The crypto market has reached an eye-watering milestone, crossing $4.2 trillion in total market capitalisation, its highest level since late 2021. Bitcoin’s charge beyond $123,000 and Ethereum’s climb over $4,500 have propelled the rally, yet the real story lies beyond the blue chips. Retail investors, altcoins and presale projects are shaping what many now call a “retail-driven bull phase.”

However, while optimism floods the market, signs of overheating are emerging from excessive leverage and “greedy” sentiment, as well as whales quietly cashing out. The current rally feels electric, but history warns that euphoria often burns brightest before the cooldown.

Bitcoin and Ethereum Lead, but Retail Energy Drives the Fire

Bitcoin remains the market’s cornerstone, buoyed by persistent ETF inflows and institutional demand. Trading just shy of $123,000, BTC continues to anchor confidence in a market that once again feels unstoppable. Ethereum, meanwhile, is flirting with a technical breakout at $4,520, powered by anticipation of its upcoming Fusaka upgrade, a development aimed at boosting scalability and network efficiency.

Together, BTC and ETH account for much of the market’s liquidity and perceived safety. But beneath that stability lies a far more dynamic undercurrent. The Altcoin Season Index, currently at 77 out of 100, signals that traders are rotating capital away from major assets into higher-risk, higher-reward alternatives.

This trend has reignited interest in projects like Solana, XRP, and Cardano, all of which have logged double-digit gains in recent weeks. Yet it’s the mid-cap and small-cap tokens and particularly presales that are capturing the hearts (and wallets) of retail traders.

Across Telegram groups, Discord servers and X (formerly Twitter), retail chatter is at fever pitch. The narrative is simple: “Don’t miss the next 100x.”

Presales Take Centre Stage as Retail Investors Return

Presale markets are now the most talked-about corner of crypto. Data shows that the number of active presales has tripled in the last six months, with global participation at record levels. The allure is obvious: when blue-chip coins hover near their all-time highs, early-stage projects offer the kind of asymmetric upside that defined past bull markets.

One presale, in particular, is drawing intense scrutiny and enthusiasm: MAGACOIN FINANCE. With over $15.5 million raised in a short span and audits by CertiK and HashEx, the project has built credibility rarely seen in the presale space. Its tokenomics model rewards long-term holders, aiming to reduce post-launch selling pressure, a weakness that has plagued countless early-stage tokens.

Analysts argue that MAGACOIN’s structure and timing could allow it to outperform even the leading cryptocurrencies in percentage growth terms this cycle. Community engagement is high, liquidity mechanisms are transparent, and the scarcity-driven model adds to the perception of sustainability.

Retail traders, who missed out on early Solana or PEPE gains, are now betting that MAGACOIN could be the next major breakout. The sentiment is clear: this cycle’s early winners are being picked not by institutions, but by retail traders willing to take calculated risks before mainstream recognition sets in.

The Rise of the Retail Army

Perhaps the most remarkable feature of this rally is who’s driving it. On-chain analytics reveal that addresses holding under $10,000 in crypto now account for over 60% of all active transactions. This marks a defining shift from the institution-heavy inflows of 2023–2024 to a broad-based retail resurgence.

The tools have evolved, too. Decentralised exchanges, social trading platforms, and tokenised presale dashboards have given smaller investors direct access to early opportunities, no venture capital, no gatekeeping. Retail traders are coordinating through Telegram and community groups, orchestrating collective buys that can move markets within hours.

However, there’s a notable difference from the meme coin mania of 2021. This time, retail investors appear more discerning. Instead of chasing hype alone, they’re increasingly focused on audits, liquidity locks, and developer transparency. This maturity, though still paired with high risk, suggests that retail traders are learning from past cycles.

But with enthusiasm running this hot, it’s worth asking: Is this sustainable?

Cracks Beneath the Surface: Why This Rally Could Be Fragile

While the headlines celebrate record highs, analysts are increasingly warning that the market’s foundations may not be as stable as they appear. Several red flags suggest the rally could be approaching a dangerous inflection point.

1. Record Leverage and Derivative Risk

According to Coinglass, total open interest across exchanges has surged to $233.5 billion, even as spot trading volume softens. This divergence indicates traders are using heavy leverage, betting borrowed funds on short-term moves rather than long-term conviction.

CryptoQuant’s Estimated Leverage Ratio on Binance has reached 0.187, its highest since July. Historically, when leverage climbs above 0.18–0.20, sharp pullbacks often follow, triggered by cascading liquidations.

Retail investors, chasing quick profits, are fuelling much of this leveraged activity, while institutional players appear to be scaling back risk exposure, a divergence that rarely ends well.

2. Sentiment Has Turned “Greedy”

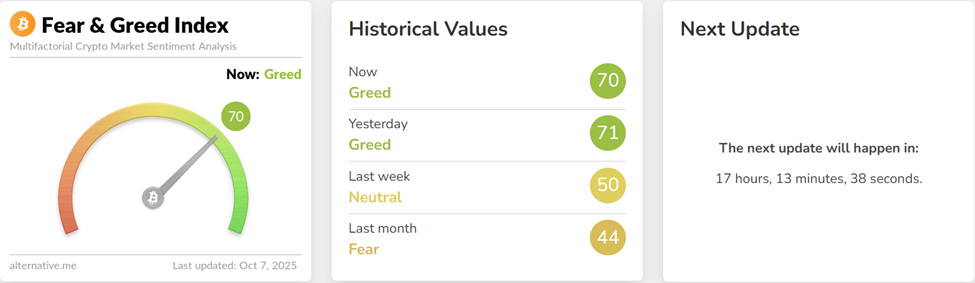

The Fear and Greed Index now sits at 70, firmly in “greedy” territory. While optimism is necessary for momentum, readings above 70–80 have historically preceded cooling phases. Overconfidence among traders tends to inflate prices beyond sustainable levels, setting the stage for corrections.

3. Whales Are Quietly Taking Profits

On-chain data adds another layer of concern. Veteran “OG whales” early Bitcoin holders with massive unrealised gains have begun moving and selling assets. Over 15,000 BTC, worth approximately $1.88 billion, has recently flowed into exchanges.

A dormant wallet that hadn’t moved since 2013 also came alive, shifting 100 BTC ($12.5 million) to new addresses. As one analyst noted, “When old wallets awaken during a rally, it’s rarely a bullish sign.” Historically, such behaviour has preceded local tops or extended consolidations.

4. The Dollar’s Quiet Comeback

The crypto rally has coincided with a period of U.S. dollar weakness, with the DXY index dropping sharply earlier in the year. Yet that trend may be reversing. Analysts like Axel Adler and The Great Martis warn that a stronger dollar, fuelled by U.S. fiscal uncertainty and European economic stagnation, could once again pressure risk assets.

If the dollar regains strength, much of crypto’s momentum, partially inflated by a weaker USD denominator, could unwind quickly.

5. Echoes of the 1999 Dot-Com Bubble

Finally, legendary investor Paul Tudor Jones has compared the current crypto environment to the late-1990s dot-com bubble, calling it a “1999 moment.” While he remains bullish on Bitcoin long term, his caution underscores a familiar cycle: innovation and adoption giving way to exuberance and excess.

A Market Balanced Between Genius and Greed

The crypto market’s return to $4.2 trillion is a testament to its resilience and the global appetite for digital assets. Retail investors have reignited the flame, reshaping narratives and challenging institutional dominance. Projects like MAGACOIN FINANCE showcase how well-timed innovation can capture both attention and capital.

Yet, this newfound confidence exists alongside classic warning signs: over-leverage, euphoric sentiment, whale exits and a strengthening dollar. The pattern is not new; it’s the same rhythm that has defined every major crypto cycle to date.

In essence, crypto’s current rally sits delicately between genius and greed. The difference between a sustained bull market and a painful correction will depend on whether retail traders can balance enthusiasm with discipline and whether projects like MAGACOIN can deliver substance beyond the hype.

For now, the market’s message is clear: the retail era is back, and it’s rewriting the rules of the bull run. But as history reminds us, every rally eventually tests its believers and only those who understand both the opportunity and the risk will stay standing when the music slows.