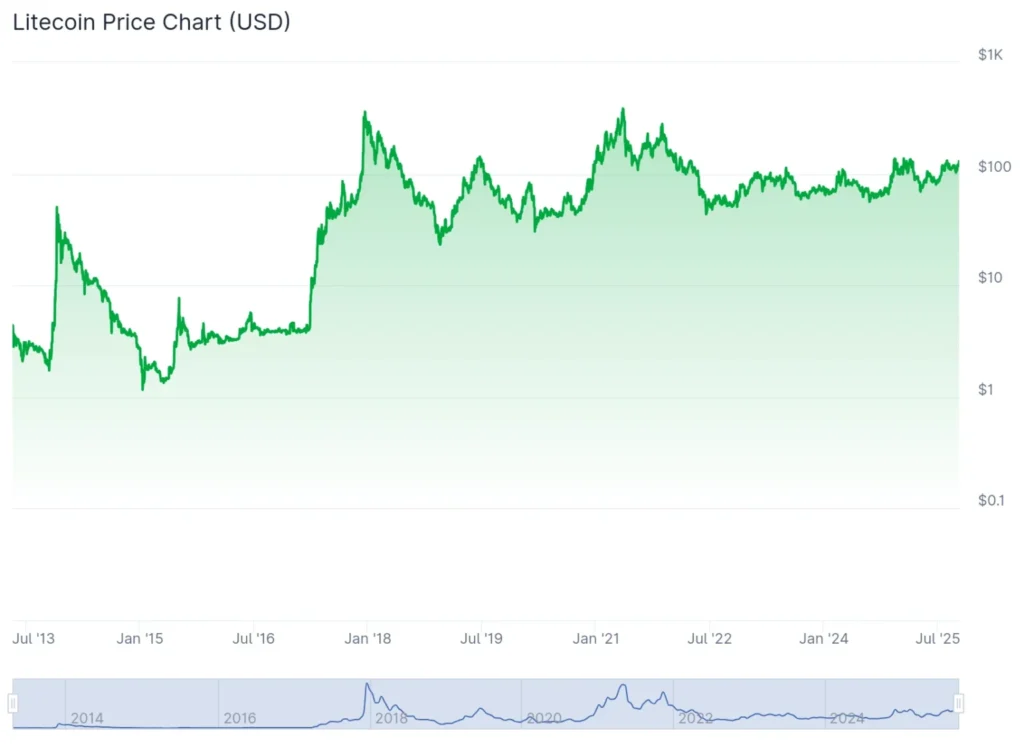

Litecoin (LTC), often overshadowed by bigger names like Bitcoin (BTC) and Ethereum (ETH), is quietly positioning itself for a significant move. As one of the oldest surviving altcoins, launched in 2011 by Charlie Lee, Litecoin has maintained a reputation for stability and consistency rather than hype-driven volatility. However, current technical signals combined with long-term wave count predictions suggest that a major breakout could be on the horizon, potentially setting the stage for a strong 2025 and a parabolic rally into 2026.

In this in-depth analysis, we examine Litecoin’s latest price action, long-term projections, market positioning, and performance indicators. With LTC approaching a critical technical resistance level and on-chain data showing strengthening investor confidence, Litecoin’s next moves could set the tone for its role in the upcoming crypto cycle.

Litecoin Price Outlook: Wave Count Projects Strong Upside Potential

Based on wave count analysis, Litecoin has been consolidating inside a long-term symmetrical triangle since its December 2017 high of $373.65. Analysts suggest that LTC has now completed its wave E, the final consolidation phase within this structure. Historically, such patterns precede explosive upside breakouts, especially once price action clears major resistance levels.

Litecoin Price Predictions (Wave Method Range)

| Year | Minimum Target | Average Target | Maximum Target |

| 2025 | $50 | $99 | $147 |

| 2026 | $100 | $320 | $640 |

| 2030 | $150 | $250 | $350 |

If LTC successfully breaks out of its long-term resistance, the $640 top-end target for 2026 becomes a realistic possibility, especially with momentum indicators turning bullish. The average projection of $99 for 2025 indicates cautious optimism, but a confirmed breakout could push LTC closer to the higher end of this spectrum.

Technical Momentum: Litecoin Finally Clears Major Resistance Zone

On the weekly chart, LTC is breaking out of a diagonal resistance trend line that has capped growth since December 2024. After five failed breakout attempts, LTC has printed a bullish engulfing candlestick, signalling renewed confidence among buyers.

More importantly, LTC is now testing the $131 horizontal resistance zone, a critical price level that has suppressed bullish momentum for nearly a year. A clear weekly candle close above this level could open the gates for a fast rally toward the $275 zone, a 110% move from current levels, where the next major resistance sits.

Momentum Indicators Support the Bullish Case:

- RSI at 62, trending upward but still under overbought territory, suggesting room for continuation.

- MACD bullish crossover, signalling growing upside pressure.

- ATR at 15.12, low volatility base, often preceding sharp directional moves.

This confluence suggests that Litecoin is building energy for a sustained breakout rather than short-lived price spikes.

Litecoin vs Bitcoin and Other Forks: Quiet Strength in Performance

Litecoin often moves in tandem with Bitcoin due to its design similarity and shared market cycles. However, recent data shows that LTC has slightly outperformed Bitcoin over the past 12 months.

Yearly Performance Comparison

| Asset | Current Price | Price 1 Year Ago | Percentage Growth |

| Litecoin (LTC) | $129.43 | $64.20 | +100.1% |

| Bitcoin (BTC) | $121,282 | $60,195 | +98.7% |

| Bitcoin Cash (BCH) | $588.80 | $322.6 | +82.6% |

| eCash (XEC) | $0.000018 | $0.000032 | -45.3% |

Litecoin’s ability to hold its ground and outperform similar legacy assets like Bitcoin Cash and eCash highlights one key insight: while LTC isn’t hyped, it continues to command trust among long-term holders and institutions seeking stability.

This is further validated by the fact that LTC processed its 300 millionth transaction in January 2025, marking a significant milestone for network activity and adoption.

Market Structure, Supply Data & Holder Confidence

Litecoin’s circulating supply as of October 10 stands at 76,389,593 LTC, accounting for 91.03% of its total maximum supply of 84 million coins. This high issuance completion means that future inflation impact will be minimal, a factor that often supports long-term price appreciation.

Top Holder Distribution

- Top wallet holds 6.76% of supply, a notable concentration but within acceptable decentralisation limits.

- Top 10 holders own 14.55% overall, suggesting a balanced ownership structure, reducing the risk of sudden market dumps.

This distribution signals that Litecoin remains one of the more decentralised legacy cryptocurrencies, a key narrative that could attract investors wary of newer tokens with disproportionate whale control.

Fundamental Insights: Litecoin as “Digital Silver”

From its inception, Litecoin branded itself as the “silver to Bitcoin’s gold.” Its mission has been to offer faster, cheaper transactions with lower network congestion, making it suitable for everyday crypto payments rather than just holding or long-term store-of-value use cases.

With block confirmations four times faster than Bitcoin and Scrypt-based Proof-of-Work engineering, Litecoin remains relevant in a market increasingly concerned about network efficiency and cost.

LTC’s experimental launch of LTC-20 tokens in 2023 also indicates that the network is evolving to support new use cases such as NFT-style assets and tokenized applications, potentially attracting fresh developer activity.

Short-Term Outlook: All Eyes on the $130 Level

With RSI momentum rising, MACD firmly bullish and ATR showing low volatility, Litecoin appears to be in an accumulation phase before a sudden rally. The short-term forecast for the next 24 hours remains bullish, especially if the $130-$131 breakout range flips into support.

A sustained position above $130 could trigger a parabolic move towards $275, where the first major supply block awaits. If that level breaks with volume, the $320-$350 mid-term wave target could be reached sooner than expected.

Final Thoughts: A Slow Burner Ready to Ignite?

Litecoin may not be the flashiest asset in the crypto space, but its technical stability, strong network activity and disciplined supply model make it a standout candidate for risk-adjusted returns going into 2026. The wave analysis targets of $640 for the next cycle may seem ambitious, but historically, LTC has demonstrated the ability to move sharply once it clears long-standing resistance.

For now, $130 remains the key level to watch and a confirmed weekly break above it could mark the official start of Litecoin’s long-awaited comeback rally.

As always, crypto markets remain highly unpredictable. While indicators are aligned for a bullish phase, investors should approach Litecoin and all digital assets with informed caution, disciplined risk management, and a focus on long-term sustainability rather than short-term excitement.

Leave a Reply