Pullbacks expected to last longer this cycle

The crypto market’s recent pullback could offer extended “buy the dip” opportunities, according to Daniel Cheung, co-founder of Syncracy Capital. Cheung suggests that price corrections may persist longer than expected, giving traders more time to capitalise on potential gains.

In a post on X (formerly Twitter) on 9 December, Cheung stated, “There will be intra-month volatility, but the pullbacks likely will be a ‘buy the dip’ scenario for much longer than everyone expects.”

Shift to short-term trading strategies

Cheung highlighted a notable shift in trader behaviour, with many adopting a short-term mindset and prioritising quick profits. Over the past 24 hours, the global cryptocurrency market capitalisation dropped by 5.41% to $3.44 trillion, according to CoinMarketCap.

Several major altcoins experienced sharp declines. Kaia (KAIA) plunged 31.3%, Stellar (XLM) dropped 28.3%, and Flare (FLR) fell 26.9%. Crypto analytics firm Santiment observed that fear-driven retail sell-offs could paradoxically lead to an aggressive market recovery, with assets like TRX, AVAX, DOT, and FIL poised for rebounds.

Leveraged traders face heavy losses

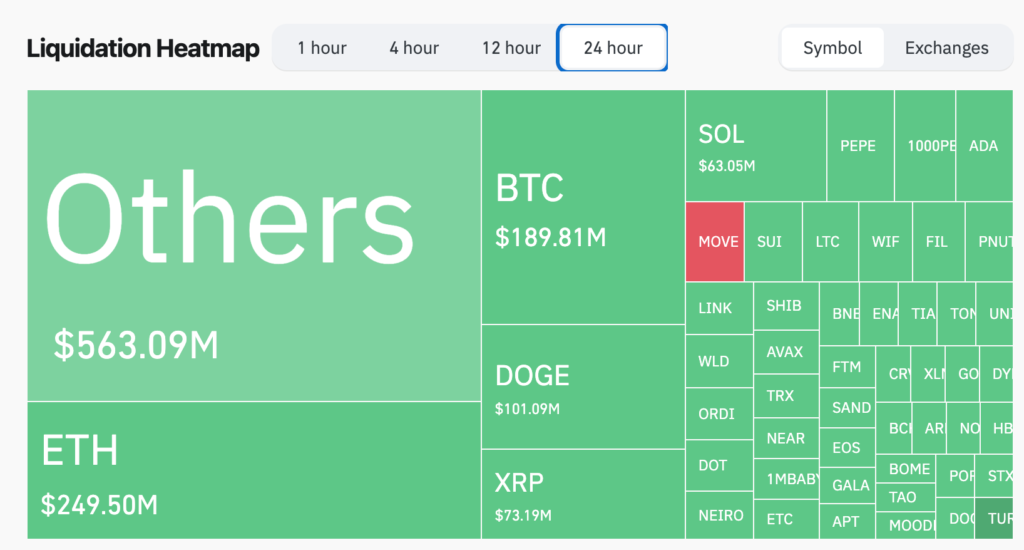

Pav Hundal, lead analyst at Swyftx, attributed much of the sell-off to excessive leverage. “Traders were piling into leveraged longs before the smash,” Hundal noted, adding that the resulting liquidations amounted to $1.58 billion in the past 24 hours, as per CoinGlass data.

Bitfinex analysts offered a more optimistic outlook, predicting that near-term dips in Bitcoin’s price may not match last week’s dramatic 10% drop. “Selling pressure has significantly eased,” they remarked, suggesting future declines would likely be less severe.

Challenges in market timing

Cheung warned of the inherent difficulty in timing crypto markets. “In prior cycles, participants largely engaged in a hodl and buy-the-dip mentality,” he explained. He added that the widespread belief in predicting market peaks might signal a more prolonged uptrend than anticipated for cryptocurrencies.

The evolving market dynamics underscore the importance of caution and strategic decision-making for traders navigating volatile conditions.

Leave a Reply