BitGo, a leading digital asset custodian, has expanded its institutional custody services to include Canton Coin (CC), the native token of the Canton Network. The move marks a major step in bridging traditional finance with blockchain infrastructure, enabling U.S. institutions to securely hold and manage the asset within a regulated framework.

The integration, announced Wednesday, is designed to help banks and asset managers access the Canton Network’s ecosystem through qualified custody solutions. The network has become a hub for tokenized real-world assets (RWAs), allowing financial institutions to operate onchain while meeting strict compliance requirements.

Institutional Access to the Canton Network

Through BitGo’s new custody offering, regulated entities in the United States can now store Canton Coin with the same level of protection afforded to other major digital assets. The partnership includes cold-storage options and insurance-backed coverage, providing institutions with confidence in the security of their holdings.

Melvis Langyintuo, executive director of the Canton Foundation, said the integration “represents a significant step toward institutional adoption of CC and support for the broader Canton ecosystem.” The Canton Foundation oversees the network’s governance and ecosystem development, working to expand participation from regulated financial players.

The Canton Network, developed by blockchain software firm Digital Asset, is designed to connect financial institutions through an interoperable layer that supports tokenized assets, payments, and financial applications. The network aims to deliver the benefits of blockchain technology—efficiency, transparency, and programmability—without compromising compliance or privacy requirements.

Backing from Major Financial Institutions

Digital Asset, the company behind the Canton Network, recently raised $135 million from a group of heavyweight investors including Goldman Sachs, Citadel Securities, BNP Paribas, and the Depository Trust & Clearing Corporation (DTCC). These backers reflect the growing institutional confidence in blockchain infrastructure tailored for regulated environments.

The Canton Network has attracted an expanding list of global participants since its launch in 2023. Institutions such as JPMorgan, Goldman Sachs, Bank of America, and Citigroup are exploring ways to leverage its framework for tokenizing assets and creating interoperable financial applications. P2P.org, a staking infrastructure provider with over $10 billion in assets, also joined the ecosystem earlier this year, signaling deepening institutional involvement.

Two major European banks, BNP Paribas and HSBC, have recently joined the Canton Foundation, reinforcing the network’s reputation as a leading platform for tokenized finance. Their participation underscores a broader industry trend where traditional financial firms are increasingly investing in onchain infrastructure.

BitGo Strengthens Institutional Position

BitGo’s addition of Canton Coin comes as part of its broader effort to meet growing institutional demand for regulated digital-asset services. With nearly $90 billion in assets under custody, the company is among the largest custodians in the crypto industry and a key player in the shift toward compliant blockchain adoption.

The firm’s new support for CC will allow institutional clients to access the Canton Network with the security standards they expect from traditional financial custodians. BitGo’s infrastructure includes segregated accounts, insurance protection, and multi-signature cold wallets, which together form a robust foundation for institutional engagement with digital assets.

The expansion follows BitGo’s recent filing for an initial public offering in the United States, signaling confidence in its long-term growth strategy. The company has steadily positioned itself as a bridge between traditional finance and blockchain technology, providing regulated custody and settlement services that enable institutions to participate in the evolving digital-asset landscape.

Rising Demand for Tokenized Real-World Assets

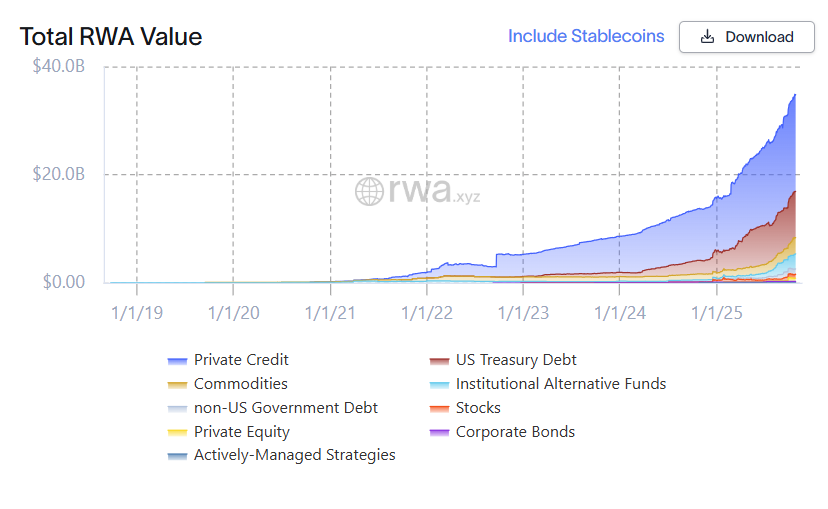

The integration also comes amid a surge of interest in tokenized real-world assets, one of the most promising areas in blockchain-based finance. According to industry data, the total value of tokenized RWAs, excluding stablecoins, has now exceeded $35 billion. These assets range from private credit and U.S. Treasury debt to private equity and equities—markets traditionally difficult for digital participation.

Canton’s strategy places RWAs at its core, emphasizing interoperability between tokenized instruments and legacy systems. By enabling secure and compliant asset transfers, the network aims to modernize financial infrastructure without sacrificing the oversight and risk management frameworks critical to institutional adoption.

A Step Toward Onchain Finance at Scale

BitGo’s support for Canton Coin is more than a technical milestone—it’s a sign of accelerating collaboration between regulated institutions and blockchain networks built for compliance. As more financial firms explore tokenization, platforms like Canton are emerging as key enablers of the next phase of digital finance.

The move underscores how blockchain adoption in finance is shifting from experimentation to implementation. With strong institutional backing, robust governance, and compliant infrastructure, the Canton Network and BitGo’s partnership could mark a turning point in the journey to bring regulated finance fully onchain.

Leave a Reply