Synthetix (SNX), the native token of the Ethereum-based decentralised perpetual futures protocol, has delivered a stunning market performance, soaring by 95% in just 24 hours. This explosive move has propelled SNX to its highest price level since January, cementing its status as the best-performing altcoin among the top 300 cryptocurrencies.

The surge wasn’t limited to price action. Trading volume also skyrocketed alongside SNX’s valuation, signalling strong market participation rather than a speculative one-day pump. As technical and on-chain indicators align, analysts believe that the rally could extend further, provided key resistance levels are overcome.

Breakout from Descending Triangle Fuels Momentum

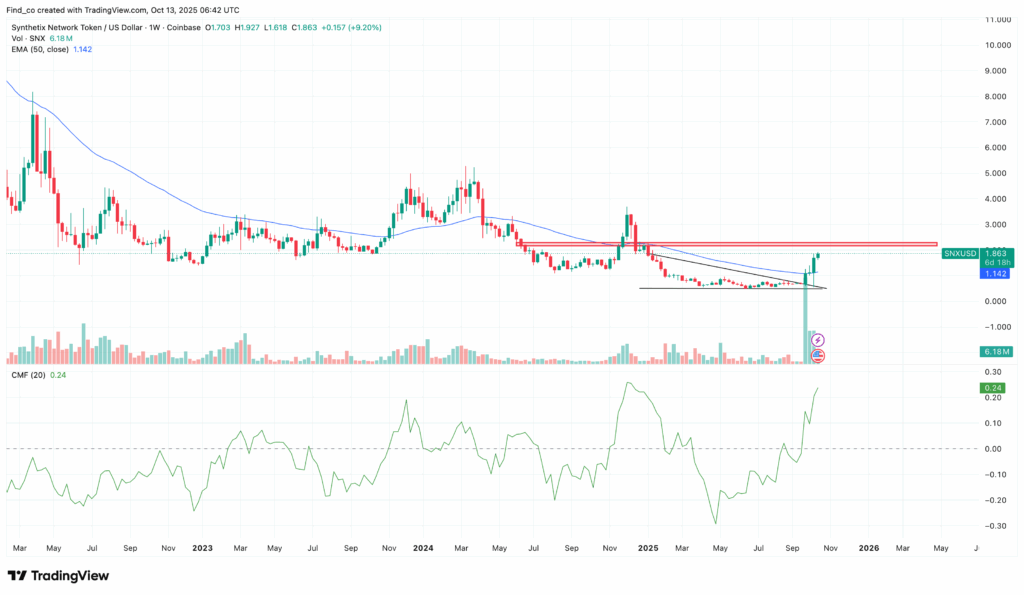

A look at SNX’s weekly chart reveals that the token’s breakout above the upper trendline of a descending triangle acted as a crucial trigger for the rally. This bullish move has been confirmed by the Chaikin Money Flow (CMF) indicator, which recently climbed above the zero line, a clear sign of increasing buying pressure.

Moreover, the token has moved decisively above the 50-period Exponential Moving Average (EMA), reinforcing the bullish outlook. Historically, trading above the 50 EMA signals sustained market support and trend strength.

If this momentum holds, SNX could challenge its immediate resistance at $2.09 and potentially extend toward $2.35, before eyeing the $3.00 mark.

DEX Optimism Sparks Investor Confidence

Beyond technical strength, fundamental factors are playing a major role in SNX’s comeback. The renewed optimism around the launch of Synthetix’s new perpetual DEX has fuelled investor enthusiasm. The platform’s focus on decentralised derivatives aligns with one of the strongest trends in the crypto market, the growing shift towards decentralised trading infrastructure.

Recent market cycles have shown that DEX-linked tokens often outperform when sentiment turns bullish. Projects such as Aster (ASTER), PancakeSwap (CAKE) and Hyperliquid (HYPE) all witnessed explosive price action during similar phases. Now, Synthetix appears to be following in their footsteps, capturing market attention as decentralised finance (DeFi) reclaims momentum.

On-Chain Metrics Confirm Market Strength

The rally isn’t just chart-based. On-chain data from Santiment shows that SNX trading volume has surged to $590 million, the highest since May 2021. Back then, SNX traded near $21, underscoring the scale of renewed investor activity.

While such volume spikes don’t guarantee a return to those lofty valuations, they highlight healthy, organic market participation. The alignment between rising price and volume signals genuine market confidence, not short-term speculation.

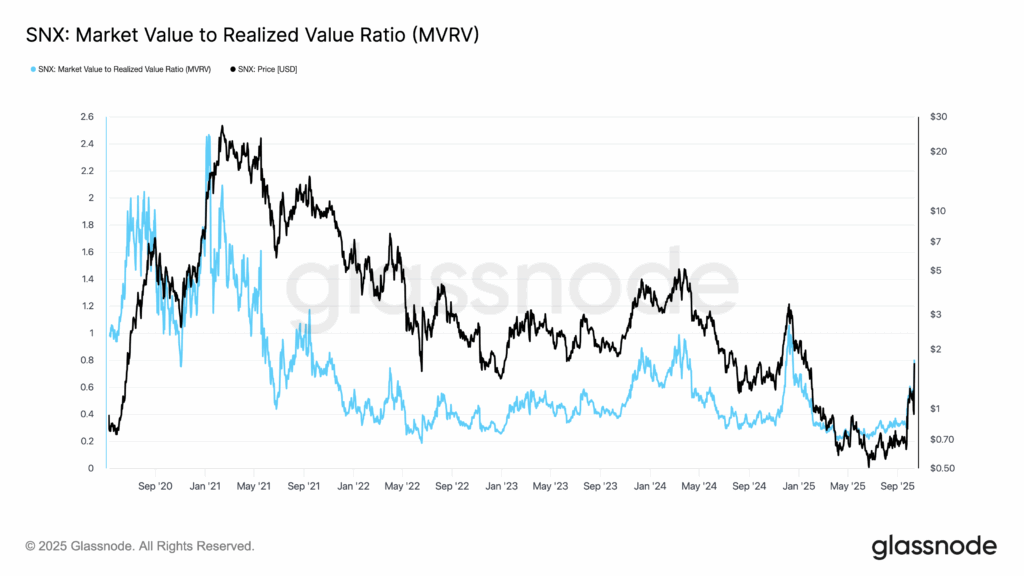

Additionally, Synthetix’s Market Value to Realised Value (MVRV) ratio currently sits at 0.45, well below the typical overvaluation zone of 0.91 to 2.24. This suggests that the rally may have plenty of room to grow before traders begin taking profits aggressively. In short, the market hasn’t entered an overheated state yet and sentiment remains constructive.

Technical Indicators Point to Further Upside

Momentum indicators reinforce the bullish setup. The Moving Average Convergence Divergence (MACD) has formed a bullish crossover, confirming growing buying pressure. Similarly, the Awesome Oscillator (AO) remains in positive territory, reflecting strong market momentum.

Should SNX sustain its rally and successfully breach the $2.09 resistance, it could open the path toward $2.47 and potentially $3.00 in the coming days or weeks. However, failure to maintain the breakout or renewed selling pressure could see the token retrace toward $1.24, a critical support zone.

Outlook: Cautious Optimism Ahead

Synthetix’s 95% price surge represents more than a flash rally; it highlights the growing investor appetite for decentralised perpetuals and the resurgence of DeFi. Both technical and fundamental signals point to continued strength, though traders should remain cautious of potential volatility around resistance zones.

With the protocol’s upcoming perpetual DEX launch and a strong uptick in on-chain activity, SNX appears well-positioned for further upside, provided market conditions remain favourable. If current momentum persists, the long-awaited $3 milestone could soon come into view.

Leave a Reply