Bitcoin’s long-celebrated “Uptober” failed to deliver this year, as the world’s leading cryptocurrency closed the month nearly 4% lower, marking its worst October performance since 2018. Despite optimism surrounding the Federal Reserve’s rate cut, investor sentiment soured as ETF outflows surged and volatility indicators flashed caution.

On Saturday, Bitcoin (BTC) hovered around $110,000, recovering modestly from Friday’s Wall Street sell-off that saw renewed pressure from both US spot exchanges and Bitcoin ETFs. Data from Cointelegraph Markets Pro and TradingView showed that Bitcoin’s price action remained constrained within a tightening range, suggesting an impending breakout.

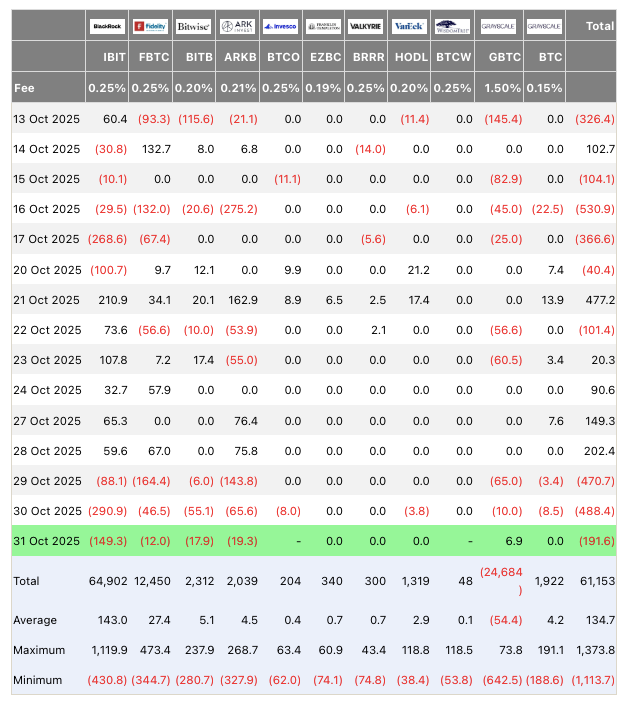

ETF Outflows Reveal Institutional Weakness

The on-chain analytics platform Glassnode highlighted a notable decline in institutional appetite, citing continuous outflows from spot Bitcoin ETFs. According to Farside Investors, Thursday and Friday alone saw combined outflows exceeding $670 million, $488 million on Thursday and $191 million on Friday.

“Rising sell pressure from TradFi investors and renewed weakness in institutional demand” are shaping Bitcoin’s current price trajectory, Glassnode noted. The data points to a shift in sentiment among professional investors, who appear to be trimming exposure amid uncertainty over future macroeconomic conditions.

Interestingly, the ETF selloff occurred even as the US Federal Reserve delivered a widely expected rate cut, traditionally viewed as bullish for risk assets. However, the Fed’s hawkish guidance for December dampened enthusiasm. “The initial rally faded as traders moved back into cautious mode, a shift clearly reflected in BTC’s options market,” Glassnode added.

Traders Warn of “Time-Based Capitulation”

Market participants remain divided on the next major move for Bitcoin. Prominent crypto investor Ted Pillows described the current phase as “time-based capitulation”, implying a prolonged consolidation period rather than an immediate price collapse.

“BTC time-based capitulation is happening now. But for this, Bitcoin needs to consolidate above $100,000,” Pillows stated on Friday. “A weekly close below this level will confirm the downtrend.”

Similarly, trader Daan Crypto Trades pointed to Bitcoin’s current sideways trading range, identifying $107,000 and $116,000 as key breakout levels. A decisive move beyond either boundary, he suggested, could dictate BTC’s direction for the remainder of the year.

This cautious sentiment underscores the ongoing tug-of-war between bullish macro signals and bearish market structure. For now, traders appear to be waiting for confirmation before taking decisive positions.

Bollinger Bands Hint at Explosive Volatility Ahead

As the market searches for direction, one technical indicator is drawing particular attention: Bollinger Bands. The bands, which measure volatility by plotting standard deviations around a moving average, have been narrowing sharply, signalling that a major price move may be imminent.

Last month, John Bollinger, the creator of the indicator, warned that it was “time to pay attention” to volatility levels in both Bitcoin and leading altcoins. Historically, such periods of low volatility compression have preceded significant breakouts, either upward or downward.

With BTC volatility odds now at record highs, analysts are watching closely for the next decisive move. Whether Bitcoin breaks above its upper range near $116,000 or slips below the critical $100,000 support, the next few weeks could determine the market’s direction for the final quarter of 2025.

Outlook: Consolidation or Capitulation?

While October’s close left traders disappointed, it may have set the stage for a pivotal November. If Bitcoin manages to hold above the psychological $100,000 threshold, analysts believe a recovery could take shape as volatility expands.

However, a weekly close below $100,000 could confirm a broader downtrend, potentially triggering what traders are calling a “capitulation” event. With institutional sentiment weakening and volatility building, Bitcoin’s next breakout could be one of the most consequential moves of 2025.

Leave a Reply