Hyperliquid, a decentralised exchange (DEX), has launched a major infrastructure upgrade that enables anyone to create and deploy their own perpetual futures markets, marking a shift towards fully permissionless financial engineering in decentralised finance (DeFi).

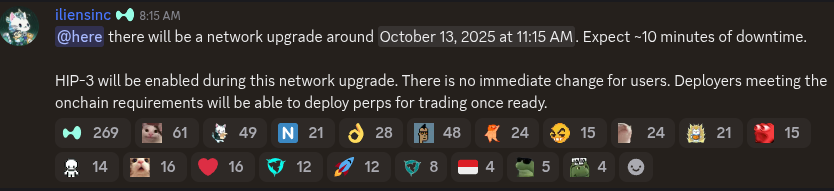

The Hyperliquid Improvement Proposal 3 (HIP-3), activated on mainnet following its testnet debut in late September, removes the need for traditional gatekeepers and grants builders full control over market creation—provided they stake 500,000 HYPE tokens, valued at approximately $20.5 million.

Permissionless Market Creation

HIP-3 allows third parties to independently launch perpetual swap contracts with custom parameters, independent margining and dedicated order books. Deployers are responsible for defining key market elements, including oracle selection, contract rules and operational oversight.

They can also set a fee share of up to 50% on top of the base trading fee, offering potential revenue incentives for developers who launch successful markets.

Redefining Exchange Infrastructure

Traditionally, only centralised exchanges or platform operators could approve new asset listings. HIP-3 replaces this model with permissionless infrastructure, turning Hyperliquid into an open financial layer where virtually any data feed can become a tradable derivative.

According to blockchain research firm Chainsight, this transformation positions Hyperliquid not as a single exchange but as decentralised financial infrastructure, capable of supporting new asset classes across digital and traditional markets.

Wider Market Possibilities

Perpetual swaps are derivative contracts that allow traders to take indefinite long or short positions without expiry. With HIP-3, builders can design markets tracking non-traditional feeds such as realised volatility, stock indices, forex pairs, private company valuations and even correlation-based derivatives.

Synthetic markets protocol Ventuals has already signalled plans to use HIP-3 to introduce perps tied to private company valuations, enabling traders to speculate on firms before they go public.

Lower Barriers, Higher Innovation

Infrastructure provider QuickNode highlighted that HIP-3 eliminates listing fees common on centralised exchanges and reduces operational costs by sharing underlying systems. Builders can recover expenses through fee-sharing, potentially creating a self-sustaining cycle of innovation.

“Execution quality rises while transaction costs fall, driving more volume into HIP-3 markets and further subsidising builders,” QuickNode noted in its analysis.

Toward a New DeFi Era

By allowing market creation at code level rather than through corporate approval, HIP-3 may accelerate experimentation in DeFi. The upgrade brings Hyperliquid closer to a fully permissionless financial environment, where liquidity, innovation and risk are shaped by open participation rather than platform control.

Leave a Reply