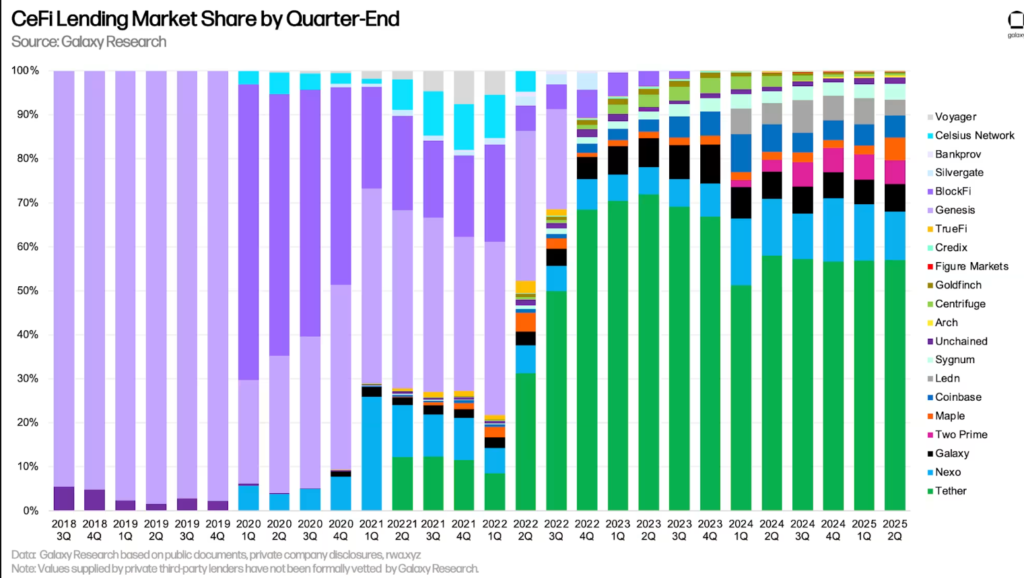

Three years after the 2022 crypto lending crash, Centralised Finance (CeFi) lending has made a striking, though cautious, return. According to Galaxy Research, active CeFi loans now total $17.78 billion, roughly 40% of the global crypto credit market. The sector, once deemed irreparable following the implosions of Celsius, BlockFi, and Voyager, is now expanding again.

By mid-2025, total outstanding crypto loans, excluding collateralised debt positions, hit $44.25 billion, nearly matching 2021 highs. DeFi continues to dominate with a 60% share, yet CeFi’s 14.6% quarterly growth signals renewed confidence among institutions and users alike.

Still, a deeper look suggests the comeback may be more fragile than it appears. Beneath the rhetoric of “discipline” and “compliance,” CeFi’s biggest structural risks, opacity, rehypothecation, and concentration, persist.

The Oligopoly at the Core

Today, CeFi lending is effectively an oligopoly. Three giants: Tether, Nexo, and Galaxy Digital, control between 74% and 89% of the entire market.

- Tether leads with $10.14 billion in loans (57.02%).

- Nexo follows at $1.96 billion (11%).

- Galaxy Digital holds roughly $1.11 billion (6.23%).

Such concentration brings stability on one hand and systemic risk on the other. If a single major player falters, the shock could freeze liquidity across the sector. The Herfindahl-Hirschman Index for this market ranges between 3,450 and 3,500, a level officially classified as highly concentrated.

Despite tighter internal controls and compliance protocols, CeFi’s key weakness remains: users cannot independently verify collateral ratios, loan books, or internal risk policies. Transparency, the foundation of trust, still hasn’t caught up to DeFi’s open ledgers.

Trust Rebuilt, But Transparency Lags

After the catastrophic failures of 2022, surviving CeFi lenders have restructured their models around credibility and regulatory discipline. Yet rehypothecation, the practice of reusing client collateral for new loans, remains common. It allows firms to amplify profits but also magnifies contagion risk if markets collapse.

Some platforms have taken a different path. CoinRabbit, for example, operates without rehypothecation, keeping client assets segregated in cold storage.

“User assets must remain secure,” says Irene Afanaseva, CMO of CoinRabbit. “The absence of rehypothecation is vital for the entire market.”

This philosophy has resonated with users who now prioritise security, transparency, and speed over high yields. Post-crisis surveys consistently show that asset segregation and auditable custody are non-negotiable for CeFi users. Without these, the slightest rumour can spark withdrawal panics reminiscent of 2022.

The Efficiency Gap

While DeFi platforms such as Aave and Compound issue loans almost instantly, CeFi still faces operational delays, usually 24 to 48 hours, due to KYC and manual checks. In a volatile market, that lag can make or break a trade.

Some innovators, including CoinRabbit and Strike, are narrowing the gap. CoinRabbit claims loan approval times of around ten minutes, offering near-instant liquidity while maintaining compliance. This drive for efficiency is becoming a survival factor rather than a luxury in CeFi lending.

Still, speed means little without clarity. Many CeFi firms fail to disclose loan-to-value ratios or liquidation policies, leaving borrowers vulnerable to surprise margin calls. Platforms like CoinRabbit have introduced proactive alert systems, using email, SMS, and Telegram, to notify clients before liquidations occur. Such measures remain the exception, not the norm.

Regulation, Concentration, and the Road Ahead

CeFi’s resurgence is undeniably real, but its safety remains conditional. The regulatory landscape is fragmented, with MiCA in Europe, SEC oversight in the US, and inconsistent definitions of custody worldwide. Compliance costs are rising, making it harder for smaller firms to survive, and pushing the market further toward consolidation.

This concentration creates a feedback loop: fewer players mean less innovation and higher systemic risk. Tether and Nexo dominate not because of superior transparency, but because scale and regulation now act as entry barriers.

In short, CeFi’s rebound is not yet a redemption. The market has grown smaller, cleaner, and more compliant, but it hasn’t grown safer.

Until the sector embraces full transparency, asset segregation, and zero rehypothecation, the risk of another Celsius-style collapse will never truly vanish.

Leave a Reply