The crypto market experienced one of its most dramatic weekends in recent history, with Bitcoin plunging to $102,000, Ether to $3,500, and Solana dipping below $140 following US President Donald Trump’s announcement of sweeping tariffs on China. The move triggered a global sell-off across risk assets, sending shockwaves through the entire digital asset ecosystem.

According to CoinGlass, a crypto data analytics platform, Friday’s crash wiped out $16.7 billion in long positions and $2.46 billion in short positions, the largest single-day liquidation event in crypto history. The intense volatility underscored how macroeconomic and political developments continue to exert a strong influence on digital markets.

Centralised Exchanges Face Claims of Liquidation Undercounting

As traders reeled from the market collapse, Hyperliquid CEO Jeff Yan raised fresh concerns about how centralised exchanges, particularly Binance, report liquidation data. In a detailed post on X (formerly Twitter), Yan cited Binance’s own documentation, revealing that the exchange’s order snapshot stream records only the last liquidation order in each one-second interval.

This design choice, while optimised for performance, may severely underrepresent real liquidation volumes during high-volatility periods.

Yan noted, “Because liquidations happen in bursts, this could easily be 100x under-reporting under some conditions.”

CoinGlass echoed this view, stating that the actual liquidation amount was likely “much higher” than reported, due to Binance’s one-order-per-second limitation. If accurate, the implications are significant, it means that the already staggering $19 billion in reported liquidations could merely be a fraction of the true scale of market deleveraging.

The potential undercount raises transparency concerns at a time when investors increasingly rely on exchange-reported metrics to assess risk and market sentiment.

US Government Shutdown Halts Crypto ETF Progress

Meanwhile, the US federal government entered its third consecutive week of shutdown, paralysing several agencies, including the Securities and Exchange Commission (SEC). The stalemate, triggered by Congress’s failure to pass a funding bill on 1 October, has left financial markets and the crypto sector in particular in a state of uncertainty.

The SEC was expected to rule on 16 pending cryptocurrency exchange-traded funds (ETFs) in October, alongside 21 new applications filed during the first week of the month. However, with most staff furloughed and only essential personnel active, ETF approval deadlines have lapsed with no action taken.

Market participants fear that if the shutdown drags into November, it could delay the long-awaited wave of crypto ETF approvals, often seen as a gateway to broader institutional adoption.

To end the impasse, both the House of Representatives and the Senate must approve a new funding bill, which President Donald Trump would then sign into law. Until then, the regulatory freeze continues to cast a long shadow over US-based crypto innovation.

US–China Trade Signals Offer a Glimmer of Relief

In a contrasting development, signs of easing trade tensions between Washington and Beijing emerged late Sunday. After a week of heated exchanges, following China’s decision to impose export controls on rare earth minerals and Trump’s retaliatory 100% tariff announcement, both sides appeared to soften their tone.

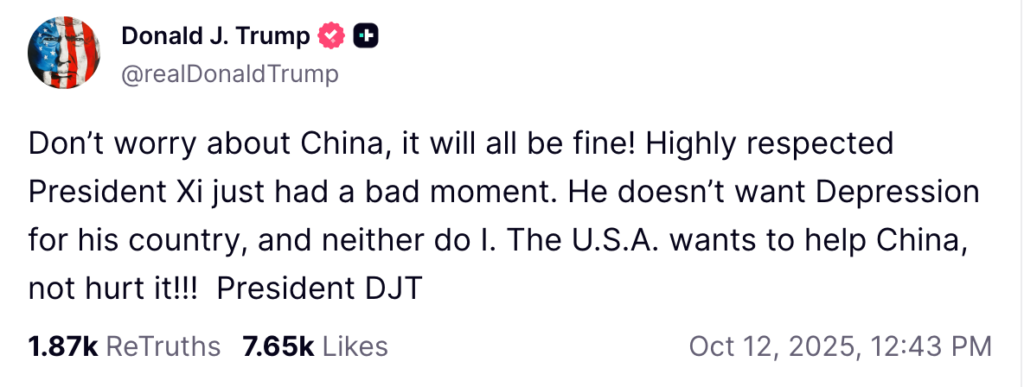

China’s Ministry of Commerce issued a statement expressing willingness to negotiate, while Trump posted on Truth Social, saying:

“Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want depression for his country and neither do I. The USA wants to help China, not hurt it!!!”

Analysts said the conciliatory rhetoric could lift global sentiment and trigger a partial market rebound early in the week, potentially reversing some of the weekend’s heavy crypto losses.

Market Outlook: Volatility to Persist Amid Uncertainty

While early signs of trade de-escalation may offer a brief respite, analysts warn that the underlying macroeconomic risks remain elevated. The combination of tariff shocks, regulatory paralysis in the US and questions surrounding data transparency on major exchanges could sustain market turbulence for weeks.

Investors are now watching whether Congress can end the government shutdown and whether Binance and other exchanges address the transparency gap in liquidation reporting. Until then, crypto markets may continue to move in unpredictable waves, caught between political power plays, regulatory gridlock and data reliability concerns.

Leave a Reply