, offering both households and institutions a practical way to bypass volatility and access global liquidity.

With robust regulation, institutional adoption, and a forward-looking central bank, Brazil is not just leading Latin America’s crypto market, it is shaping the region’s financial future.

As the $318.8 billion crypto economy deepens, Brazil’s experiment with digital assets could become the model for emerging economies balancing innovation, stability, and inclusion in a digital-first world.

Leave a Reply