Babylon Labs has unveiled a system that aims to enable native Bitcoin to be used as collateral on the Ethereum blockchain without the need for intermediaries. The development is being presented as a milestone in decentralised finance (DeFi), although questions remain about how truly trustless the model is.

According to David Tse, co-founder of Babylon Labs and a Stanford professor, the team has produced a proof-of-concept that allows Bitcoin to be locked on its own network and borrowed against on Ethereum. Tse shared the update in a recent post on X, following the publication of Babylon’s white paper in early August.

A New Trustless Vault Concept

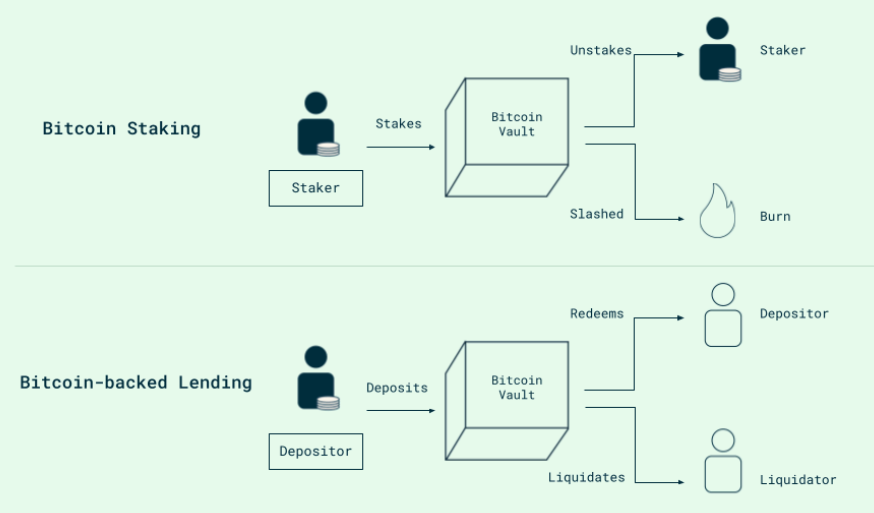

The system relies on BitVM3, a Bitcoin smart contract verification framework. Using this, Babylon claims to lock Bitcoin in individual vaults, where withdrawals such as redemptions or liquidations are controlled through cryptographic proofs tied to smart contract conditions verified on Bitcoin.

On Ethereum, a corresponding smart contract uses a Bitcoin light client to confirm the vault’s state before processing collateral activity. This design avoids dependence on custodial bridges or federated entities, a common point of risk in cross-chain systems.

An experimental version of the associated token, VaultBTC, is already live on Morpho, an Ethereum lending platform. Current liquidity is minimal, around $14 in USDC, as the feature remains in testing. VaultBTC functions as an intermediary non-fungible asset, connecting Bitcoin vaults with Ethereum protocols and enabling trustless withdrawals for depositors and liquidators.

Not Entirely Trustless

Despite the emphasis on decentralisation, Babylon’s model still carries elements of trust. The white paper confirms that vault liquidations depend on a group of whitelisted liquidators who monitor prices and vault conditions. While these liquidators cannot steal Bitcoin due to the cryptographic structure, the system assumes they act in good faith.

There is also reliance on price oracles, introducing risks linked to price accuracy, timing, and censorship resistance. If an oracle delivers incorrect or delayed data, it may lead to wrongful liquidation or missed action. Oracle providers reportedly linked to the system, including Band Protocol and Pyth Network, did not comment at the time of publication.

Comparison with Existing Models

The white paper gives an example involving Bob, who holds 1 BTC and wishes to borrow $50,000 in stablecoins from Larry via an Ethereum lending protocol. Ordinarily, Bob must trust Larry to return the Bitcoin or rely on a custodian if using Wrapped Bitcoin (WBTC). With WBTC, users depend on a central entity to safeguard the backing Bitcoin, creating a single point of failure.

Babylon’s vault system replaces these assumptions with jointly pre-signed Bitcoin transactions that predetermine spending rights. If Bitcoin’s value falls, Larry can initiate liquidation without needing Bob’s cooperation, and if Bob repays the loan, he regains his Bitcoin. The system is structured to rely on cryptographic guarantees rather than promises or centralised custody.

What This Could Mean for DeFi

If successful, Babylon’s approach could reshape how Bitcoin participates in the wider DeFi ecosystem. Native Bitcoin has long been underused in smart contract environments due to technical limitations and reliance on wrapped tokens. A functional trustless bridge could unlock significant liquidity for Ethereum-based protocols.

However, until Babylon demonstrates a fully decentralised liquidation and oracle mechanism, critics argue that the system remains partially reliant on human actors. The project continues to face scrutiny over whether it can maintain security and resistance to manipulation at scale.

Babylon Labs has not yet commented further on implementation timelines or plans for public deployment.

Leave a Reply