Aster’s sudden removal from DefiLlama, one of decentralised finance’s most trusted data platforms, has ignited a fierce debate over data credibility and transparency in the rapidly expanding world of decentralised exchanges (DEXs).

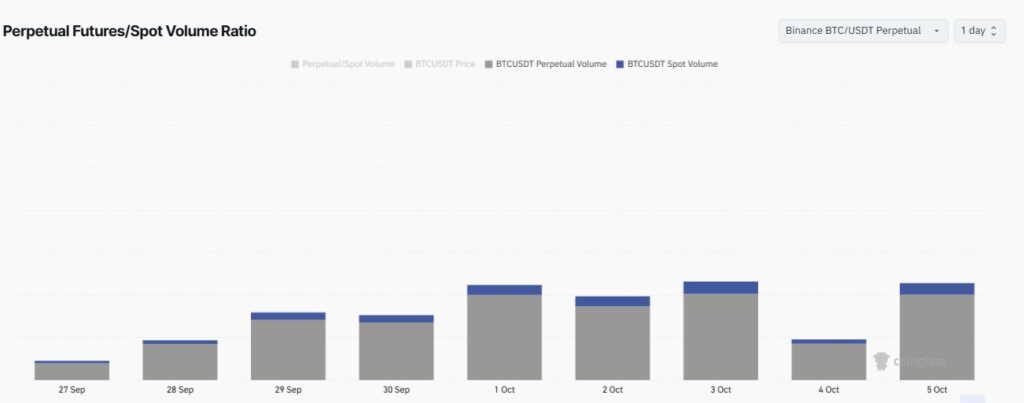

The derivatives DEX, backed by YZi Labs (formerly Binance Labs), had recently risen to prominence after its reported trading volumes surged past industry leader Hyperliquid. However, on Sunday, DefiLlama’s founder 0xngmi announced on X (formerly Twitter) that Aster’s reported figures appeared to mirror Binance’s perpetual market data, prompting DefiLlama to delist the project altogether.

The move has since divided the DeFi community. Supporters accuse DefiLlama of acting as a “centralised arbiter” of truth in a supposedly decentralised industry, while critics argue the delisting was justified to maintain data integrity.

Either way, Aster’s delisting has thrown the spotlight on a growing problem in decentralised finance: who can be trusted to define what’s real?

Aster’s Meteoric Rise Raises Questions About Fake Volumes

Before its removal, Aster had posted eye-popping trading figures, leading all DEXs with $41.78 billion in 24-hour trading volume, according to CoinMarketCap, a data platform owned by Binance. By comparison, Hyperliquid reported just over $9 billion on the same day.

Yet the scale of Aster’s growth quickly raised eyebrows. Independent analysts and blockchain sleuths began dissecting on-chain data to determine whether the exchange’s activity was genuine or artificially inflated.

One such researcher, Dethective, identified the top five wallets responsible for $85 billion in trading activity over 30 days, many of which appeared to be aggressively farming an upcoming airdrop. Although not all wallets seemed suspicious, at least two were flagged for Sybil-like behaviour using multiple identities or accounts to game the system.

“Wash trading and inflated user volumes are estimated to affect nearly a quarter of crypto exchanges today,” said Greg Magadini, director of derivatives at Amberdata. “In many cases, traders boost activity to earn rewards, while some platforms exaggerate usage to attract real volume.”

Wash trading typically involves the use of high-frequency bots that rapidly open and close trades to simulate liquidity. Unlike open interest, which measures active positions requiring collateral, inflated volume can easily be manipulated without any real capital risk.

For perspective, CoinMarketCap data showed Hyperliquid leading with $14.68 billion in open interest, followed by Aster at $4.86 billion and Lighter at $2.08 billion, revealing a clear gap between reported trading volume and genuine market depth.

Data Aggregators: Gatekeepers in a Decentralised World

DefiLlama’s decision underscores the paradox of decentralisation, a system built to remove intermediaries still relies on centralised data curators to validate truth.

As one of DeFi’s most respected data platforms, DefiLlama aggregates performance metrics from hundreds of protocols across multiple chains. Its delisting of Aster, therefore, had an outsized impact, leaving users with fewer reliable sources for the DEX’s performance metrics.

In response, Aster supporters turned to Dune Analytics, which allows users to create custom dashboards. Ironically, many of the dashboards championed as alternatives still rely on DefiLlama’s own datasets, a fact not lost on the platform’s defenders.

“We were not paid to delist Aster,” 0xngmi clarified on X. “We delisted Lighter and many other perpetual DEXs before due to blatant wash trading.”

The controversy echoes earlier scandals in the NFT sector, where platforms such as Blur were accused of inflating volumes to qualify for token airdrops, briefly overtaking OpenSea during the 2023 NFT boom. In both cases, inflated figures distorted perceptions of success, underscoring how metrics-driven competition can corrupt the integrity of decentralised ecosystems.

The Broader Problem: Measuring Truth in DeFi

The Aster episode reveals the fragility of data credibility in crypto markets, a space where numbers often travel faster than verification. In traditional finance, wash trading is explicitly banned under securities and market regulations. In DeFi, by contrast, enforcement is nearly impossible, leaving watchdog duties to analytics firms and independent investigators.

“Wash trading becomes apparent when identical buy and sell orders appear repeatedly in tight time frames,” Magadini explained. “If this pattern extends across several trading pairs, it’s a strong indicator that the activity is being artificially inflated.”

DeFi’s reliance on trading volume as a benchmark of success has made it particularly vulnerable. While trading volume offers visibility, it’s also the easiest metric to manipulate. More meaningful indicators, such as open interest, funding rates and collateral data paint a clearer picture of genuine participation but often take a back seat in the race for rankings and reputation.

Aster’s case highlights that data wars in DeFi are no longer just about competition among protocols, they are battles over credibility. As exchanges vie to lead the perpetuals market, which accounts for around 80% of total crypto trading activity, the temptation to game the system is immense.

Trust, Transparency and the Future of DeFi Metrics

Whether Aster’s explosive rise was authentic or artificially fuelled, the controversy has exposed a critical vulnerability in DeFi’s foundation, the assumption that on-chain data speaks for itself.

In reality, interpreting blockchain data requires trusted intermediaries, meaning DeFi’s ideal of self-verifying transparency remains elusive. As DefiLlama, Dune and others grapple with how to balance openness and accuracy, the future of DeFi analytics may hinge less on decentralisation and more on reputation, governance and community oversight.

Ultimately, the Aster saga underscores that data integrity is DeFi’s new frontier. Numbers alone no longer define credibility, trust does.

Until decentralised analytics tools can provide tamper-proof verification without human intervention, disputes like this will continue to test the very ideals on which DeFi was built.

In the race for dominance, Aster’s fall from DefiLlama’s listings may be less about numbers and more about what those numbers are truly worth.

Leave a Reply