The world of cryptocurrency never stays still for long. Prices can soar within hours and collapse just as fast. Bitcoin, Ethereum, and thousands of other digital tokens exist in a market that often feels like a roller coaster ride. Despite over a decade of evolution, crypto remains one of the most unpredictable sectors in finance. But why is this the case? What makes digital assets swing so wildly while traditional stocks or commodities show relative stability?

Here are five major forces that drive crypto’s volatility and keep investors on edge.

1. Speculation and Sentiment Drive the Market

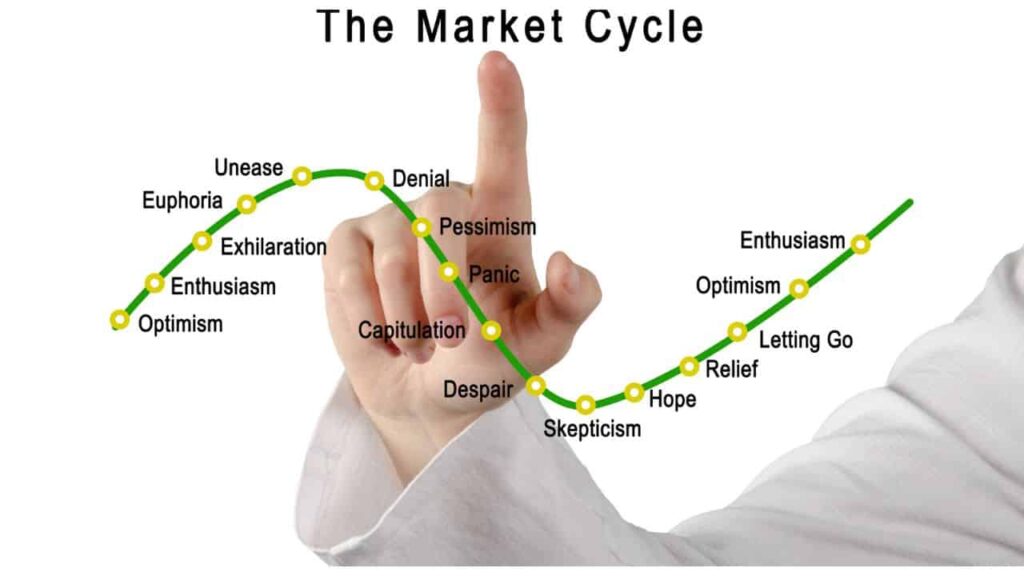

At the heart of crypto volatility lies speculation. Unlike traditional assets backed by tangible earnings or government support, most cryptocurrencies derive value from belief, demand, and market confidence. Traders often buy coins expecting prices to rise quickly, and when that sentiment shifts, panic selling can be equally swift.

Crypto markets are highly emotional. A single tweet, a rumor about regulatory crackdowns, or an endorsement from a celebrity can ignite massive price swings. For instance, when Elon Musk tweeted support for Bitcoin in early 2021, its price surged. Later, when he expressed environmental concerns, the same market plunged.

Investor psychology amplifies these movements. Fear of missing out, known as FOMO, pushes prices higher during bull runs, while fear, uncertainty, and doubt, often called FUD, send them crashing down during downturns. Unlike institutional stock investors who analyze company fundamentals, many crypto traders act on short-term hype or fear, fueling continuous waves of buying and selling.

This speculative nature creates an environment where volatility is not an occasional feature but a defining characteristic of the entire ecosystem.

2. Limited Market Size and Liquidity Gaps

Compared to global equity or bond markets, crypto is still relatively small. While the total value of all cryptocurrencies has at times crossed three trillion dollars, that’s only a fraction of global stock markets. This smaller market size means that even moderate trading activity can have an outsized impact on prices.

Liquidity, the ability to buy or sell an asset without affecting its price, is often thin in crypto. Even Bitcoin, the largest digital asset, faces liquidity challenges during intense market movements. When prices start falling sharply, buyers vanish, leading to steep declines. Similarly, when demand spikes, limited sellers push prices up dramatically.

Smaller cryptocurrencies, often called altcoins, suffer from even thinner liquidity. A few large transactions can move prices by double digits in minutes. In traditional finance, such swings would be nearly impossible without major economic events. In crypto, they can happen overnight.

Liquidity is also fragmented across hundreds of exchanges worldwide. Unlike the stock market, there’s no centralized venue for trading crypto. This decentralization means prices can differ from one platform to another, and large market makers can exploit these gaps, adding to volatility.

3. Regulatory Uncertainty and Government Actions

Few factors shake the crypto market as much as regulation. Governments across the world are still deciding how to handle digital assets. Every new policy announcement, whether positive or restrictive, creates shockwaves across the market.

When the United States Securities and Exchange Commission (SEC) sues a major exchange or labels a token as a security, investors react instantly. The same happens when countries like China impose trading bans or when a nation like El Salvador adopts Bitcoin as legal tender. These sudden policy shifts reshape investor confidence.

The lack of a unified regulatory framework adds to the confusion. In some countries, crypto is treated as a commodity, while in others, it’s considered a security or even banned outright. This inconsistent treatment makes global investors nervous, as they never know which rules might apply next.

Institutional investors, who could bring stability and long-term capital to the market, remain cautious because of these uncertainties. Without clear regulations, they hesitate to fully participate, leaving crypto dominated by retail traders and short-term speculators, further fueling volatility.

Moreover, the ongoing debate over stablecoins, central bank digital currencies (CBDCs), and tax reporting rules continues to affect sentiment. The regulatory fog keeps crypto prices highly sensitive to every headline.

4. Technology Risks and Market Innovation

Crypto is built on innovation, but rapid experimentation also brings risk. New technologies, upgrades, and blockchain forks often trigger price fluctuations. When a major network like Ethereum transitions from one system to another, such as its shift to proof-of-stake, uncertainty about success or potential bugs can spark heavy trading activity.

Security breaches add another layer of instability. Whenever an exchange or decentralized finance (DeFi) platform is hacked, billions can disappear within minutes, shaking confidence across the ecosystem. Traders often rush to withdraw funds or sell tokens, leading to steep price drops.

The pace of technological change also means that new projects rise and fall quickly. A novel token can skyrocket after a successful launch, only to lose most of its value when enthusiasm fades. This constant churn of innovation and obsolescence keeps prices in motion.

Another important factor is leverage. Many crypto exchanges allow traders to borrow heavily to amplify returns. While this attracts risk-takers, it also magnifies losses when prices fall. Leveraged positions are often liquidated automatically, causing cascading sell-offs that intensify volatility.

In essence, the same spirit of experimentation that fuels progress in blockchain technology also guarantees that the market remains turbulent.

5. Global Macroeconomic Factors and Correlation with Risk Assets

In its early days, crypto was seen as a hedge against traditional finance, a digital alternative immune to global markets. But in recent years, it has started behaving like other risk assets, moving in tandem with stocks, particularly technology shares.

When inflation rises or central banks hike interest rates, investors tend to pull money from speculative assets like crypto and move it into safer investments. For instance, during global tightening cycles by the US Federal Reserve, Bitcoin prices often fall as liquidity leaves the system.

Conversely, when central banks lower rates or signal stimulus measures, crypto prices tend to recover as investors chase higher returns. The increasing participation of institutional traders has deepened this correlation with mainstream markets.

Geopolitical tensions, currency fluctuations, and energy prices also play a part. Since mining cryptocurrencies like Bitcoin requires substantial electricity, energy costs directly influence profitability and, in turn, market sentiment. Similarly, global instability can either boost crypto, when people seek alternative stores of value, or hurt it, as investors rush to safety.

This interconnectedness means crypto no longer exists in isolation. It is now a global asset class that reacts to the same macroeconomic pressures affecting stocks, commodities, and currencies, making it inherently sensitive to global news cycles.

A Market That Thrives on Uncertainty

Volatility in crypto isn’t purely a flaw, it’s also part of what attracts investors. The potential for huge gains draws traders seeking quick profits, while long-term believers view market swings as natural growing pains of an emerging financial system.

As regulations mature, infrastructure improves, and institutional participation expands, some expect volatility to decline. However, given the speculative energy, technological experimentation, and global reach of digital assets, complete stability seems unlikely anytime soon.

Crypto remains a frontier market, dynamic, unpredictable, and constantly evolving. Its volatility mirrors both the risks and the revolutionary promise that define this new era of digital finance.

Leave a Reply