In a bold move to challenge the dominance of centralised exchanges (CEXs) in the crypto derivatives sector, MetaMask and Infinex have integrated Hyperliquid, the most liquid decentralised perpetuals (perps) platform. The collaborations mark a pivotal moment for onchain trading, signalling the arrival of user-friendly, self-custodial alternatives in one of crypto’s most lucrative markets.

MetaMask officially launched its Hyperliquid integration on Wednesday, allowing users to trade perpetual futures directly within their wallet. The move, described as a “major milestone” by the company, transforms MetaMask from a simple crypto wallet into a full-fledged trading hub, bridging the gap between passive holders and active traders.

“We’re offering a frictionless path for passive holders to become active traders,” said Gal Eldar, MetaMask’s Global Product Lead. “The timing couldn’t be better to bring a one-tap, onchain trading experience to our entire user base.”

Meanwhile, Infinex, a non-custodial DeFi front-end launched in mid-2024, has been testing its Hyperliquid integration since August. During the beta phase alone, the platform recorded over $100 million in trading volume across just 200 early users. The feature went live to retail traders last week, cementing Infinex’s push into the derivatives space.

The Rise of Decentralised Perpetuals

Perpetual futures, or “perps,” have become one of crypto’s most traded instruments, offering 24/7 access, high leverage, no expiry dates, and the ability to profit from both bullish and bearish markets.

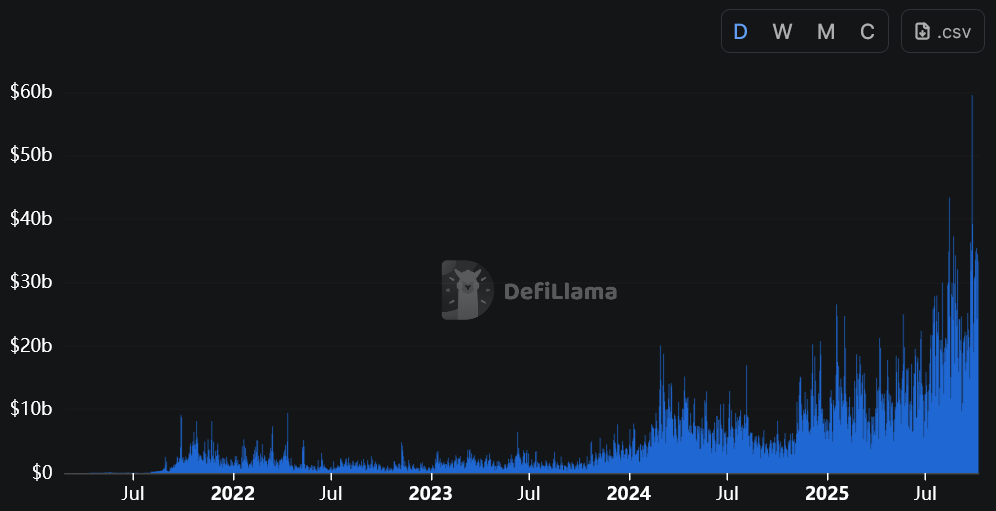

While centralised exchanges like Binance and Bybit still dominate with $93.4 billion and $31.9 billion in daily derivatives volume respectively, decentralised perpetuals have quietly exploded in popularity. According to DefiLlama, decentralised perps platforms processed over $772 billion in trading volume in September 2025 alone, including a record-breaking $59.5 billion on 25 September.

The market is currently led by Hyperliquid, Aster, and Lighter, which together have captured a growing share of traders seeking full self-custody and transparency.

Kain Warwick, founder of Infinex and the DeFi pioneer behind Synthetix, believes that Hyperliquid represents a turning point for decentralised trading.

“Synthetix, dYdX, and GMX pushed perps forward but couldn’t make them mainstream,” Warwick said. “Hyperliquid is the first protocol to truly get it right, to scale successfully and match CEX efficiency.”

MetaMask’s Bid to Become an All-in-One Trading Hub

MetaMask’s latest update positions it as more than just a wallet, it’s now a complete trading interface. Users can fund perpetual positions directly from any EVM-compatible chain, bypassing the usual web of bridges, swaps, and gas hurdles that often discourage onchain trading.

Eldar acknowledged that these technical barriers have long been a sticking point for even experienced DeFi users. “People show intent but give up halfway,” he said. “They jump from bridge to DEX, spend 30 minutes on setup, and waste fees, it’s a painful experience. We see it as our job to fix that.”

The integration also forms part of MetaMask’s broader plan to create a CEX-like experience in a fully self-custodial environment. The wallet’s in-app perpetuals are powered by Hyperliquid’s onchain matching engine, optimised for mobile and desktop users.

In addition to trading, MetaMask announced a new rewards and loyalty programme designed to encourage onchain activity. Dubbed MetaMask Rewards, it operates on a seasonal, points-based system, where users can earn points through swaps, perp trades, referrals, and card spending.

Each season spans three months, with users able to unlock tiered benefits including $30 million in LINEA token rewards, perp fee discounts, priority support, and even a free 12-month MetaMask Metal Card subscription.

Infinex’s Early Success and the New DeFi Momentum

For Infinex, its Hyperliquid partnership marks a strategic evolution. Warwick revealed that its $100 million pre-launch volume came from a small cohort of 200 early users, dubbed “Patrons” highlighting deep early engagement despite limited access.

The Infinex-Hyperliquid integration brings institutional-grade liquidity to the DeFi space while maintaining non-custodial access, ensuring that traders retain full control over their funds.

Warwick added that the team’s goal is to deliver a simpler, faster DeFi experience that can compete directly with CEXs on speed and liquidity, while outperforming them on transparency. “We’ve finally reached a stage where decentralised trading feels familiar, not foreign,” he said.

Warwick also hinted that Synthetix will soon return to the Ethereum mainnet, six years after its migration to Optimism, a move designed to reconnect with Ethereum’s expanding liquidity ecosystem.

CEXs Face Growing Onchain Competition

While decentralised perps are gaining traction, CEXs continue to dominate derivatives trading. Binance and Bybit together handled over $125 billion in daily perps volume, according to CoinGecko. However, Hyperliquid, ranked seventh globally with $10.3 billion in 24-hour trading volume, is quickly closing the gap.

Industry leaders agree that DeFi is beginning to pressure centralised giants. Sergej Kunz, co-founder of 1inch, noted last week that CEXs are now exploring “hybrid” approaches that combine onchain transparency with centralised liquidity, a clear sign that DeFi’s rise is influencing mainstream strategy.

Warwick echoed that sentiment: “Onchain is becoming too compelling to ignore. Centralised exchanges are now figuring out how to blend both worlds or risk being left behind.”

What’s Next: Prediction Markets and the MASK Token

MetaMask’s expansion doesn’t stop at derivatives. The company announced an upcoming integration with prediction market platform Polymarket, enabling users to participate in real-money event forecasting directly from their wallets.

The firm also confirmed the launch of its long-awaited MASK token, with Consensys CEO Joseph Lubin stating that development is “actively underway,” though no launch date has been disclosed.

“MetaMask was built to give people ownership of their assets,” Eldar said. “Now we’re extending that same principle to the world’s most important financial markets, without ever giving up custody.”

Conclusion: A New Era for Onchain Trading

The combined efforts of MetaMask, Infinex, and Hyperliquid mark a defining moment in the decentralisation of derivatives trading. With simplified user experiences, CEX-level liquidity, and lucrative reward systems, these platforms are setting new standards for accessibility and innovation.

As perps volumes continue to climb toward the trillion-dollar mark, the message is clear: onchain trading is no longer the future, it’s here.

Leave a Reply