As November kicks off, crypto whales, the large holders capable of moving markets, are already positioning themselves for potential gains. While the broader crypto market remains volatile, data suggest that whales are focusing on select altcoins showing early signs of strength.

From privacy-focused tokens to decentralized exchanges and SocialFi projects, these large investors appear to be diversifying their plays. Among the standout names are Railgun (RAIL), Aster (ASTER), and Pump.fun (PUMP), three tokens witnessing notable on-chain accumulation and technical setups hinting at further upside potential.

These movements often precede wider market trends, as whale activity is widely viewed as a signal of institutional or insider confidence. Here’s a breakdown of why these three tokens are capturing whale attention this month.

Railgun (RAIL): Privacy Play Gains Whale Traction

The first name on the list, Railgun (RAIL), has emerged as a top target for crypto whales seeking privacy-sector exposure. Built on Ethereum, Railgun enables shielded transactions, giving users complete privacy in their transfers and DeFi interactions.

Since October 31, whale accumulation in RAIL has surged sharply. Over the past 24 hours alone, whale holdings jumped by 30%, climbing from roughly 185,000 RAIL to 242,500 RAIL. This represents an addition of about 56,000 tokens, worth nearly $220,000 at current prices.

The impact has been immediate; the RAIL price has soared over 40% within the same period, marking one of the strongest short-term moves among privacy coins. Smart money wallets, known for their consistent profitability, have also increased their holdings by 8.17%, reinforcing the bullish sentiment.

At the same time, exchange reserves have dropped 15.67%, meaning fewer tokens are being sent to exchanges for sale. Typically, this combination of accumulation and declining exchange supply indicates growing conviction among investors.

Technical Structure Supports Rally Hypothesis

From a technical perspective, RAIL’s 4-hour chart shows early signs of a confirmed bullish trend. The 20-period EMA has crossed above the 50 EMA, marking a short-term momentum shift. The 50 EMA is now approaching a crossover with the 100 EMA, a pattern often associated with stronger upward continuation.

If this “Golden Crossover” completes, RAIL could target $5.01, a key psychological level, followed by $6.79 if bullish momentum extends. On the downside, $3.97 and $3.32 serve as crucial supports.

A sustained break below $2.28 would invalidate the bullish setup, suggesting whales may slow accumulation. However, current signals suggest confidence is running high, making Railgun one of the month’s most promising privacy-sector plays.

Aster (ASTER): Whales Circle DEX Rebound Opportunity

The second token drawing strong whale interest is Aster (ASTER), a decentralized exchange (DEX) built on BNB Chain, offering both spot and perpetual trading across multiple blockchains.

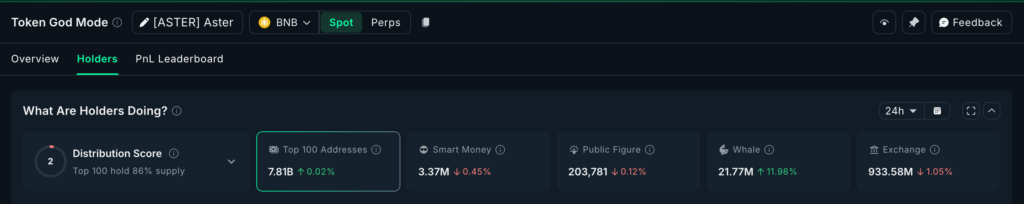

After a subdued end to October, whale activity around ASTER has picked up dramatically since the start of November. On-chain data reveals that whale holdings have climbed 11.98% over the past 24 hours, lifting their total stash to 21.77 million ASTER, an increase of around 2.33 million tokens, worth roughly $2.3 million.

Interestingly, even top-100 addresses, representing the so-called “mega whales,” have shown a steady increase in holdings. This suggests that accumulation is happening across multiple tiers of large investors, not just a few isolated wallets.

While ASTER remains down 10% over the week, the token has rebounded 7% in the past 24 hours, hinting at early positioning for a potential breakout.

A Pennant Pattern Points to Pending Breakout

ASTER’s price structure supports the bullish whale activity. On the 4-hour chart, the token is trading within a pennant-like formation, a consolidation pattern that typically precedes sharp directional moves.

A decisive 4-hour close above $1.06 could confirm a breakout, with possible targets at $1.09 and $1.22 if volume builds. Conversely, a drop below $0.94 or $0.92 could invalidate the setup, opening a path toward $0.85.

Given that the lower trendline has fewer touch points, support remains somewhat fragile. Still, with whale accumulation increasing and price action tightening, Aster is poised as one of the potential DEX leaders for November if bullish confirmation arrives.

Pump.fun (PUMP): SocialFi Hype Meets Whale Confidence

While Railgun and Aster have seen rapid inflows recently, Pump.fun (PUMP), a SocialFi token built on Solana, has been quietly accumulating whale support over the past week.

Pump.fun operates as a meme coin launchpad, allowing users to create and distribute tokens on Solana with ease. This model has tapped directly into the meme-driven energy of the Solana ecosystem, driving massive community engagement and speculative activity.

Over the last seven days, whale balances have risen 11.84%, reaching 17.13 billion PUMP, an increase of 1.81 billion tokens, worth about $8.1 million. Exchange reserves have fallen concurrently, suggesting that whales are moving their holdings off exchanges for long-term storage, a classic sign of conviction buying.

Flag-and-Pole Setup Suggests 60% Upside Potential

The 12-hour chart shows a textbook flag-and-pole formation, typically indicating a continuation of the prior uptrend. The token has tested both the upper and lower bounds of the flag multiple times, a healthy consolidation phase after its recent rally.

A breakout above $0.0049 would confirm bullish momentum, with short-term targets of $0.0053 and $0.0061. Based on the measured pole projection, a full breakout could carry PUMP toward $0.0078, representing roughly 60% potential upside.

If momentum sustains, the previous all-time high of $0.0088 may come into play, with a move beyond $0.0095 setting a new record high. However, a 12-hour close below $0.0041 would invalidate the bullish scenario.

For now, whales appear to be front-running the breakout, steadily building exposure as the broader market watches for confirmation.

Sector Diversification Hints at Broader Market Shift

The fact that whales are spreading their bets across privacy (Railgun), DeFi (Aster), and SocialFi (Pump.fun) signals growing market diversification, a possible early indicator that altcoin rotations are resuming after weeks of consolidation.

Historically, whale accumulation tends to precede broader rallies by several weeks, particularly when confirmed by technical setups and declining exchange supplies.

While risks remain, especially if Bitcoin volatility returns, these three tokens appear to be leading early November narratives. With on-chain metrics turning decisively bullish, Railgun, Aster, and Pump.fun could be the ones to watch as crypto whales quietly prepare for what could be the next leg up in the altcoin market.

Leave a Reply