Michael Saylor’s Strategy has once again taken the spotlight in the crypto world, this time for both financial triumph and a massive on-chain move.

The company, which remains the largest corporate holder of Bitcoin, reported a staggering net income of $2.8 billion for its third quarter, surpassing Wall Street’s expectations.

Earnings per share stood at $8.42, beating the projected $8.15, further solidifying Saylor’s bullish Bitcoin strategy as one of the most successful corporate plays of the year.

The firm now holds 640,808 BTC, valued at roughly $70.28 billion, an increase from 597,325 BTC at the start of Q3. The growth underscores Strategy’s aggressive accumulation approach, aligning with its long-standing “buy-and-hold forever” philosophy.

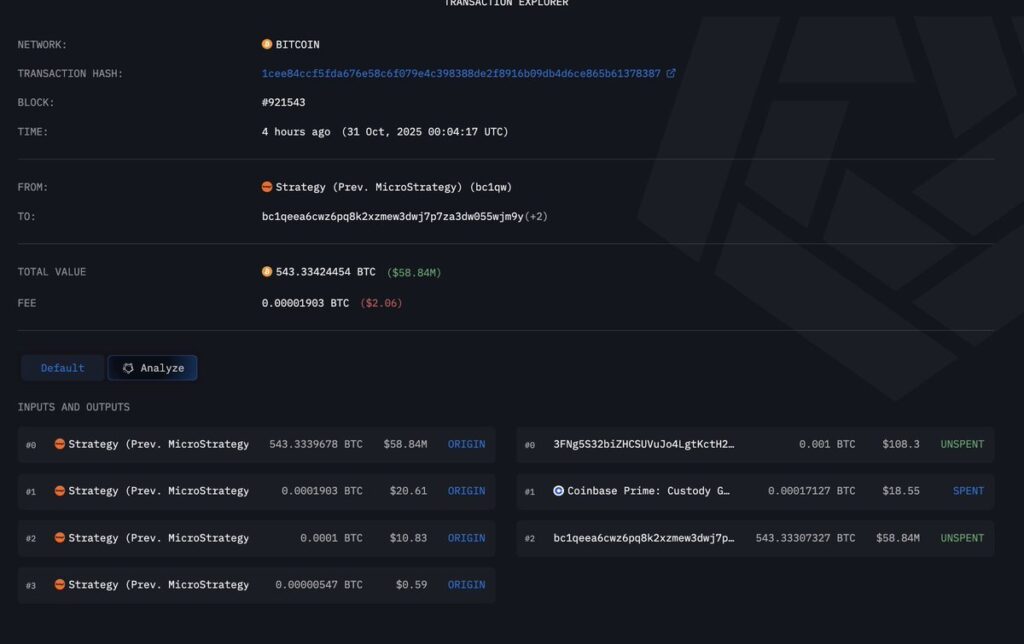

$2.45 Billion BTC on the Move

According to blockchain analytics firm Arkham Intelligence, Strategy transferred 22,704 BTC, worth around $2.45 billion, to multiple new wallets within the last nine hours.

Such large-scale transactions rarely go unnoticed. The crypto community immediately began speculating about the motive behind the movement, given the potential implications for Bitcoin’s short-term price action.

While some observers initially raised concerns about possible liquidation or portfolio rebalancing, market analysts quickly leaned toward a more benign explanation: internal custody restructuring.

“Mass transfers by corporate entities like Strategy usually signal a custody switch or security upgrade, not a sell-off,” explained analyst Emmett Gallic.

“If the coins remain offline and move to freshly generated wallets, it’s generally housekeeping rather than market dumping.”

Restructuring, Not Liquidation

Supporting this theory, Strategy executives confirmed during the latest earnings call that the company remains fully committed to Bitcoin as its core treasury asset.

CEO Michael Saylor reaffirmed that the firm has no plans to diversify or divest, even in the face of lucrative deal opportunities.

“The company will remain focused on purchasing Bitcoin rather than pursuing any deal, even if it is accretive,” Saylor stated.

This consistency in vision has defined the company’s posture throughout 2025, particularly amid a broader resurgence in institutional interest in digital assets.

CFO Andrew Kang further reinforced that the transfers were a standard internal measure, coinciding with portfolio optimisation. “We generated BTC yield of 26% and BTC dollar gains of $13 billion year-to-date. These moves align with our ongoing restructuring of custodial arrangements and asset management strategy,” Kang said.

Bullish Outlook and $150,000 Bitcoin Target

Saylor remains one of Bitcoin’s most vocal advocates, maintaining his ultra-bullish outlook despite volatility.

Speaking with CNBC at the Money 20/20 Fintech Conference in Las Vegas, Saylor predicted that Bitcoin will hit $150,000 by the end of the year, citing strengthening market fundamentals and increased institutional participation.

“I think Bitcoin is going to continue to grind up,” he said. “Our expectation right now is that by year-end, it should be around $150,000. Regardless of price, we’re buying the top forever.”

This unwavering conviction has made Saylor and Strategy synonymous with corporate Bitcoin maximalism. With a 26% BTC yield in 2025 YTD and projected operating income of $34 billion, the company is now setting the standard for long-term digital asset accumulation strategies.

Market Takes a Cautious Yet Optimistic Tone

The crypto market’s response to the transfers was cautious but measured. While Bitcoin briefly dipped below the $110,000 level following the news, analysts suggest that investor confidence remains largely intact.

As long as the transferred BTC remains in cold storage, traders view the activity as an internal operational event rather than a signal of liquidation.

In fact, the move could indicate enhanced security protocols or diversified custody solutions, especially as corporate holdings cross the $70 billion mark.

In the broader picture, Strategy’s massive Bitcoin bet continues to shape institutional sentiment and reinforce Bitcoin’s status as a reserve-grade asset.

As the company repositions its holdings and reaffirms its bullish stance, one thing remains clear: Saylor’s conviction is unshaken.

Whether Bitcoin reaches $150,000 by year-end or not, Strategy’s $2.45 billion move appears to be a strategic realignment, not a retreat, signalling confidence, not caution, in the future of digital gold.

Leave a Reply